Homeowners Insurance Quote Sheet Template Form

Understanding the Homeowners Insurance Quote Sheet Template

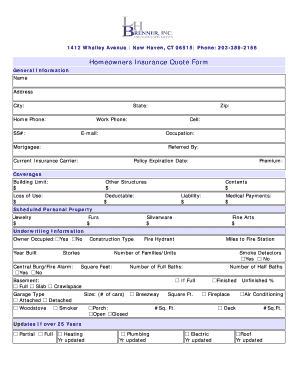

The homeowners insurance quote sheet template is a valuable document designed to help individuals gather and compare quotes from various insurance providers. This template typically includes essential information such as coverage options, premium costs, deductibles, and policy limits. By using this template, homeowners can ensure they have a comprehensive view of their insurance options, allowing for informed decision-making regarding their coverage needs.

How to Use the Homeowners Insurance Quote Sheet Template

To effectively use the homeowners insurance quote sheet template, start by filling in your personal information, including your address, property details, and any specific coverage requirements you may have. Next, reach out to multiple insurance companies to request quotes. As you receive each quote, enter the details into the corresponding sections of the template. This organized approach enables you to compare different policies side by side, making it easier to identify the best option for your needs.

Key Elements of the Homeowners Insurance Quote Sheet Template

Several key elements should be included in the homeowners insurance quote sheet template. These elements typically encompass:

- Personal Information: Name, address, and contact details.

- Property Details: Type of home, year built, and square footage.

- Coverage Options: Types of coverage such as dwelling, personal property, liability, and additional living expenses.

- Premium Costs: Monthly or annual premium amounts from each insurer.

- Deductibles: Amounts you would pay out of pocket before coverage kicks in.

- Policy Limits: Maximum amounts the insurer will pay for claims.

Steps to Complete the Homeowners Insurance Quote Sheet Template

Completing the homeowners insurance quote sheet template involves several straightforward steps:

- Gather necessary personal and property information.

- Contact multiple insurance providers for quotes.

- Fill in the template with the information received from each provider.

- Compare the quotes based on coverage, costs, and terms.

- Make an informed decision based on your findings.

Obtaining the Homeowners Insurance Quote Sheet Template

The homeowners insurance quote sheet template can often be obtained through various sources. Many insurance companies provide downloadable templates on their websites. Additionally, online resources and financial planning websites may offer customizable templates that can be printed or filled out digitally. Ensure that the template you choose is user-friendly and meets your specific needs for comparing insurance quotes.

Legal Use of the Homeowners Insurance Quote Sheet Template

Using the homeowners insurance quote sheet template is legal and encouraged as it aids in the comparison of insurance options. However, it is important to ensure that any information entered is accurate and truthful. Misrepresentation of details can lead to issues with policy approval or claims in the future. Always keep a copy of the completed template for your records, as it may be useful during the policy selection process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homeowners insurance quote sheet template

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a homeowners insurance quote?

A homeowners insurance quote is an estimate of the cost of insurance coverage for your home. It takes into account various factors such as the value of your property, location, and coverage options. Obtaining a homeowners insurance quote helps you understand your potential expenses and coverage needs.

-

How can I get a homeowners insurance quote?

You can get a homeowners insurance quote by contacting insurance providers directly or using online comparison tools. Many companies offer quick online forms where you can input your information to receive an estimate. This process is usually straightforward and can be completed in just a few minutes.

-

What factors affect my homeowners insurance quote?

Several factors can influence your homeowners insurance quote, including the age and condition of your home, your credit score, and the amount of coverage you desire. Additionally, the location of your home and any safety features, like security systems, can also impact your quote. Understanding these factors can help you find the best rates.

-

Are there any discounts available for homeowners insurance quotes?

Yes, many insurance providers offer discounts that can lower your homeowners insurance quote. Common discounts include bundling policies, having a security system, or being claims-free for a certain period. It's beneficial to ask your insurer about available discounts to maximize your savings.

-

What is included in a homeowners insurance quote?

A homeowners insurance quote typically includes coverage for the structure of your home, personal belongings, liability protection, and additional living expenses. Each quote may vary based on the coverage limits and deductibles you choose. Reviewing the details of your quote ensures you understand what is covered.

-

How often should I get a homeowners insurance quote?

It's advisable to get a homeowners insurance quote at least once a year or whenever you make signNow changes to your property. Changes such as renovations or acquiring new valuables can affect your coverage needs. Regularly reviewing your quote helps ensure you have adequate protection.

-

Can I change my homeowners insurance quote after purchasing?

Yes, you can often adjust your homeowners insurance quote even after purchasing a policy. If your needs change or if you find a better rate, contact your insurance provider to discuss your options. They can help you modify your coverage or find a more competitive quote.

Get more for Homeowners Insurance Quote Sheet Template

- Site work contractor package district of columbia form

- Siding contractor package district of columbia form

- Refrigeration contractor package district of columbia form

- Drainage contractor package district of columbia form

- Tax free exchange package district of columbia form

- Landlord tenant sublease package district of columbia form

- Dc buy form

- Option to purchase package district of columbia form

Find out other Homeowners Insurance Quote Sheet Template

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation