Form 1099 S Rev April

What is the Form 1099 S Rev April

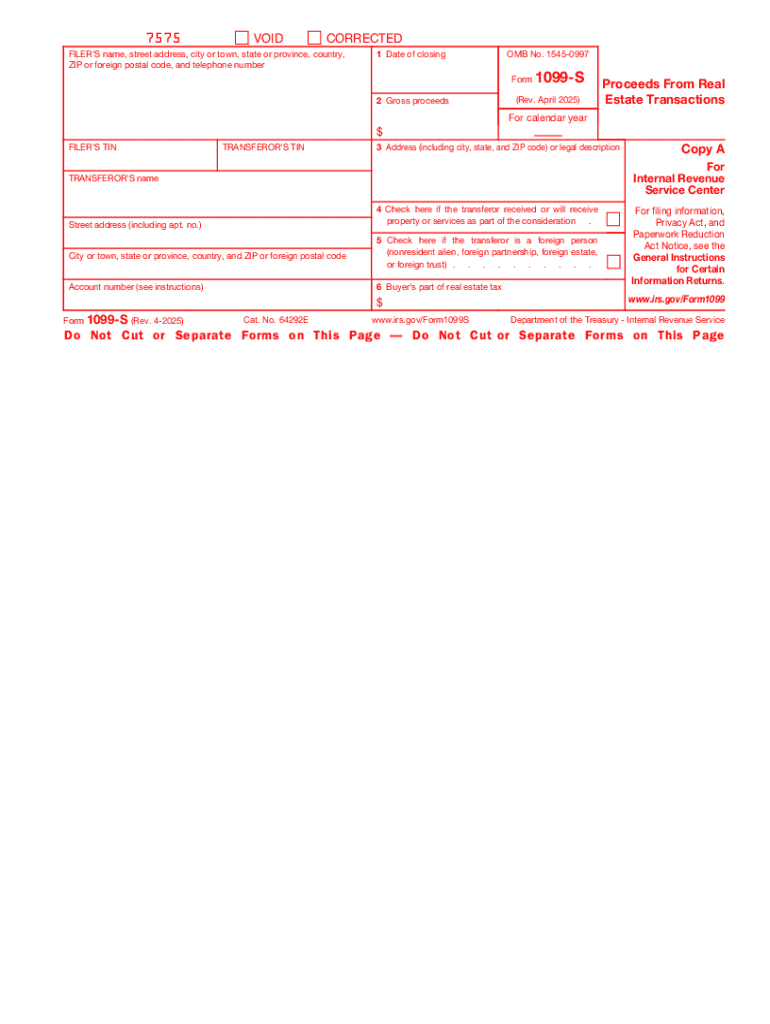

The Form 1099 S Rev April is a tax form used in the United States to report the sale or exchange of real estate. This form is essential for both the seller and the buyer, as it provides necessary information to the Internal Revenue Service (IRS) regarding the transaction. The form details the gross proceeds from the sale, which are crucial for accurately reporting income and calculating potential tax liabilities. It is important for taxpayers to understand the implications of this form, as it ensures compliance with federal tax regulations.

How to use the Form 1099 S Rev April

To use the Form 1099 S Rev April, individuals must first determine if they are required to file it. Generally, the form is filed by the person responsible for closing the transaction, often the closing agent or title company. Once the sale is completed, the responsible party must fill out the form with accurate details about the transaction, including the seller's information, the buyer's information, and the sale price. After completing the form, it must be submitted to the IRS and a copy provided to the seller for their records.

Steps to complete the Form 1099 S Rev April

Completing the Form 1099 S Rev April involves several key steps:

- Gather necessary information, including the seller's and buyer's names, addresses, and taxpayer identification numbers (TIN).

- Record the gross proceeds from the sale, which is the total amount received by the seller.

- Indicate the date of the sale and any applicable property details.

- Complete the form accurately, ensuring that all information is correct to avoid penalties.

- Submit the completed form to the IRS by the specified deadline and provide a copy to the seller.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1099 S Rev April are crucial to ensure compliance. Typically, the form must be filed with the IRS by the last day of February if submitted on paper, or by March thirty-first if filed electronically. Additionally, a copy of the form must be provided to the seller by the same deadlines. It is important to stay informed about any changes in these dates to avoid potential penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 1099 S Rev April. These guidelines outline who is required to file the form, the information that must be included, and the filing process. It is essential for filers to familiarize themselves with these guidelines to ensure that they meet all regulatory requirements. The IRS also emphasizes the importance of accuracy in reporting to prevent issues with tax compliance.

Penalties for Non-Compliance

Failure to file the Form 1099 S Rev April accurately and on time can result in significant penalties. The IRS imposes fines based on the length of the delay and the size of the business. For example, if the form is filed late, penalties can range from $50 to $260 per form, depending on how late the form is submitted. Additionally, inaccuracies in the reported information can lead to further penalties, making it crucial to ensure that all details are correct before submission.

Create this form in 5 minutes or less

Related searches to Form 1099 S Rev April

Create this form in 5 minutes!

How to create an eSignature for the form 1099 s rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 S Rev April and why is it important?

Form 1099 S Rev April is a tax form used to report proceeds from real estate transactions. It is crucial for both buyers and sellers to ensure accurate reporting to the IRS, which helps avoid potential penalties. Understanding this form can simplify your tax filing process.

-

How can airSlate SignNow help with Form 1099 S Rev April?

airSlate SignNow provides a seamless way to eSign and send Form 1099 S Rev April electronically. This not only speeds up the process but also ensures that your documents are securely stored and easily accessible. With our platform, you can manage all your tax documents efficiently.

-

What features does airSlate SignNow offer for managing Form 1099 S Rev April?

Our platform offers features such as customizable templates, secure eSigning, and document tracking specifically for Form 1099 S Rev April. These tools help streamline the process, making it easier to manage your tax documents. Additionally, you can collaborate with others in real-time.

-

Is there a cost associated with using airSlate SignNow for Form 1099 S Rev April?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for handling Form 1099 S Rev April. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs. You can choose a plan that fits your budget and requirements.

-

Can I integrate airSlate SignNow with other software for Form 1099 S Rev April?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to manage Form 1099 S Rev April alongside your existing tools. This integration enhances your workflow and ensures that all your documents are synchronized across platforms.

-

What are the benefits of using airSlate SignNow for Form 1099 S Rev April?

Using airSlate SignNow for Form 1099 S Rev April offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the eSigning process, making it easier for you to complete your tax documents on time. Plus, you can access your documents from anywhere.

-

How secure is airSlate SignNow when handling Form 1099 S Rev April?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure storage solutions to protect your Form 1099 S Rev April and other sensitive documents. You can trust that your information is safe while using our platform.

Get more for Form 1099 S Rev April

Find out other Form 1099 S Rev April

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online