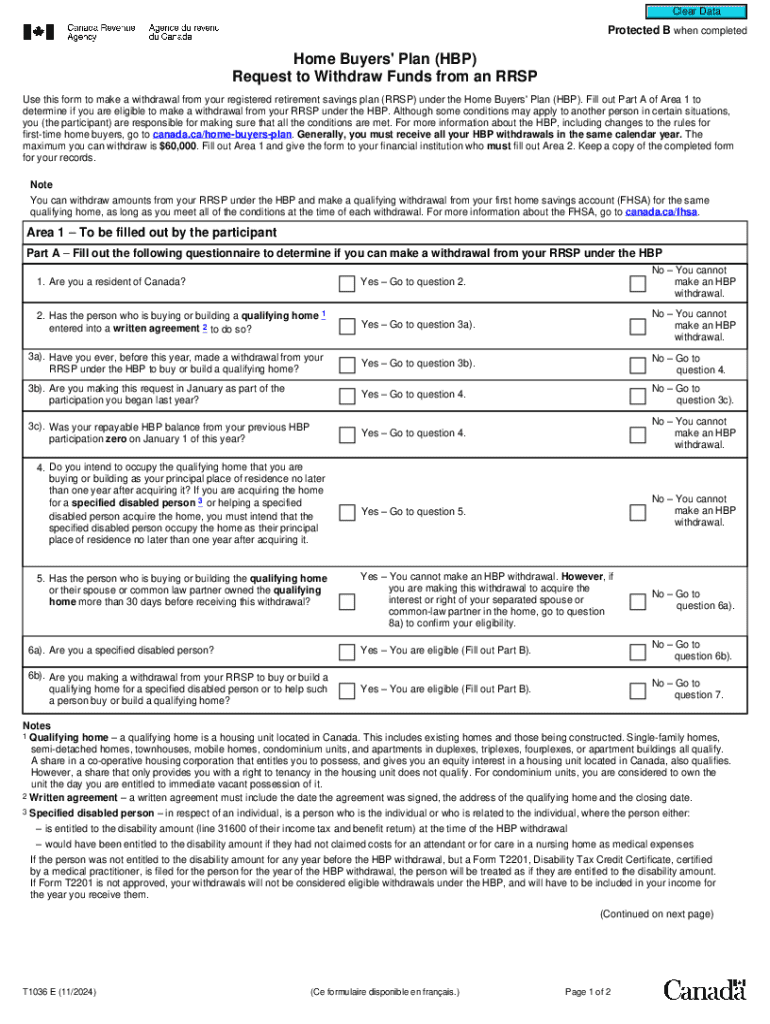

T1036 E Form

What is the T1036 E

The T1036 E form is a specific tax document used in the United States, primarily for reporting certain financial information to the Internal Revenue Service (IRS). It is essential for individuals and businesses to understand the purpose of this form, as it plays a significant role in tax compliance and reporting. The T1036 E is often associated with specific tax situations, making it crucial for taxpayers to accurately complete and submit this form to avoid potential penalties.

How to use the T1036 E

Using the T1036 E form involves a few straightforward steps. First, gather all necessary financial documents and information relevant to the tax year in question. This may include income statements, expense records, and any other documentation that supports the information reported on the form. Next, carefully fill out the form, ensuring that all fields are completed accurately. Once completed, you can submit the T1036 E either electronically or via mail, depending on your preference and the specific requirements set forth by the IRS.

Steps to complete the T1036 E

Completing the T1036 E form requires attention to detail. Start by entering your personal information, including your name, address, and Social Security number. Next, provide the relevant financial data as requested on the form. Double-check all entries for accuracy, particularly numerical values and calculations. After filling out the form, review it for completeness, ensuring that you have signed and dated it as required. If submitting electronically, follow the prompts for digital submission; if mailing, ensure it is sent to the correct IRS address.

Legal use of the T1036 E

The T1036 E form is legally binding once submitted to the IRS. It is important to use this form in accordance with IRS guidelines to ensure compliance with federal tax laws. Misuse or inaccurate reporting on the T1036 E can lead to legal repercussions, including fines or audits. Taxpayers should ensure they understand the legal implications of their submissions and maintain accurate records of all documents related to the T1036 E for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the T1036 E form vary depending on the specific tax year and the taxpayer's situation. Generally, forms must be submitted by April 15 of the following year, but extensions may be available. It is crucial to stay informed about any changes to deadlines that the IRS may announce, as missing a deadline can result in penalties or interest on unpaid taxes. Keeping a calendar of important tax dates can help ensure timely submissions.

Required Documents

To complete the T1036 E form accurately, you will need several supporting documents. These may include income statements, such as W-2s or 1099s, receipts for deductible expenses, and any other relevant financial records. Having these documents organized and readily available will streamline the process of filling out the form and help ensure that all information reported is accurate and complete.

Handy tips for filling out T1036 E online

Quick steps to complete and e-sign T1036 E online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing documents can be. Obtain access to a HIPAA and GDPR compliant solution for optimum simplicity. Use signNow to electronically sign and share T1036 E for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the t1036 e

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is T1036 E and how does it relate to airSlate SignNow?

T1036 E is a specific document type that can be efficiently managed using airSlate SignNow. Our platform allows users to easily send, sign, and store T1036 E documents securely, streamlining the entire process for businesses.

-

How much does airSlate SignNow cost for managing T1036 E documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those focused on T1036 E documents. You can choose from monthly or annual subscriptions, ensuring you get the best value for your document management requirements.

-

What features does airSlate SignNow provide for T1036 E document handling?

Our platform includes features such as customizable templates, real-time tracking, and secure cloud storage specifically designed for T1036 E documents. These tools enhance efficiency and ensure compliance with legal standards.

-

Can I integrate airSlate SignNow with other software for T1036 E management?

Yes, airSlate SignNow seamlessly integrates with various applications, allowing you to manage T1036 E documents alongside your existing workflows. Popular integrations include CRM systems, cloud storage services, and productivity tools.

-

What are the benefits of using airSlate SignNow for T1036 E documents?

Using airSlate SignNow for T1036 E documents offers numerous benefits, including reduced turnaround time, enhanced security, and improved collaboration among team members. Our solution simplifies the signing process, making it more efficient for all parties involved.

-

Is airSlate SignNow user-friendly for managing T1036 E documents?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to manage T1036 E documents. Our intuitive interface ensures that users can quickly navigate the platform and complete their tasks without extensive training.

-

How does airSlate SignNow ensure the security of T1036 E documents?

airSlate SignNow prioritizes the security of your T1036 E documents by implementing advanced encryption and compliance with industry standards. We ensure that your sensitive information is protected throughout the signing process.

Get more for T1036 E

Find out other T1036 E

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement