C8030 State of Michigan Form

What is the C8030 State Of Michigan Form

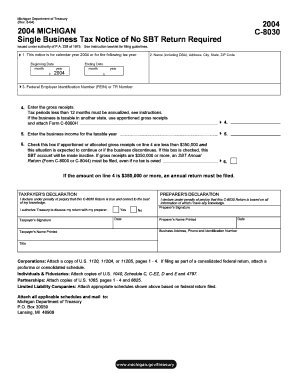

The C8030 State Of Michigan Form is an official document used primarily for tax-related purposes within the state. This form is essential for individuals and businesses to report specific financial information to the Michigan Department of Treasury. Understanding the purpose and requirements of the C8030 form is crucial for compliance with state tax laws.

How to obtain the C8030 State Of Michigan Form

The C8030 form can be obtained directly from the Michigan Department of Treasury's official website. It is also available at local government offices and tax assistance centers. Ensuring you have the correct and most current version of the form is vital for accurate filing.

Steps to complete the C8030 State Of Michigan Form

Completing the C8030 form involves several key steps:

- Gather all necessary financial documents, including income statements and tax records.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Report your income and any deductions or credits applicable to your situation.

- Review the completed form for accuracy before submission.

- Submit the form according to the instructions provided, either online or by mail.

Key elements of the C8030 State Of Michigan Form

The C8030 form includes several critical sections that must be completed:

- Personal Information: This section captures your identifying details.

- Income Reporting: Here, you will list all sources of income.

- Deductions and Credits: This part allows you to claim any eligible deductions and credits.

- Signature: Your signature certifies the accuracy of the information provided.

Form Submission Methods

The C8030 form can be submitted through various methods:

- Online: Many users prefer to file electronically through the Michigan Department of Treasury's online portal.

- Mail: You can print the completed form and send it via postal mail to the designated address.

- In-Person: Submitting the form in person at local tax offices is also an option for those who prefer direct interaction.

Legal use of the C8030 State Of Michigan Form

The C8030 form is legally required for reporting specific financial information to the state. Failing to submit this form or submitting incorrect information can lead to penalties. It is essential to ensure that all information is accurate and submitted on time to comply with Michigan tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the c8030 state of michigan form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the C8030 State Of Michigan Form?

The C8030 State Of Michigan Form is a specific document required for various state-related processes in Michigan. It is essential for businesses and individuals to understand its purpose and how to complete it accurately to avoid delays in processing.

-

How can airSlate SignNow help with the C8030 State Of Michigan Form?

airSlate SignNow provides an efficient platform for completing and eSigning the C8030 State Of Michigan Form. Our user-friendly interface allows you to fill out the form digitally, ensuring that all necessary information is captured correctly and securely.

-

Is there a cost associated with using airSlate SignNow for the C8030 State Of Michigan Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our cost-effective solutions ensure that you can manage the C8030 State Of Michigan Form and other documents without breaking the bank.

-

What features does airSlate SignNow offer for the C8030 State Of Michigan Form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking specifically for the C8030 State Of Michigan Form. These tools streamline the process, making it easier to manage your documents efficiently.

-

Can I integrate airSlate SignNow with other applications for the C8030 State Of Michigan Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the C8030 State Of Michigan Form alongside your existing workflows. This enhances productivity and ensures that all your documents are in one place.

-

What are the benefits of using airSlate SignNow for the C8030 State Of Michigan Form?

Using airSlate SignNow for the C8030 State Of Michigan Form provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform simplifies the eSigning process, making it easier for you to focus on your core business activities.

-

Is airSlate SignNow compliant with state regulations for the C8030 State Of Michigan Form?

Yes, airSlate SignNow is designed to comply with state regulations, ensuring that your C8030 State Of Michigan Form is processed legally and securely. We prioritize compliance to give you peace of mind when handling sensitive documents.

Get more for C8030 State Of Michigan Form

- Cows scale printable 531692148 form

- Company removal form

- Apls manual pdf download form

- The great debaters movie response worksheet answer key pdf 536681738 form

- Duplicate1099 aflac com form

- Relevo de responsabilidad estetica form

- Public records new address change docx form

- Orange county bar association mentoring program form

Find out other C8030 State Of Michigan Form

- Electronic signature Indiana Postnuptial Agreement Template Later

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later