3360 Qxd 2010

What is the 3360 QXD

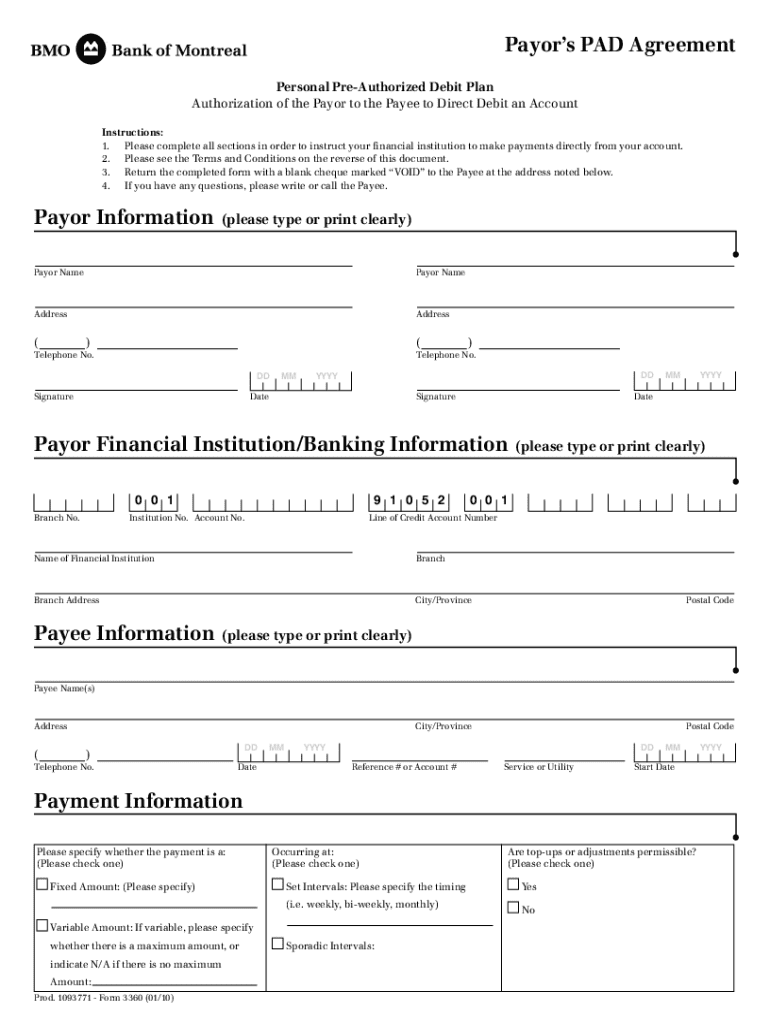

The 3360 QXD is a specific form used in various administrative processes, often related to tax or compliance requirements. This form is designed to collect essential information from individuals or businesses, ensuring that all necessary details are captured for accurate processing. Understanding its purpose is crucial for anyone required to fill it out, as it helps facilitate transactions or formal requests within the legal framework.

How to Use the 3360 QXD

Using the 3360 QXD involves several steps to ensure accuracy and compliance. First, gather all required information, including personal or business details, financial data, and any supporting documents. Next, fill out the form carefully, ensuring that all fields are completed accurately. After completing the form, review it for any errors before submission. Depending on the requirements, you may need to submit it online, by mail, or in person.

Steps to Complete the 3360 QXD

Completing the 3360 QXD requires attention to detail. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Collect all necessary information and documents.

- Fill out the form, ensuring all sections are completed.

- Double-check for accuracy and completeness.

- Submit the form according to the specified method.

Legal Use of the 3360 QXD

The 3360 QXD must be used in accordance with applicable laws and regulations. It is important to ensure that the information provided is truthful and accurate, as submitting false information can lead to legal consequences. Understanding the legal implications of using this form is essential, especially for businesses that may face scrutiny from regulatory bodies.

Required Documents

When filling out the 3360 QXD, certain documents may be required to support your submission. Commonly needed documents include identification, proof of income, and any relevant financial statements. Having these documents ready can streamline the process and ensure that your application is complete.

Form Submission Methods

The 3360 QXD can typically be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal

- Mailing the completed form to the appropriate address

- Submitting in person at a local office or agency

Examples of Using the 3360 QXD

Understanding practical applications of the 3360 QXD can help clarify its purpose. For instance, individuals may use this form to apply for specific benefits or to report financial information for tax purposes. Businesses may also utilize it to comply with regulatory requirements or to provide necessary documentation for audits.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 3360 qxd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3360 qxd and how does it relate to airSlate SignNow?

The 3360 qxd is a specific document format that can be easily managed using airSlate SignNow. This platform allows users to send, sign, and store documents in various formats, including the 3360 qxd, ensuring a seamless workflow for businesses.

-

How much does airSlate SignNow cost for users dealing with 3360 qxd documents?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Users dealing with 3360 qxd documents can choose from various subscription options, ensuring they find a plan that fits their budget and needs.

-

What features does airSlate SignNow offer for managing 3360 qxd documents?

airSlate SignNow provides a range of features for managing 3360 qxd documents, including eSignature capabilities, document templates, and real-time collaboration tools. These features streamline the signing process and enhance productivity for users.

-

Can I integrate airSlate SignNow with other tools while working with 3360 qxd files?

Yes, airSlate SignNow offers integrations with various third-party applications, allowing users to work seamlessly with 3360 qxd files. This flexibility enhances workflow efficiency and ensures that all your tools work together smoothly.

-

What are the benefits of using airSlate SignNow for 3360 qxd document management?

Using airSlate SignNow for 3360 qxd document management provides numerous benefits, including increased efficiency, reduced turnaround times, and enhanced security. The platform's user-friendly interface makes it easy for businesses to adopt and utilize effectively.

-

Is airSlate SignNow secure for handling sensitive 3360 qxd documents?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive 3360 qxd documents. With features like encryption and secure cloud storage, users can trust that their documents are safe and compliant with industry standards.

-

How can I get started with airSlate SignNow for my 3360 qxd needs?

Getting started with airSlate SignNow for your 3360 qxd needs is simple. You can sign up for a free trial on their website, explore the features, and see how it can streamline your document management process.

Get more for 3360 qxd

- Nevada construction contracts and agreementsus legal form

- Nevada commercial form

- Control number nv p052 pkg form

- Control number nv p055 pkg form

- Control number nv p056 pkg form

- Control number nv p057 pkg form

- Control number nv p060 pkg form

- Contractor license requirements nevada state contractors form

Find out other 3360 qxd

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word