Canada Child Benefits Application JKC TAX Form

What is the Canada Child Benefits Application JKC TAX

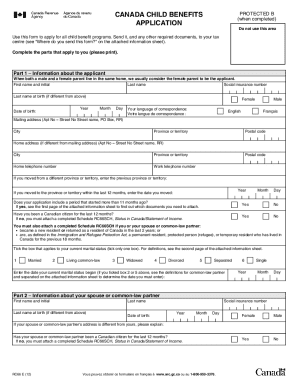

The Canada Child Benefits Application JKC TAX is a form designed for parents or guardians in Canada to apply for financial assistance through the Canada Child Benefit (CCB) program. This program provides monthly payments to eligible families to help cover the costs of raising children under the age of 18. The application process is essential for determining eligibility based on various factors, including family income and the number of children.

Steps to complete the Canada Child Benefits Application JKC TAX

Completing the Canada Child Benefits Application involves several important steps:

- Gather necessary information, including your Social Insurance Number (SIN) and details about your children.

- Determine your eligibility based on income thresholds and family size.

- Fill out the application form accurately, ensuring all required fields are completed.

- Review the application for any errors or missing information before submission.

- Submit the application online, by mail, or in person at designated locations.

Required Documents

To successfully complete the Canada Child Benefits Application, you will need to provide several key documents:

- Your Social Insurance Number (SIN).

- Proof of identity, such as a birth certificate or passport for each child.

- Income information for you and your spouse or partner, if applicable.

- Any previous tax returns or notices of assessment that may be requested.

Eligibility Criteria

To qualify for the Canada Child Benefits, applicants must meet specific eligibility criteria, including:

- Being a resident of Canada.

- Having a child under the age of 18.

- Filing a tax return for the previous year, even if you have no income.

- Meeting income thresholds that vary based on family size.

Form Submission Methods

The Canada Child Benefits Application can be submitted through various methods, providing flexibility for applicants:

- Online submission through the Canada Revenue Agency (CRA) website.

- Mailing the completed form to the appropriate CRA address.

- In-person submission at local CRA offices or designated service locations.

Application Process & Approval Time

The application process for the Canada Child Benefits typically involves the following timeline:

- After submission, the CRA will review your application for completeness and accuracy.

- Approval can take up to eight weeks, depending on the volume of applications.

- You will receive a notice from the CRA indicating your eligibility and the amount of benefits you will receive.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada child benefits application jkc tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Canada Child Benefits Application JKC TAX?

The Canada Child Benefits Application JKC TAX is a streamlined process that allows parents to apply for child benefits in Canada efficiently. This application ensures that families receive the financial support they need to raise their children, making it an essential tool for eligible parents.

-

How does airSlate SignNow facilitate the Canada Child Benefits Application JKC TAX?

airSlate SignNow simplifies the Canada Child Benefits Application JKC TAX by providing an easy-to-use platform for eSigning and sending necessary documents. This ensures that your application is processed quickly and securely, reducing the hassle often associated with paperwork.

-

What are the costs associated with using airSlate SignNow for the Canada Child Benefits Application JKC TAX?

Using airSlate SignNow for the Canada Child Benefits Application JKC TAX is cost-effective, with various pricing plans to suit different needs. You can choose a plan that fits your budget while ensuring you have access to all the features necessary for a smooth application process.

-

What features does airSlate SignNow offer for the Canada Child Benefits Application JKC TAX?

airSlate SignNow offers features such as document templates, eSignature capabilities, and secure cloud storage, all tailored for the Canada Child Benefits Application JKC TAX. These features enhance the user experience, making it easier to manage your application and related documents.

-

Are there any benefits to using airSlate SignNow for the Canada Child Benefits Application JKC TAX?

Yes, using airSlate SignNow for the Canada Child Benefits Application JKC TAX provides numerous benefits, including faster processing times and reduced paperwork. Additionally, the platform's user-friendly interface ensures that even those unfamiliar with technology can navigate the application process with ease.

-

Can I integrate airSlate SignNow with other tools for the Canada Child Benefits Application JKC TAX?

Absolutely! airSlate SignNow offers integrations with various tools and applications, enhancing your experience with the Canada Child Benefits Application JKC TAX. This allows you to streamline your workflow and manage your documents more effectively.

-

Is airSlate SignNow secure for handling the Canada Child Benefits Application JKC TAX?

Yes, airSlate SignNow prioritizes security, ensuring that all documents related to the Canada Child Benefits Application JKC TAX are protected. With advanced encryption and compliance with industry standards, you can trust that your sensitive information is safe.

Get more for Canada Child Benefits Application JKC TAX

- Tt2 exemption update form

- Btvgb wire transfer form withdrawals from btvgb account

- How does grossmont verify independant student form

- F a s t phoenix childrens hospital form

- South carolina dosh c 15 form

- Notice of non appearance hearing regarding final accounting notice of non appearance hearing regarding final accounting form

- Consulting service agreement template form

- Consulting service short consulting agreement template form

Find out other Canada Child Benefits Application JKC TAX

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors