Form 1099 Q Rev April

What is the Form 1099 Q Rev April

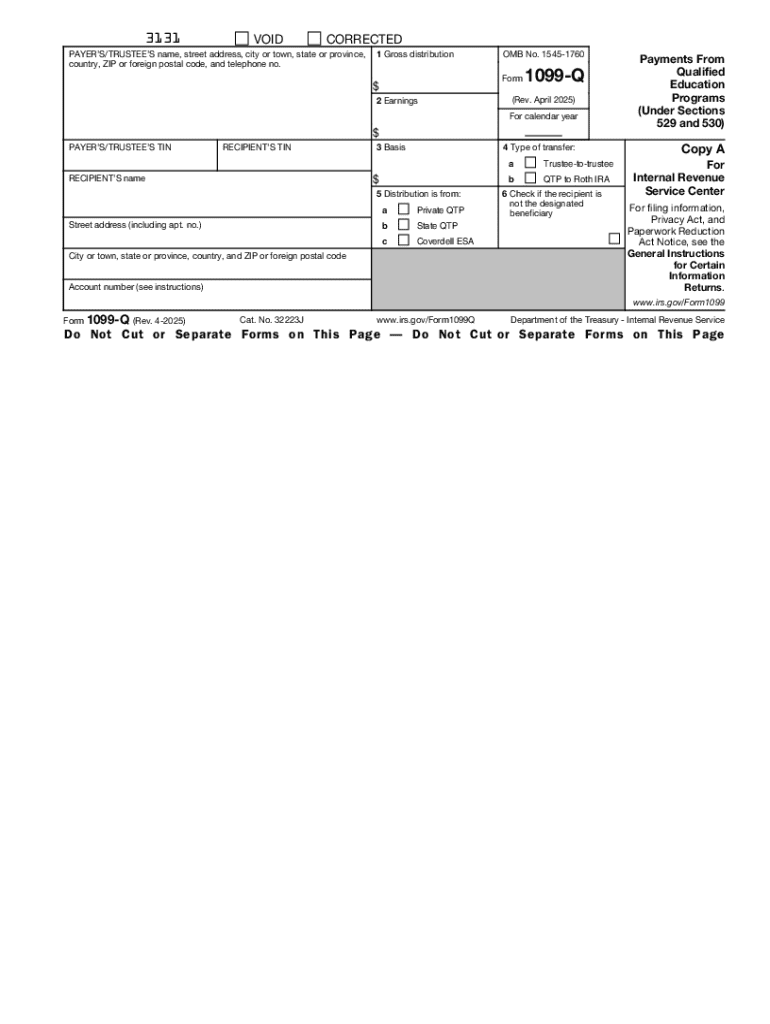

The Form 1099 Q Rev April is a tax document used in the United States to report distributions from qualified education programs, such as 529 plans and Coverdell Education Savings Accounts. This form is essential for both taxpayers and educational institutions, ensuring that the IRS receives accurate information regarding the funds used for educational expenses. The form captures details about the recipient, the amount distributed, and the purpose of the funds, helping to determine any tax implications for the taxpayer.

How to use the Form 1099 Q Rev April

To effectively use the Form 1099 Q Rev April, recipients must first understand its purpose. This form must be filled out when a distribution is made from a qualified education program. Taxpayers need to report the information on their tax returns to accurately reflect any taxable income. It is important to keep the form for personal records and to ensure that all reported amounts match the distributions received. Additionally, the form may be used to verify educational expenses when applying for financial aid or scholarships.

Steps to complete the Form 1099 Q Rev April

Completing the Form 1099 Q Rev April involves several key steps:

- Gather necessary information, including the recipient's name, address, and taxpayer identification number.

- Collect details about the educational institution and the qualified program from which the distribution was made.

- Input the total amount distributed during the tax year, specifying any amounts used for qualified educational expenses.

- Review the completed form for accuracy before submitting it to the IRS and providing a copy to the recipient.

Key elements of the Form 1099 Q Rev April

The Form 1099 Q Rev April includes several important elements that must be accurately reported:

- Recipient Information: This includes the name, address, and taxpayer identification number of the individual receiving the distribution.

- Distribution Amount: The total amount distributed during the tax year must be clearly stated.

- Qualified Expenses: Any amounts that were used for qualified educational expenses should be indicated.

- Educational Institution Details: Information about the institution from which the funds were distributed is also necessary.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 1099 Q Rev April. Generally, the form must be submitted to the IRS by the end of January following the tax year in which the distribution occurred. Recipients should also receive their copies by this deadline to ensure timely reporting on their tax returns. Keeping track of these important dates helps avoid penalties and ensures compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for filling out and submitting the Form 1099 Q Rev April. Taxpayers should refer to the IRS instructions for Form 1099 Q, which outline the requirements for reporting distributions, the necessary information to include, and the process for submitting the form. Familiarity with these guidelines can help ensure accurate reporting and compliance with tax laws.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1099 q rev april

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1099 Q Rev April?

Form 1099 Q Rev April is a tax form used to report distributions from qualified education programs. It is essential for individuals who have received payments from 529 plans or Coverdell ESAs. Understanding this form can help you accurately report your educational expenses and avoid potential tax issues.

-

How can airSlate SignNow help with Form 1099 Q Rev April?

airSlate SignNow provides a streamlined solution for electronically signing and sending Form 1099 Q Rev April. Our platform ensures that your documents are securely signed and delivered, making tax season less stressful. With our user-friendly interface, you can easily manage your forms and keep track of submissions.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to be cost-effective, ensuring that you can manage documents like Form 1099 Q Rev April without breaking the bank. You can choose from monthly or annual subscriptions based on your usage requirements.

-

Are there any features specifically for tax forms like Form 1099 Q Rev April?

Yes, airSlate SignNow includes features tailored for tax forms, including templates for Form 1099 Q Rev April. You can customize these templates to fit your specific needs, ensuring compliance and accuracy. Additionally, our platform allows for easy tracking and management of all your tax-related documents.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This integration allows you to easily import and export Form 1099 Q Rev April and other documents, streamlining your workflow and enhancing productivity. You can connect with popular platforms to ensure a smooth process.

-

What are the benefits of using airSlate SignNow for Form 1099 Q Rev April?

Using airSlate SignNow for Form 1099 Q Rev April offers numerous benefits, including enhanced security, ease of use, and time savings. Our platform ensures that your documents are signed and stored securely, reducing the risk of fraud. Additionally, the intuitive interface allows you to complete your forms quickly and efficiently.

-

Is airSlate SignNow suitable for small businesses handling Form 1099 Q Rev April?

Yes, airSlate SignNow is an excellent choice for small businesses managing Form 1099 Q Rev April. Our cost-effective solution is designed to meet the needs of businesses of all sizes, providing essential features without overwhelming complexity. Small businesses can benefit from our easy-to-use platform to handle their tax documentation efficiently.

Get more for Form 1099 Q Rev April

- Sample letter of invitation to governor form

- Developmental counseling form

- Massrmvcommvforms20060pdf

- Onion cell mitosis worksheet answers form

- Form 6 deped 396452501

- Auto investment form aif

- Application for cancellation of enrollment fs mapua edu form

- Application of marriage license firstmiddlenam form

Find out other Form 1099 Q Rev April

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast