Form 1099 MISC Rev April

What is the Form 1099 MISC Rev April

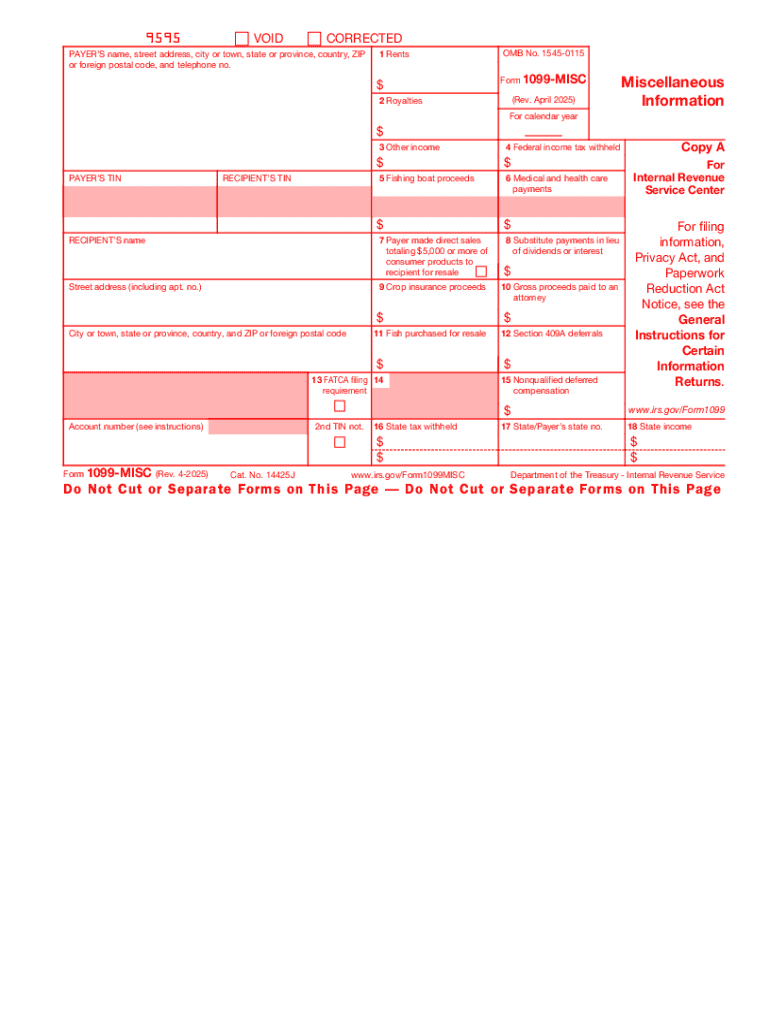

The Form 1099 MISC Rev April is a tax document used in the United States to report various types of income other than wages, salaries, and tips. This form is primarily utilized by businesses to report payments made to independent contractors, freelancers, and other non-employees. It includes information on payments for services, rents, prizes, awards, and other types of income that do not fall under traditional employment compensation.

How to use the Form 1099 MISC Rev April

This form is essential for businesses that have paid $600 or more to a non-employee during the tax year. To use the Form 1099 MISC Rev April, businesses must complete the form with the recipient's details, including their name, address, and taxpayer identification number (TIN). The total payments made to the individual or entity must be accurately reported in the relevant boxes on the form. After completing the form, it must be distributed to the recipient and filed with the IRS.

Steps to complete the Form 1099 MISC Rev April

Completing the Form 1099 MISC Rev April involves several key steps:

- Gather necessary information about the recipient, including their name, address, and TIN.

- Determine the total amount paid to the recipient during the tax year.

- Fill out the form, ensuring that all information is accurate and complete.

- Distribute a copy of the completed form to the recipient by the specified deadline.

- File the form with the IRS, either electronically or by mail, by the required due date.

Filing Deadlines / Important Dates

For the Form 1099 MISC Rev April, the filing deadlines are crucial for compliance. Generally, businesses must provide recipients with their copies by January 31 of the following year. Additionally, the form must be filed with the IRS by the same date if submitting paper forms. If filing electronically, the deadline typically extends to March 31. It is important to be aware of these dates to avoid penalties.

Key elements of the Form 1099 MISC Rev April

The Form 1099 MISC Rev April contains several key elements that are essential for accurate reporting:

- Recipient's Information: Name, address, and TIN.

- Payment Amounts: The total amount paid, categorized by type of payment.

- Filing Information: Details about the payer, including their name, address, and TIN.

- Box Designations: Specific boxes for reporting different types of income, such as rents, royalties, and non-employee compensation.

IRS Guidelines

The IRS provides specific guidelines for the use of the Form 1099 MISC Rev April. These guidelines outline who must file the form, the types of payments that must be reported, and the necessary information to include. Businesses should refer to the IRS instructions for Form 1099 MISC to ensure compliance with all reporting requirements and to avoid potential penalties for incorrect or late filings.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 misc rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 MISC Rev April and why is it important?

Form 1099 MISC Rev April is a tax form used to report various types of income other than wages, salaries, and tips. It is essential for businesses to accurately report payments made to independent contractors and other non-employees to ensure compliance with IRS regulations.

-

How can airSlate SignNow help with Form 1099 MISC Rev April?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign Form 1099 MISC Rev April. With its user-friendly interface, you can streamline the process of collecting signatures and ensure that your forms are completed accurately and on time.

-

What are the pricing options for using airSlate SignNow for Form 1099 MISC Rev April?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. You can choose from monthly or annual subscriptions, allowing you to manage your Form 1099 MISC Rev April needs without breaking the bank.

-

Are there any features specifically designed for handling Form 1099 MISC Rev April?

Yes, airSlate SignNow includes features such as customizable templates for Form 1099 MISC Rev April, automated reminders for signers, and secure storage for completed documents. These features help ensure that your tax forms are processed efficiently and securely.

-

Can I integrate airSlate SignNow with other software for managing Form 1099 MISC Rev April?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and business management software, making it easy to manage your Form 1099 MISC Rev April alongside your other financial documents. This integration helps streamline your workflow and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for Form 1099 MISC Rev April?

Using airSlate SignNow for Form 1099 MISC Rev April offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security for sensitive information. Additionally, the platform's ease of use allows you to focus more on your business rather than administrative tasks.

-

Is airSlate SignNow compliant with IRS regulations for Form 1099 MISC Rev April?

Yes, airSlate SignNow is designed to comply with IRS regulations for Form 1099 MISC Rev April. The platform ensures that all eSigned documents meet legal standards, providing peace of mind for businesses when filing their tax forms.

Get more for Form 1099 MISC Rev April

- Essential vocabulary for biology staar form

- Fedex retiree travel request form

- Poetry contest entry form dakota county co dakota mn

- Wi schedule wd form

- Student learning objectives michigan form

- Verizon wireless w9 form

- Anesthesia permission form jackson veterinary clinic

- Standard service level nhs agreement template form

Find out other Form 1099 MISC Rev April

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe