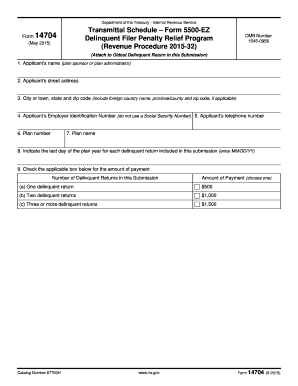

Form 14704

What is the Form 14704

Form 14704 is a specific document used by taxpayers in the United States to request a determination of their eligibility for a tax refund. This form is particularly relevant for individuals who believe they have overpaid their taxes or are seeking a refund for specific tax credits. Understanding the purpose of Form 14704 is essential for ensuring accurate tax filings and maximizing potential refunds.

How to use the Form 14704

Using Form 14704 involves several straightforward steps. First, ensure you have all necessary personal information, including your Social Security number and details about your tax payments. Next, fill out the form accurately, providing all required information regarding your tax situation. After completing the form, review it for any errors or omissions. Finally, submit the form to the appropriate tax authority as indicated in the instructions.

Steps to complete the Form 14704

Completing Form 14704 requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including previous tax returns and payment records.

- Fill in your personal information, ensuring that your name and Social Security number are correct.

- Detail the specific reasons for your refund request, citing relevant tax credits or overpayments.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Key elements of the Form 14704

Form 14704 includes several key elements that are crucial for its validity. These elements typically consist of:

- Your personal identification information, such as name and Social Security number.

- A section detailing the tax years for which you are requesting a refund.

- Specific reasons for the refund request, including any relevant tax credits.

- A signature line to confirm the accuracy of the information provided.

Filing Deadlines / Important Dates

Being aware of filing deadlines is essential when submitting Form 14704. Generally, the IRS has specific timeframes within which refund requests must be filed. For most taxpayers, the deadline is typically three years from the original tax return due date. It is important to check for any updates or changes to these deadlines to ensure compliance and avoid missing out on potential refunds.

Form Submission Methods

Form 14704 can be submitted through various methods, depending on the preferences of the taxpayer. The common submission methods include:

- Online submission through the IRS e-file system, if applicable.

- Mailing the completed form to the designated IRS address.

- In-person delivery at local IRS offices, where allowed.

Legal use of the Form 14704

Form 14704 must be used in accordance with IRS regulations to ensure its legal validity. Taxpayers should only use this form for legitimate refund requests based on accurate financial information. Misuse of the form, such as filing false information, can lead to penalties or legal repercussions. It is advisable to consult a tax professional if there are uncertainties regarding its use.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14704

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 14704 and how can airSlate SignNow help?

Form 14704 is a document used for specific business processes, and airSlate SignNow provides an efficient way to manage and eSign this form. With our platform, you can easily upload, send, and track Form 14704, ensuring a seamless workflow for your business.

-

Is there a cost associated with using airSlate SignNow for Form 14704?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, allowing you to manage Form 14704 and other documents without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 14704?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage specifically for Form 14704. These features enhance your document management process, making it easier to handle important forms efficiently.

-

Can I integrate airSlate SignNow with other applications for Form 14704?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling Form 14704. This means you can connect with tools you already use, enhancing productivity and efficiency.

-

How does airSlate SignNow ensure the security of Form 14704?

Security is a top priority at airSlate SignNow. We implement advanced encryption and compliance measures to protect your Form 14704 and other sensitive documents, ensuring that your data remains safe and secure throughout the signing process.

-

What are the benefits of using airSlate SignNow for Form 14704?

Using airSlate SignNow for Form 14704 offers numerous benefits, including faster turnaround times, reduced paper usage, and improved accuracy. Our platform simplifies the signing process, allowing you to focus on what matters most—growing your business.

-

Is it easy to get started with airSlate SignNow for Form 14704?

Yes, getting started with airSlate SignNow for Form 14704 is quick and easy. Simply sign up for an account, upload your form, and you can begin sending and signing documents in no time.

Get more for Form 14704

- Ventura county fictitious business name search form

- Form arts gs articles of incorporation of a general stock corporation

- Ladbs inform07

- Printable welding test form

- New business application form

- Stormwater mitigation plan form

- Sl2 diligent search form

- Pgampe medical baseline self certification form 2002

Find out other Form 14704

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer