Form NYC 210 Claim for New York City School Tax Credit Tax Year

Understanding the NYC 210 Claim for New York City School Tax Credit

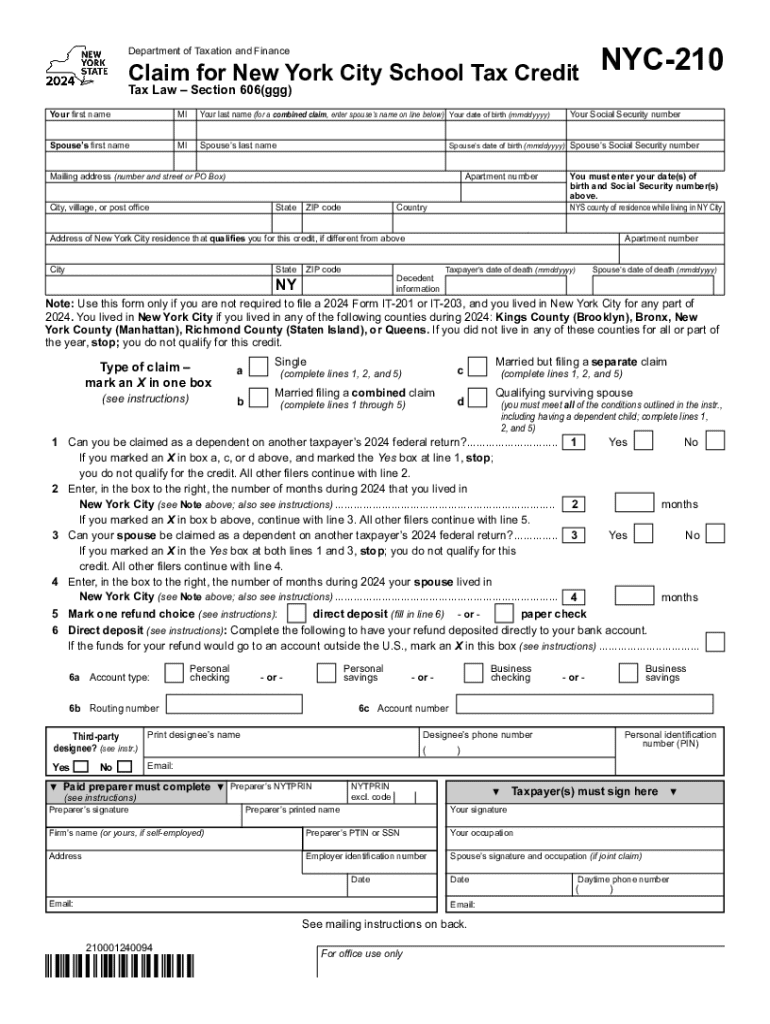

The NYC 210 form is essential for taxpayers in New York City seeking to claim the School Tax Credit. This form allows eligible residents to receive a credit against their city tax liability, which can significantly reduce their overall tax burden. The credit is designed to support families and individuals who contribute to the educational system through property taxes. Understanding the details of this form is crucial for maximizing potential tax benefits.

Steps to Complete the NYC 210 Claim for New York City School Tax Credit

Filling out the NYC 210 form involves several key steps:

- Gather necessary information, including your tax identification number and details about your property.

- Complete the identification section of the form, ensuring all personal information is accurate.

- Provide details about your property taxes and any other relevant financial information.

- Review the eligibility criteria to confirm that you meet all requirements for the credit.

- Sign and date the form to certify its accuracy before submission.

Following these steps carefully will help ensure that your claim is processed smoothly.

Eligibility Criteria for the NYC 210 Claim for New York City School Tax Credit

To qualify for the School Tax Credit using the NYC 210 form, applicants must meet specific eligibility criteria:

- Must be a resident of New York City.

- Must own property or be responsible for paying property taxes.

- Income levels must fall within the limits set by the city for the applicable tax year.

- Must not have previously claimed the credit for the same tax year.

Confirming your eligibility before completing the form can save time and prevent potential issues during the filing process.

How to Obtain the NYC 210 Claim for New York City School Tax Credit

The NYC 210 form can be easily obtained through various channels:

- Visit the official New York City Department of Finance website to download a printable version of the form.

- Request a physical copy from your local tax office or community center.

- Check with tax preparation services that may provide the form as part of their offerings.

Ensuring you have the correct version of the form is important for accurate filing.

Form Submission Methods for the NYC 210 Claim

Once the NYC 210 form is completed, there are several methods for submission:

- Online submission through the New York City Department of Finance website, if available.

- Mail the completed form to the designated address provided on the form.

- In-person submission at your local tax office, which may offer additional assistance.

Choosing the right submission method can help ensure your claim is processed efficiently.

Required Documents for the NYC 210 Claim

When filing the NYC 210 form, certain documents are typically required to support your claim:

- Proof of residency, such as a utility bill or lease agreement.

- Documentation of property ownership or tax responsibility.

- Income verification documents, including recent pay stubs or tax returns.

Having these documents ready will facilitate a smoother filing process and help avoid delays.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form nyc 210 claim for new york city school tax credit tax year 772083209

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New York school tax credit form?

The New York school tax credit form is a document that allows eligible taxpayers to claim a credit for certain educational expenses. This form is essential for parents and guardians looking to reduce their tax liability while supporting their children's education. Understanding how to fill out the New York school tax credit form can help maximize your benefits.

-

How can airSlate SignNow help with the New York school tax credit form?

airSlate SignNow provides a user-friendly platform to easily fill out and eSign the New York school tax credit form. Our solution streamlines the process, ensuring that you can complete your forms quickly and efficiently. With airSlate SignNow, you can manage your documents from anywhere, making tax season less stressful.

-

Is there a cost associated with using airSlate SignNow for the New York school tax credit form?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, ensuring that you can access the tools necessary to complete the New York school tax credit form without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for the New York school tax credit form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing the New York school tax credit form. These features enhance your experience by making it easier to complete and submit your forms accurately. Additionally, our platform ensures that your documents are stored securely.

-

Can I integrate airSlate SignNow with other software for the New York school tax credit form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the New York school tax credit form. Whether you use accounting software or document management systems, our integrations can help you manage your documents more efficiently.

-

What are the benefits of using airSlate SignNow for tax forms like the New York school tax credit form?

Using airSlate SignNow for tax forms like the New York school tax credit form offers numerous benefits, including time savings and increased accuracy. Our platform reduces the likelihood of errors and ensures that your forms are completed correctly. Additionally, the convenience of eSigning allows you to finalize documents quickly.

-

How secure is airSlate SignNow when handling the New York school tax credit form?

Security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your data when handling the New York school tax credit form. You can trust that your sensitive information is safe and secure while using our platform.

Get more for Form NYC 210 Claim For New York City School Tax Credit Tax Year

- Department of public safety lee county southwest florida form

- Permanent resident number imagecontact information finder

- Oag ca govfirearmsformsforms and publicationsstate of california department of

- Modest means program public application form signnow

- Wb 40 amendment to offer to purchase new castle title form

- Unemployment benefitapplication enclosedunemplo form

- Form 2971 child care regulation request for background check form 2971 child care regulation request for background check

- Octopus mental health and substance use disorder a form

Find out other Form NYC 210 Claim For New York City School Tax Credit Tax Year

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free