4508 Affidavit Attesting that Qualified Forest Property Shall Remain Qualified Forest Property 4508 Affidavit Attesting that Qua Form

Understanding the 4508 Affidavit for Qualified Forest Property

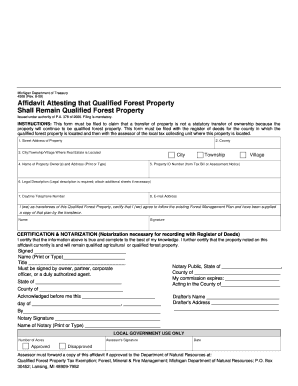

The 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property is a legal document used in the United States to affirm that certain forested land meets specific criteria to maintain its status as qualified forest property. This affidavit plays a crucial role in ensuring that property owners can benefit from tax advantages associated with maintaining their land as a qualified forest. By completing this form, property owners can demonstrate their commitment to preserving forested areas, which can contribute to environmental sustainability and conservation efforts.

How to Obtain the 4508 Affidavit

Obtaining the 4508 Affidavit is a straightforward process. Property owners can typically acquire the form from their local tax assessor's office or the relevant state forestry department. Many states also provide downloadable versions of the affidavit on their official websites. It is essential to ensure that the version obtained is the most current and applicable to the specific state regulations. Additionally, some counties may have their own variations of the form, so checking local guidelines is advisable.

Steps to Complete the 4508 Affidavit

Completing the 4508 Affidavit involves several key steps:

- Gather necessary information about the property, including its location, size, and current use.

- Review the eligibility criteria to ensure the property qualifies as forest property.

- Fill out the affidavit form accurately, providing all required details and signatures.

- Submit the completed affidavit to the appropriate local authority, either in person or by mail.

It is important to double-check all information for accuracy to avoid delays or complications in processing.

Legal Use of the 4508 Affidavit

The 4508 Affidavit serves a significant legal purpose in the context of property taxation and land use. By submitting this affidavit, property owners affirm their compliance with state laws regarding qualified forest property. This legal acknowledgment can protect property owners from potential penalties or tax liabilities associated with misclassification of their land. Furthermore, it helps maintain transparency with local authorities regarding land use and conservation efforts.

Key Elements of the 4508 Affidavit

Several key elements are essential to the 4508 Affidavit:

- Property Identification: Clear identification of the property, including its legal description and tax identification number.

- Owner Information: Details about the property owner, including name, address, and contact information.

- Affirmation Statement: A declaration that the property meets the criteria for qualified forest property.

- Signature and Date: The owner must sign and date the affidavit to validate the information provided.

Completing these elements accurately is crucial for the affidavit's acceptance by local authorities.

Eligibility Criteria for the 4508 Affidavit

To qualify for the 4508 Affidavit, the property must meet specific eligibility criteria, which may vary by state. Generally, the property should be primarily used for forestry or conservation purposes and must be designated as forest land by the local tax authority. Additionally, the land should not be developed for non-forest uses, such as residential or commercial properties. Property owners should consult their local forestry department or tax assessor for detailed eligibility requirements relevant to their area.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 4508 affidavit attesting that qualified forest property shall remain qualified forest property 4508 affidavit attesting that

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property?

The 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property is a legal document that certifies a property meets the criteria to remain classified as qualified forest property. This affidavit is essential for property owners looking to maintain their tax benefits and ensure compliance with state regulations.

-

How can airSlate SignNow help with the 4508 Affidavit?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property. Our solution streamlines the process, making it efficient and secure for property owners to manage their documentation.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that suits your requirements for managing the 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property.

-

What features does airSlate SignNow offer for document management?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage. These features enhance the management of the 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property, ensuring that you can access and manage your documents effortlessly.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows for a more streamlined workflow when handling the 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property and other important documents.

-

What are the benefits of using airSlate SignNow for the 4508 Affidavit?

Using airSlate SignNow for the 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and compliance.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your documents, including encryption and secure access controls. This ensures that your 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property is safe from unauthorized access.

Get more for 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property 4508 Affidavit Attesting That Qua

- Texas dl 7 form

- Tsp 19 form

- Zahtjev za upis u registar udruga word form

- Sickle cell anemia sca action plan over revised 32709 all current medications name of medication dosage time medication to be form

- Dancemovement therapy certification board inc form

- Original raffle license application wisconsin department of form

- Form 5558 rev january

- 700 14 hr payroll policy nc 4 tax compliance form

Find out other 4508 Affidavit Attesting That Qualified Forest Property Shall Remain Qualified Forest Property 4508 Affidavit Attesting That Qua

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors