Form CT DRS CT 1040ES Fill Online, Printable, Fillable

What is the CT 1040ES Form?

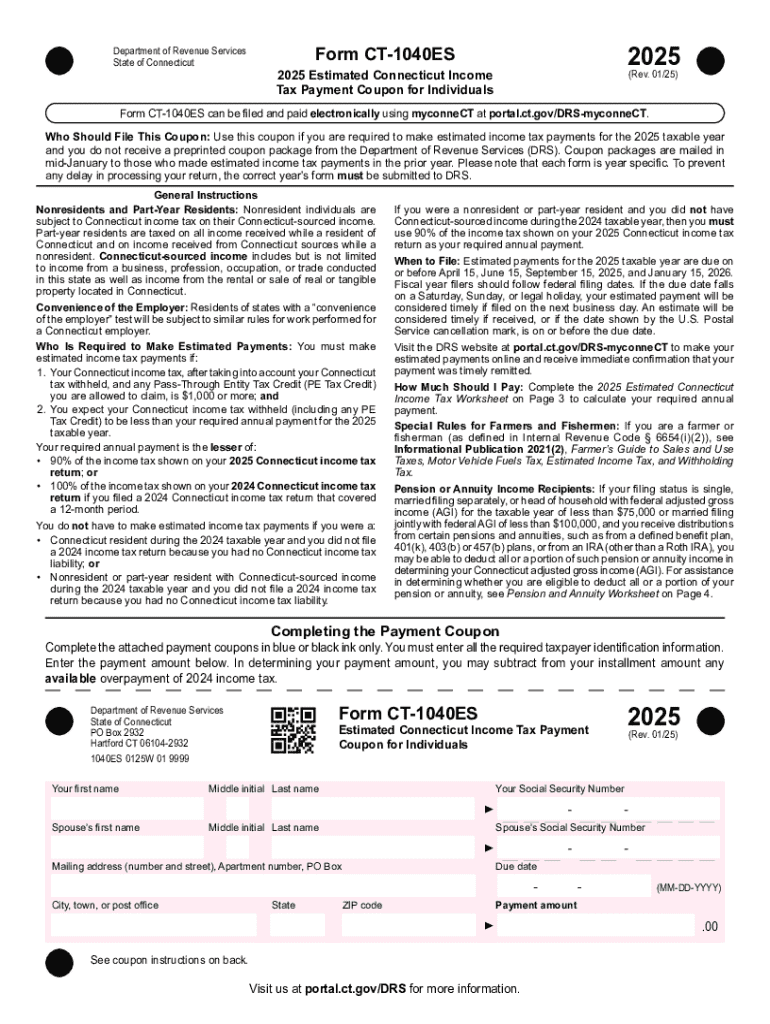

The CT 1040ES form is a crucial document used by residents of Connecticut to make estimated income tax payments. This form is specifically designed for individuals who expect to owe tax of one thousand dollars or more when filing their annual income tax return. It is essential for ensuring that taxpayers meet their tax obligations throughout the year, rather than facing a large tax bill at the end of the tax year.

Steps to Complete the CT 1040ES Form

Completing the CT 1040ES form involves several key steps:

- Gather your financial information, including your expected income and deductions for the year.

- Calculate your estimated tax liability using the Connecticut income tax tables.

- Fill out the CT 1040ES form with your personal information and estimated tax amounts.

- Review the form for accuracy to avoid any potential issues with the Connecticut Department of Revenue Services.

- Submit the form either online or by mail, depending on your preference.

Filing Deadlines for the CT 1040ES Form

It is important to be aware of the filing deadlines for the CT 1040ES form. Typically, estimated tax payments are due on the fifteenth day of April, June, September, and January of the following year. Missing these deadlines can result in penalties and interest on unpaid taxes, so timely submission is crucial.

Required Documents for the CT 1040ES Form

To successfully complete the CT 1040ES form, taxpayers should have the following documents ready:

- Your previous year's tax return, which can provide insight into your income and deductions.

- Documentation of any expected changes in income, such as new employment or business income.

- Records of any deductions or credits you plan to claim.

Who Issues the CT 1040ES Form?

The CT 1040ES form is issued by the Connecticut Department of Revenue Services (DRS). This state agency is responsible for administering tax laws in Connecticut and provides the necessary forms and guidelines for taxpayers to comply with state tax requirements.

Legal Use of the CT 1040ES Form

The CT 1040ES form is legally required for individuals who expect to owe a significant amount in state income tax. By submitting this form, taxpayers fulfill their obligation to pay estimated taxes and avoid potential penalties for underpayment. It is essential to use the form correctly to ensure compliance with Connecticut tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct drs ct 1040es fill online printable fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are CT state income tax forms?

CT state income tax forms are official documents required by the Connecticut Department of Revenue Services for filing state income taxes. These forms help individuals and businesses report their income, deductions, and tax liabilities. Using airSlate SignNow, you can easily fill out and eSign these forms, streamlining your tax filing process.

-

How can airSlate SignNow help with CT state income tax forms?

airSlate SignNow provides a user-friendly platform to create, fill out, and eSign CT state income tax forms efficiently. Our solution simplifies the document management process, allowing you to focus on your finances rather than paperwork. With our secure eSignature feature, you can ensure your forms are signed and submitted promptly.

-

Are there any costs associated with using airSlate SignNow for CT state income tax forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Our plans are designed to be cost-effective, providing you with the tools necessary to manage CT state income tax forms without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing CT state income tax forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for CT state income tax forms. These tools enhance your efficiency and ensure that your forms are completed accurately and on time. Additionally, our platform allows for easy collaboration with tax professionals if needed.

-

Can I integrate airSlate SignNow with other software for CT state income tax forms?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage your CT state income tax forms. This integration allows for automatic data transfer, reducing manual entry errors and saving you time during tax season. Check our integration options to see what works best for you.

-

Is airSlate SignNow secure for handling CT state income tax forms?

Yes, security is a top priority at airSlate SignNow. We use advanced encryption and security protocols to protect your CT state income tax forms and personal information. You can confidently eSign and manage your documents, knowing that your data is safe and compliant with industry standards.

-

How can I get started with airSlate SignNow for CT state income tax forms?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features for managing CT state income tax forms. Once registered, you can access templates, create documents, and begin eSigning your forms in no time.

Get more for Form CT DRS CT 1040ES Fill Online, Printable, Fillable

Find out other Form CT DRS CT 1040ES Fill Online, Printable, Fillable

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation