PTAX 343 BApplicationb Madison County Government Co Madison Il Form

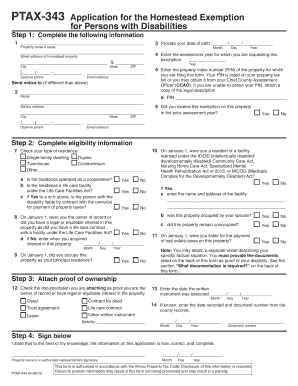

What is the PTAX 343 Application?

The PTAX 343 Application is a form used by property owners in Madison County, Illinois, to apply for a property tax exemption. This form is essential for individuals seeking to reduce their tax burden by claiming exemptions available under state law. The application is typically submitted to the local government to ensure that property owners receive the financial relief they are entitled to, particularly for properties that meet specific criteria, such as those used for residential purposes or owned by veterans.

How to Use the PTAX 343 Application

Using the PTAX 343 Application involves several straightforward steps. First, property owners must gather necessary documentation that supports their claim for exemption. This may include proof of ownership, income statements, or other relevant information. Once the required documents are collected, the applicant fills out the form, ensuring that all information is accurate and complete. After completing the form, it should be submitted to the appropriate local government office, either by mail or in person, depending on the submission guidelines provided by Madison County.

Steps to Complete the PTAX 343 Application

Completing the PTAX 343 Application requires careful attention to detail. Follow these steps:

- Obtain the PTAX 343 form from the Madison County Government website or local office.

- Gather all necessary documentation, including proof of ownership and any supporting financial documents.

- Fill out the application form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form along with all required documents to the local government office.

Eligibility Criteria for the PTAX 343 Application

To qualify for the PTAX 343 Application, applicants must meet specific eligibility criteria set forth by the state. Generally, the property must be the primary residence of the owner, and the owner must provide proof of residency. Additionally, there may be income limits or other conditions that must be satisfied to qualify for certain exemptions. It is important for applicants to review these criteria carefully to ensure they meet all requirements before submitting the application.

Required Documents for the PTAX 343 Application

When submitting the PTAX 343 Application, several documents are typically required. These may include:

- Proof of property ownership, such as a deed or title.

- Identification documents, like a driver's license or state ID.

- Income verification, which may include tax returns or pay stubs.

- Any additional documentation that supports the claim for exemption, as specified by the local government.

Form Submission Methods

The PTAX 343 Application can be submitted through various methods, depending on the preferences of the applicant and the guidelines of Madison County. Common submission methods include:

- Online submission through the Madison County Government website, if available.

- Mailing the completed form and documents to the designated office.

- In-person delivery to the local government office during business hours.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ptax 343 bapplicationb madison county government co madison il

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the PTAX 343 BApplicationb for Madison County Government Co Madison Il?

The PTAX 343 BApplicationb is a form used by property owners in Madison County, Illinois, to apply for property tax exemptions. This application is essential for those seeking to reduce their property tax burden through available exemptions. Understanding this form can help you navigate the local tax system effectively.

-

How can airSlate SignNow assist with the PTAX 343 BApplicationb Madison County Government Co Madison Il?

airSlate SignNow streamlines the process of completing and submitting the PTAX 343 BApplicationb for Madison County Government Co Madison Il. Our platform allows you to fill out the form electronically, ensuring accuracy and saving time. Additionally, you can eSign the document securely, making the submission process hassle-free.

-

What are the pricing options for using airSlate SignNow for the PTAX 343 BApplicationb?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for individuals and teams. Our cost-effective solution ensures that you can manage the PTAX 343 BApplicationb Madison County Government Co Madison Il without breaking the bank. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow provide for managing the PTAX 343 BApplicationb?

With airSlate SignNow, you gain access to features such as customizable templates, document tracking, and secure eSigning. These tools simplify the management of the PTAX 343 BApplicationb Madison County Government Co Madison Il, allowing you to focus on what matters most—getting your application approved. Our user-friendly interface makes it easy for anyone to use.

-

Are there any benefits to using airSlate SignNow for the PTAX 343 BApplicationb?

Using airSlate SignNow for the PTAX 343 BApplicationb Madison County Government Co Madison Il offers numerous benefits, including increased efficiency and reduced paperwork. Our platform enhances collaboration by allowing multiple users to work on the document simultaneously. Additionally, you can access your documents from anywhere, ensuring you never miss a deadline.

-

Can I integrate airSlate SignNow with other tools for the PTAX 343 BApplicationb?

Yes, airSlate SignNow integrates seamlessly with various applications and tools, enhancing your workflow for the PTAX 343 BApplicationb Madison County Government Co Madison Il. Whether you use CRM systems, cloud storage, or project management tools, our integrations help streamline your processes. This connectivity ensures that all your documents are organized and easily accessible.

-

Is airSlate SignNow secure for submitting the PTAX 343 BApplicationb?

Absolutely! airSlate SignNow prioritizes security, ensuring that your PTAX 343 BApplicationb Madison County Government Co Madison Il is protected. We utilize advanced encryption and secure servers to safeguard your data. You can confidently submit your application, knowing that your information is safe and compliant with regulations.

Get more for PTAX 343 BApplicationb Madison County Government Co Madison Il

Find out other PTAX 343 BApplicationb Madison County Government Co Madison Il

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free