Form it 196 Fill Out & Sign Online

What is the Form It 196 Fill Out & Sign Online

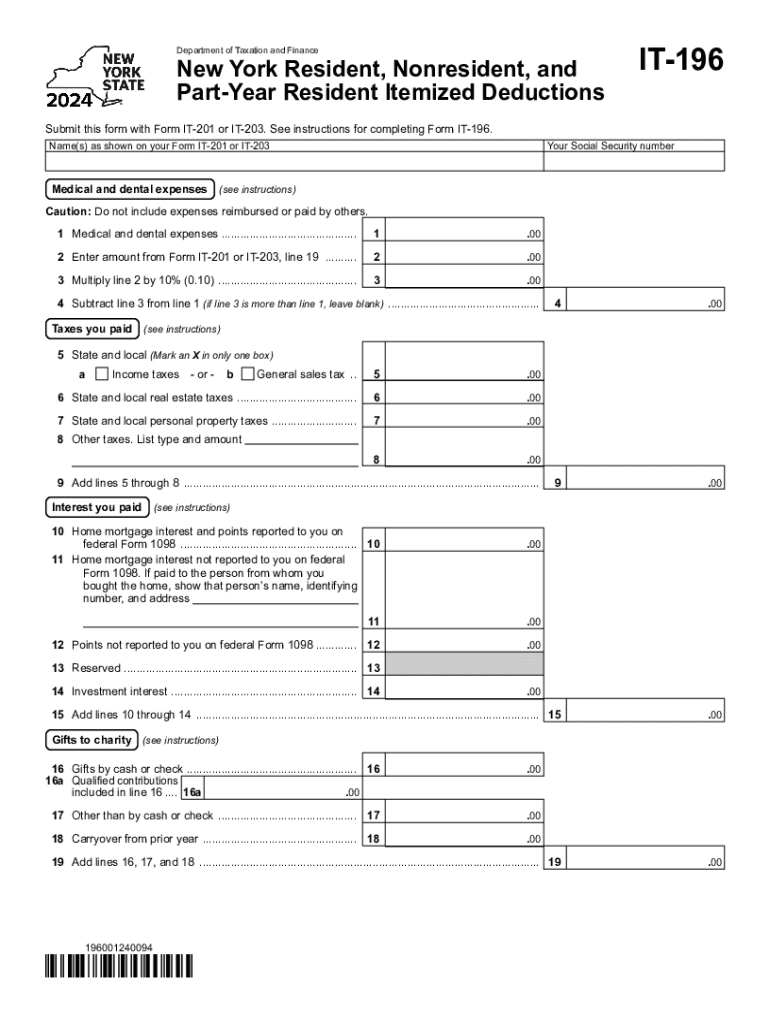

The Form It 196 is a document utilized for various purposes, including tax reporting and compliance within the United States. This form is essential for individuals and businesses to accurately report their financial information to the IRS. It serves as a formal declaration of income, deductions, and other relevant financial details, ensuring compliance with federal tax laws.

Steps to complete the Form It 196 Fill Out & Sign Online

Completing the Form It 196 online involves several straightforward steps:

- Access the form through a secure online platform.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details regarding your income and any applicable deductions.

- Review the information for accuracy before submitting.

- Sign the form electronically to validate your submission.

Following these steps ensures that the form is completed accurately and submitted in a timely manner.

How to obtain the Form It 196 Fill Out & Sign Online

The Form It 196 can be obtained online through various official channels. Users can visit the IRS website or trusted e-signature platforms to access the form. These platforms often provide the form in a user-friendly format, allowing for easy completion and submission. It is crucial to ensure that you are using a legitimate source to avoid any issues with your submission.

Legal use of the Form It 196 Fill Out & Sign Online

The legal use of the Form It 196 is critical for maintaining compliance with tax regulations. This form must be filled out accurately and submitted on time to avoid penalties. It is important to understand that any false information provided on the form can lead to severe legal consequences, including fines or audits. Ensuring the accuracy of the information reported is essential for lawful compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Form It 196 vary depending on the specific circumstances of the taxpayer. Generally, the form must be submitted by the annual tax filing deadline, which is typically April 15 for most individuals. However, certain extensions may apply. It is important to stay informed about any changes to these deadlines to ensure timely submission and compliance.

Required Documents

To complete the Form It 196, several documents may be required, including:

- W-2 forms from employers

- 1099 forms for other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Having these documents ready can streamline the process of filling out the form and help ensure accuracy in reporting.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 196 fill out ampamp sign online

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Form It 196 Fill Out & Sign Online' feature?

The 'Form It 196 Fill Out & Sign Online' feature allows users to easily complete and electronically sign the Form It 196 document from anywhere. This feature streamlines the process, ensuring that you can fill out necessary information and sign the document securely without the need for printing or scanning.

-

How much does it cost to use the 'Form It 196 Fill Out & Sign Online' service?

Pricing for the 'Form It 196 Fill Out & Sign Online' service varies based on the plan you choose. airSlate SignNow offers flexible pricing options that cater to different business needs, ensuring you get the best value for your document signing requirements.

-

What are the benefits of using airSlate SignNow for 'Form It 196 Fill Out & Sign Online'?

Using airSlate SignNow for 'Form It 196 Fill Out & Sign Online' provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. You can manage your documents seamlessly while ensuring compliance with legal standards.

-

Can I integrate 'Form It 196 Fill Out & Sign Online' with other applications?

Yes, airSlate SignNow allows you to integrate 'Form It 196 Fill Out & Sign Online' with various applications such as Google Drive, Dropbox, and CRM systems. This integration enhances your workflow by allowing you to manage documents across different platforms effortlessly.

-

Is it easy to use the 'Form It 196 Fill Out & Sign Online' feature?

Absolutely! The 'Form It 196 Fill Out & Sign Online' feature is designed to be user-friendly, making it easy for anyone to fill out and sign documents. With a simple interface, you can navigate through the process without any technical expertise.

-

What types of documents can I sign using 'Form It 196 Fill Out & Sign Online'?

While 'Form It 196 Fill Out & Sign Online' specifically refers to the Form It 196 document, airSlate SignNow supports a wide range of document types for electronic signing. You can use it for contracts, agreements, and other forms that require signatures.

-

Is my data secure when using 'Form It 196 Fill Out & Sign Online'?

Yes, your data is secure when using 'Form It 196 Fill Out & Sign Online' with airSlate SignNow. The platform employs advanced encryption and security protocols to protect your information, ensuring that your documents remain confidential and safe.

Get more for Form It 196 Fill Out & Sign Online

Find out other Form It 196 Fill Out & Sign Online

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template