Burbank Transfer Stamps Form

Understanding Burbank Transfer Stamps

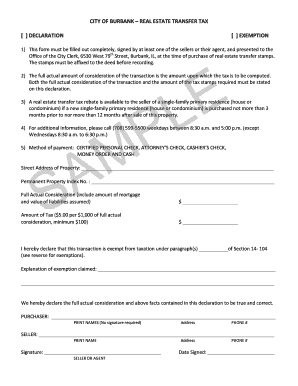

Burbank transfer stamps are essential for documenting the transfer of property ownership within Burbank, California. These stamps serve as proof that the required taxes have been paid on the property transfer. Typically, they are used in real estate transactions and are crucial for ensuring compliance with local regulations. The stamps are issued by the city and are a necessary part of the closing process when buying or selling property.

How to Use Burbank Transfer Stamps

Using Burbank transfer stamps involves several steps. First, you must determine the necessary amount of transfer tax based on the property's sale price. Once calculated, you can purchase the appropriate stamps from the city’s finance department. After acquiring the stamps, affix them to the deed or other relevant documents before submitting them for recording. This ensures that the transaction is officially recognized and compliant with local laws.

Obtaining Burbank Transfer Stamps

To obtain Burbank transfer stamps, you need to visit the city’s finance department or their official website. You will be required to provide information about the property transaction, including the sale price and property details. Payment for the stamps is typically made at the time of purchase, and you can often pay via check or credit card. Ensure you have all necessary documentation ready to streamline the process.

Steps to Complete Burbank Transfer Stamps

Completing the Burbank transfer stamps involves a few key steps:

- Calculate the transfer tax based on the property's sale price.

- Visit the Burbank finance department to purchase the stamps.

- Complete the deed or transfer document, ensuring all details are accurate.

- Affix the transfer stamps to the completed document.

- Submit the document for recording at the appropriate county office.

Legal Use of Burbank Transfer Stamps

Burbank transfer stamps must be used legally to ensure the validity of property transactions. They indicate that the transfer tax has been paid, which is a requirement for recording the deed. Failing to use these stamps correctly can result in penalties or delays in the property transfer process. It is essential to adhere to all local regulations regarding their use to avoid complications.

Key Elements of Burbank Transfer Stamps

Key elements of Burbank transfer stamps include the following:

- The stamp amount, which reflects the transfer tax due.

- A unique identification number for tracking purposes.

- The date of issuance, which is important for record-keeping.

- Signature or seal from the issuing authority to verify authenticity.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the burbank transfer stamps

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Burbank transfer stamps?

Burbank transfer stamps are essential tools for businesses in Burbank that facilitate the transfer of ownership or rights in various documents. These stamps ensure that all necessary legal requirements are met when signing and transferring documents electronically. Utilizing airSlate SignNow, you can easily incorporate Burbank transfer stamps into your document workflows.

-

How much do Burbank transfer stamps cost?

The cost of Burbank transfer stamps can vary based on the provider and the volume of transactions. With airSlate SignNow, you can access affordable pricing plans that include the use of Burbank transfer stamps as part of your eSigning solution. This ensures that you get a cost-effective way to manage your document transfers.

-

What features does airSlate SignNow offer for Burbank transfer stamps?

airSlate SignNow offers a range of features for Burbank transfer stamps, including customizable templates, secure eSigning, and real-time tracking of document status. These features streamline the process of transferring documents, making it easier for businesses to manage their transactions efficiently. Additionally, you can integrate Burbank transfer stamps seamlessly into your existing workflows.

-

How can Burbank transfer stamps benefit my business?

Using Burbank transfer stamps can signNowly enhance your business operations by ensuring compliance and reducing the time spent on document management. With airSlate SignNow, you can expedite the signing process, minimize errors, and improve overall efficiency. This leads to faster transactions and a better experience for your clients.

-

Are Burbank transfer stamps legally recognized?

Yes, Burbank transfer stamps are legally recognized when used in accordance with local regulations. airSlate SignNow ensures that all electronic signatures and stamps comply with legal standards, providing you with peace of mind. This means you can confidently use Burbank transfer stamps for your business transactions.

-

Can I integrate Burbank transfer stamps with other software?

Absolutely! airSlate SignNow allows for seamless integration with various software applications, enabling you to incorporate Burbank transfer stamps into your existing systems. This flexibility helps streamline your workflow and enhances productivity by connecting all your tools in one place.

-

How do I get started with Burbank transfer stamps on airSlate SignNow?

Getting started with Burbank transfer stamps on airSlate SignNow is simple. First, sign up for an account, then explore the platform's features to create and manage your documents. You can easily add Burbank transfer stamps to your templates and start sending documents for eSigning in no time.

Get more for Burbank Transfer Stamps

- Umastandi application form

- The legend of the cedar tree answer key form

- Signage agreement sample form

- Scao fillable forms

- Icivics answer key form

- Llenar formulario application for adoption services hands across water

- Endocrine system worksheet sites jackson k12 ga form

- Donation pledge form for every dream capital campaign centralunionpreschool

Find out other Burbank Transfer Stamps

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast