Wage Theft Protection Act of Notice to Employees Form

What is the Wage Theft Protection Act of Notice to Employees

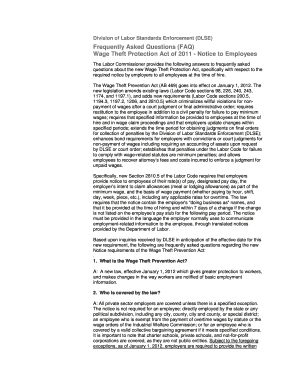

The Wage Theft Protection Act of Notice to Employees is a legal requirement aimed at protecting workers from wage theft. This act mandates that employers provide clear and comprehensive information to their employees regarding their rights and the terms of their employment. The notice typically includes details about wages, work hours, and the methods used for wage payment. Understanding this act is crucial for both employers and employees to ensure compliance and protect workers' rights.

Key elements of the Wage Theft Protection Act of Notice to Employees

This notice must include several critical elements to ensure employees are fully informed. Key components typically consist of:

- The employee's rate of pay, including overtime rates.

- The regular pay schedule, detailing when employees will receive their wages.

- The employer's contact information, including the name and address.

- A statement regarding the employee's rights under state and federal wage laws.

These elements serve to provide transparency and help prevent misunderstandings regarding compensation.

How to use the Wage Theft Protection Act of Notice to Employees

Employers must distribute the Wage Theft Protection Act of Notice to Employees at the start of employment. This can be done through various methods, including in-person delivery, email, or through an employee handbook. It is essential for employers to ensure that each employee receives and acknowledges the notice, which can be documented through e-signatures or written confirmations. This process not only fulfills legal obligations but also fosters a culture of trust and transparency within the workplace.

Steps to complete the Wage Theft Protection Act of Notice to Employees

Completing the Wage Theft Protection Act of Notice involves several straightforward steps:

- Gather all necessary information regarding employee wages and hours.

- Prepare the notice, ensuring it includes all required elements.

- Distribute the notice to each employee, ensuring they receive it in a timely manner.

- Obtain acknowledgment from each employee, confirming they have received and understood the notice.

- Keep records of the distribution and acknowledgments for compliance purposes.

Following these steps helps ensure that both employers and employees are aware of their rights and responsibilities.

Penalties for Non-Compliance

Failure to comply with the Wage Theft Protection Act can result in significant penalties for employers. These may include:

- Fines imposed by state labor departments.

- Potential lawsuits from employees seeking unpaid wages.

- Increased scrutiny from regulatory agencies.

Employers are encouraged to adhere strictly to the requirements of the act to avoid these consequences and maintain a fair workplace.

State-specific rules for the Wage Theft Protection Act of Notice to Employees

Each state may have unique regulations regarding the Wage Theft Protection Act of Notice to Employees. Employers should be aware of their specific state laws, as these can dictate additional requirements such as:

- The frequency of notice updates.

- Specific language or formats that must be used.

- Additional rights and protections provided to employees.

Staying informed about state-specific rules is essential for compliance and to ensure that employees are adequately protected.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wage theft protection act of notice to employees

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wage Theft Protection Act Of Notice To Employees?

The Wage Theft Protection Act Of Notice To Employees is a legal requirement that mandates employers to provide written notice to employees regarding their wage rights. This notice includes information about the employee's pay rate, work schedule, and other essential details. Understanding this act is crucial for both employers and employees to ensure compliance and protect workers' rights.

-

How can airSlate SignNow help with the Wage Theft Protection Act Of Notice To Employees?

airSlate SignNow offers a streamlined solution for creating, sending, and eSigning the Wage Theft Protection Act Of Notice To Employees. Our platform simplifies the process, ensuring that employers can easily comply with the legal requirements. With customizable templates, you can quickly generate the necessary documents and keep your employees informed.

-

What features does airSlate SignNow provide for managing wage theft notices?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning capabilities for managing Wage Theft Protection Act Of Notice To Employees. These features enhance efficiency and ensure that all notices are sent and signed promptly. Additionally, our platform provides tracking and reminders to help you stay compliant.

-

Is airSlate SignNow cost-effective for small businesses needing wage theft compliance?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses needing to comply with the Wage Theft Protection Act Of Notice To Employees. Our pricing plans are flexible and affordable, allowing you to choose the best option that fits your budget while ensuring compliance with legal requirements.

-

Can I integrate airSlate SignNow with other software for wage theft compliance?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, making it easy to manage the Wage Theft Protection Act Of Notice To Employees alongside your existing systems. Whether you use HR software, payroll systems, or document management tools, our platform can enhance your workflow and ensure compliance.

-

What are the benefits of using airSlate SignNow for wage theft notices?

Using airSlate SignNow for the Wage Theft Protection Act Of Notice To Employees provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform allows for quick document creation and secure eSigning, which saves time and minimizes errors. Additionally, you can easily track the status of notices sent to employees.

-

How does airSlate SignNow ensure the security of wage theft notices?

airSlate SignNow prioritizes the security of your documents, including the Wage Theft Protection Act Of Notice To Employees. We utilize advanced encryption and secure cloud storage to protect sensitive information. Our platform also complies with industry standards to ensure that your data remains safe and confidential throughout the signing process.

Get more for Wage Theft Protection Act Of Notice To Employees

- Framing contractor package oregon form

- Foundation contractor package oregon form

- Plumbing contractor package oregon form

- Brick mason contractor package oregon form

- Roofing contractor package oregon form

- Electrical contractor package oregon form

- Sheetrock drywall contractor package oregon form

- Flooring contractor package oregon form

Find out other Wage Theft Protection Act Of Notice To Employees

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF