Nassau County Deferred Compensation Plan Form

What is the Nassau County Deferred Compensation Plan

The Nassau County Deferred Compensation Plan is a retirement savings program designed to help employees save for their future. This plan allows participants to defer a portion of their salary into a tax-advantaged account, which can grow over time. Contributions are made through payroll deductions, making it a convenient option for employees looking to enhance their retirement savings. The plan is particularly beneficial for those who want to reduce their taxable income while preparing for retirement.

How to use the Nassau County Deferred Compensation Plan

Using the Nassau County Deferred Compensation Plan involves several straightforward steps. First, employees must enroll in the plan, which typically requires completing an enrollment form. Once enrolled, participants can decide how much of their salary to defer, selecting from various investment options offered by the plan. It is important to regularly review and adjust contributions based on personal financial goals and retirement plans. Employees can also access their accounts online to monitor performance and make changes as needed.

Steps to complete the Nassau County Deferred Compensation Plan

Completing the Nassau County Deferred Compensation Plan involves a few key steps:

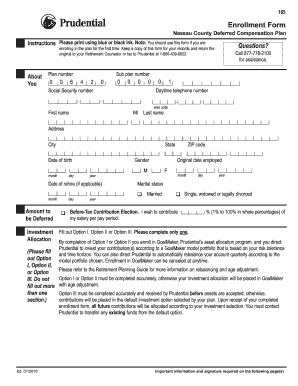

- Enrollment: Fill out the necessary enrollment form provided by the county.

- Contribution Selection: Decide on the percentage of salary to defer into the plan.

- Investment Choices: Choose from the available investment options that align with your risk tolerance and financial goals.

- Regular Review: Periodically assess your contributions and investment performance to ensure they meet your retirement objectives.

Eligibility Criteria

Eligibility for the Nassau County Deferred Compensation Plan generally includes all employees of Nassau County who meet specific employment status requirements. Typically, full-time and part-time employees can participate, though there may be restrictions based on job classification or tenure. It is advisable for employees to check with their human resources department to confirm eligibility and understand any specific conditions that may apply.

Required Documents

To participate in the Nassau County Deferred Compensation Plan, employees may need to provide several documents during the enrollment process. Commonly required documents include:

- Completed enrollment form

- Identification documents, such as a driver's license or employee ID

- Tax forms, if applicable, to determine withholding preferences

Having these documents ready can streamline the enrollment process and ensure compliance with the plan's requirements.

IRS Guidelines

The Nassau County Deferred Compensation Plan adheres to IRS guidelines governing deferred compensation plans. These guidelines dictate contribution limits, tax treatment of distributions, and withdrawal rules. For instance, contributions to the plan may be tax-deferred until withdrawal, allowing for potential growth without immediate tax implications. Participants should familiarize themselves with IRS regulations to maximize benefits and ensure compliance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nassau county deferred compensation plan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Nassau County Deferred Comp?

Nassau County Deferred Comp is a retirement savings plan designed for employees of Nassau County, allowing them to save a portion of their salary on a tax-deferred basis. This program helps employees build a secure financial future while enjoying tax benefits. By participating in Nassau County Deferred Comp, employees can take control of their retirement savings.

-

How does airSlate SignNow integrate with Nassau County Deferred Comp?

airSlate SignNow offers seamless integration with Nassau County Deferred Comp, enabling users to easily manage and eSign necessary documents related to their retirement plans. This integration streamlines the process, ensuring that all paperwork is handled efficiently and securely. With airSlate SignNow, you can focus on your savings while we take care of the documentation.

-

What are the benefits of using airSlate SignNow for Nassau County Deferred Comp?

Using airSlate SignNow for Nassau County Deferred Comp provides numerous benefits, including enhanced security, ease of use, and cost-effectiveness. Our platform allows you to eSign documents quickly, reducing the time spent on paperwork. Additionally, you can access your documents anytime, anywhere, making it easier to manage your retirement savings.

-

Is there a cost associated with using airSlate SignNow for Nassau County Deferred Comp?

airSlate SignNow offers competitive pricing plans that cater to various needs, including those related to Nassau County Deferred Comp. Our pricing is designed to be cost-effective, ensuring that you can manage your retirement documentation without breaking the bank. We also provide a free trial, allowing you to explore our features before committing.

-

What features does airSlate SignNow offer for Nassau County Deferred Comp users?

airSlate SignNow provides a range of features tailored for Nassau County Deferred Comp users, including customizable templates, secure eSigning, and document tracking. These features simplify the process of managing your retirement documents, ensuring that you can focus on saving for your future. Our user-friendly interface makes it easy for anyone to navigate.

-

How can I get started with Nassau County Deferred Comp using airSlate SignNow?

Getting started with Nassau County Deferred Comp using airSlate SignNow is simple. First, sign up for an account on our platform, then explore our templates specifically designed for retirement savings. Once you're familiar with the tools, you can begin eSigning your Nassau County Deferred Comp documents in no time.

-

Can I access my Nassau County Deferred Comp documents on mobile?

Yes, airSlate SignNow allows you to access your Nassau County Deferred Comp documents on mobile devices. Our mobile-friendly platform ensures that you can manage your retirement paperwork anytime, anywhere. This flexibility is essential for busy professionals looking to stay on top of their savings.

Get more for Nassau County Deferred Compensation Plan

- Montana plan first form

- Transient student form southeastern university seu

- Student reactivation form wor wic community college worwic

- Lomake form

- Tour diary for employees form

- Vat1614f opting to tax land and buildings new buildings exclusion from an option to tax use this form to opt to tax land and

- Memorandum in support of motion to dismiss in usa v banegas form

- E commerce vendor agreement template form

Find out other Nassau County Deferred Compensation Plan

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement