Form 6765 Rev December Credit for Increasing Research Activities

What is the Form 6765 Rev December Credit For Increasing Research Activities

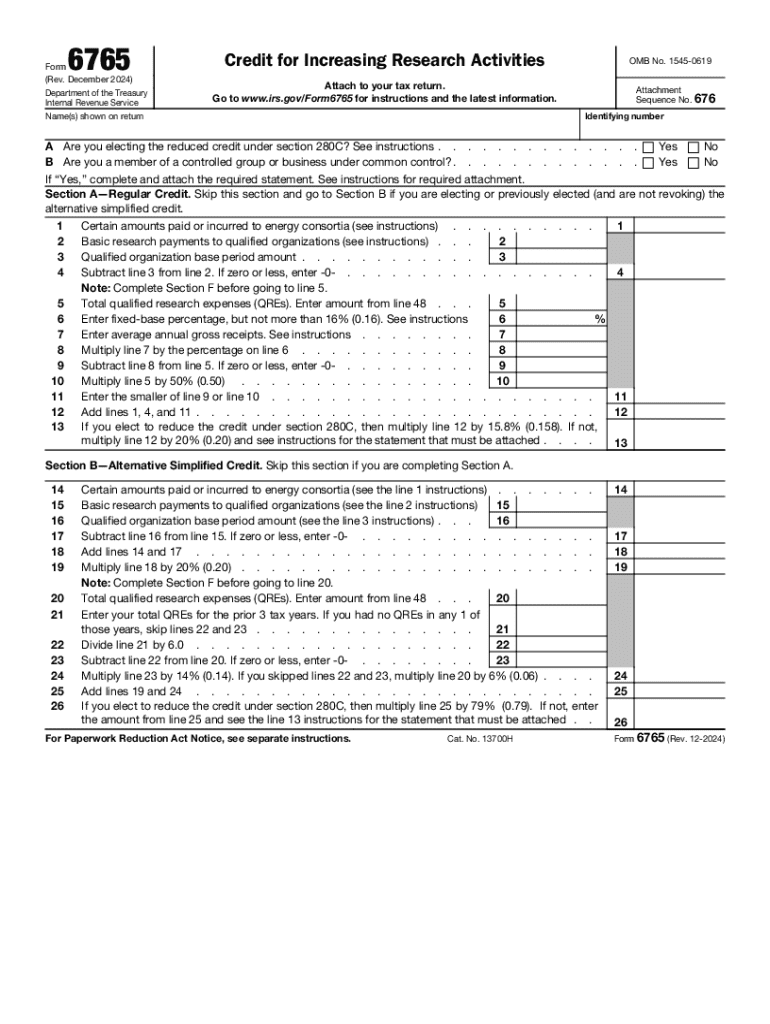

The Form 6765, titled "Credit for Increasing Research Activities," is a crucial document used by businesses to claim the Research and Development (R&D) tax credit. This credit incentivizes companies to invest in innovative projects that enhance their products or processes. The form outlines the eligibility criteria, the calculation of the credit, and the necessary documentation required to substantiate the claim. Understanding this form is essential for businesses looking to maximize their tax benefits related to research activities.

How to use the Form 6765 Rev December Credit For Increasing Research Activities

Using Form 6765 involves several steps. First, businesses must determine their eligibility for the R&D tax credit based on their activities and expenditures. Next, they need to gather all relevant documentation, including payroll records, project descriptions, and expenses related to research activities. Once the necessary information is compiled, businesses can fill out the form, ensuring that all sections are completed accurately. Finally, the completed form should be submitted with the business's tax return to claim the credit.

Steps to complete the Form 6765 Rev December Credit For Increasing Research Activities

Completing Form 6765 requires careful attention to detail. The following steps outline the process:

- Identify qualified research activities that meet IRS criteria.

- Calculate the total qualified research expenses, including wages, supplies, and contract research costs.

- Fill out the form, providing detailed descriptions of the research activities and the corresponding expenses.

- Attach any required documentation that supports the claim, such as project summaries and financial records.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the R&D tax credit and use Form 6765, businesses must meet specific criteria set forth by the IRS. The activities must aim to develop or improve products or processes through technological innovation. Additionally, the expenses claimed must be directly related to these activities. Eligible entities include corporations, partnerships, and sole proprietors engaged in qualified research. It's essential for businesses to thoroughly assess their activities against these criteria to ensure compliance and maximize their potential credit.

Filing Deadlines / Important Dates

Filing deadlines for Form 6765 align with the general tax return deadlines for businesses. Typically, corporations must file their tax returns by the fifteenth day of the fourth month after the end of their tax year. For partnerships and sole proprietors, the deadline is usually the fifteenth day of the fourth month following the end of their fiscal year. Businesses should also be aware of any extensions that may apply to their specific tax situations, as timely submission is critical to claiming the R&D tax credit.

Required Documents

When completing Form 6765, businesses must prepare several supporting documents to substantiate their claims. Required documents typically include:

- Detailed descriptions of the research projects undertaken.

- Financial records showing qualified research expenses.

- Payroll records for employees engaged in eligible research activities.

- Any contracts or agreements related to research performed by third parties.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6765 rev december credit for increasing research activities

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the citi double cash credit limit increase process?

The citi double cash credit limit increase process involves requesting a higher credit limit through your online account or by calling customer service. Typically, you need to provide your income information and explain why you need the increase. Approval is based on your creditworthiness and payment history.

-

How often can I request a citi double cash credit limit increase?

You can request a citi double cash credit limit increase every six months, provided you have maintained a good payment history and your credit score is in good standing. It's important to wait for at least six months after your last increase or initial approval to ensure a higher chance of success.

-

What factors affect my eligibility for a citi double cash credit limit increase?

Eligibility for a citi double cash credit limit increase is influenced by several factors, including your credit score, payment history, income level, and overall credit utilization. Maintaining a low balance relative to your credit limit can improve your chances of approval.

-

Are there any fees associated with a citi double cash credit limit increase?

There are no fees associated with requesting a citi double cash credit limit increase. However, it's essential to understand that a hard inquiry may be conducted on your credit report, which could temporarily affect your credit score.

-

What are the benefits of increasing my citi double cash credit limit?

Increasing your citi double cash credit limit can enhance your credit utilization ratio, which may positively impact your credit score. Additionally, a higher limit provides more flexibility for larger purchases and can help you earn more cash back rewards on your spending.

-

How does a citi double cash credit limit increase affect my credit score?

A citi double cash credit limit increase can potentially improve your credit score by lowering your credit utilization ratio. However, if a hard inquiry is made during the request process, it may cause a slight dip in your score temporarily. Overall, responsible usage of the increased limit can lead to better credit health.

-

Can I request a citi double cash credit limit increase if I have a low credit score?

While you can request a citi double cash credit limit increase with a low credit score, approval may be less likely. It's advisable to improve your credit score by making timely payments and reducing debt before applying for an increase to enhance your chances of approval.

Get more for Form 6765 Rev December Credit For Increasing Research Activities

- Affidavit of next of kin form new jersey

- Bhf exercise referral toolkit form

- Infection disease exposure contamination report form

- Louisiana department of insurance surplus line producers quarterly tax statement form 1265 a for 4th quarter and annual

- This form replaces form jfb e1

- Application for outward remittance bangkokbank com form

- Atascadero business license form

- Social media agreement template form

Find out other Form 6765 Rev December Credit For Increasing Research Activities

- How Can I Sign North Dakota Share Transfer Agreement Template

- Sign Oklahoma Debt Settlement Agreement Template Online

- Can I Sign Oklahoma Debt Settlement Agreement Template

- Sign Pennsylvania Share Transfer Agreement Template Now

- Sign Nevada Stock Purchase Agreement Template Later

- Sign Arkansas Indemnity Agreement Template Easy

- Sign Oklahoma Stock Purchase Agreement Template Simple

- Sign South Carolina Stock Purchase Agreement Template Fast

- Sign California Stock Transfer Form Template Online

- How Do I Sign California Stock Transfer Form Template

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement