Form 2 01

What is the Form 2 01

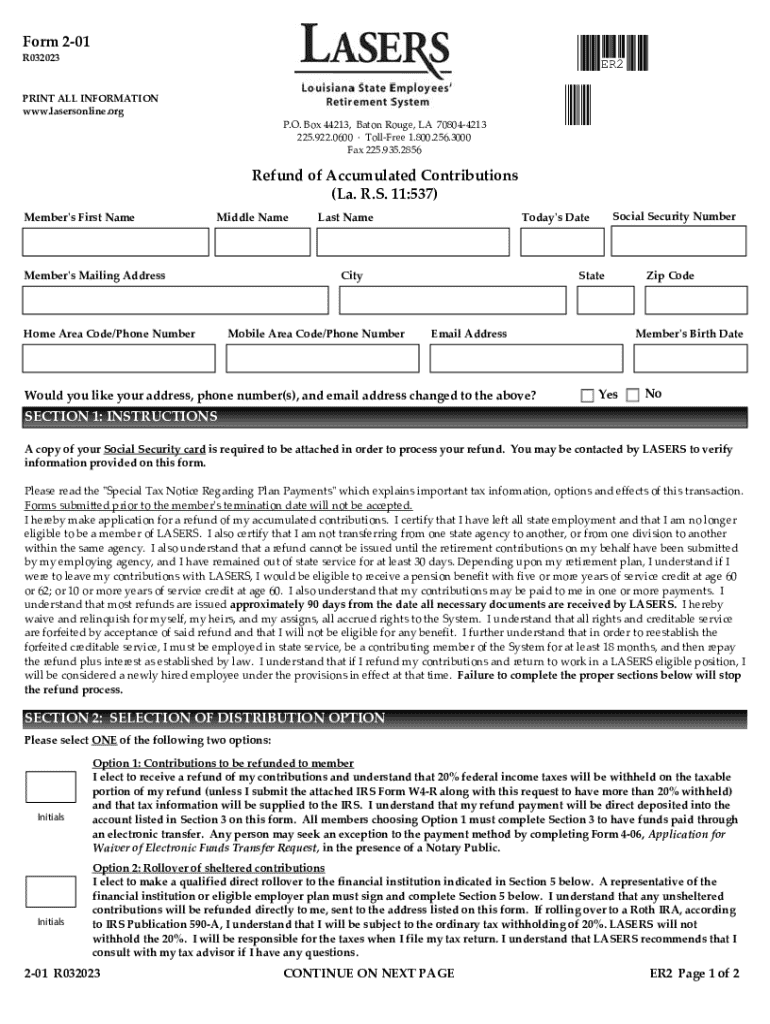

The Form 2 01 is a specific document used primarily for regulatory and compliance purposes within various sectors. It serves as a formal request or declaration that may be required by government agencies or other regulatory bodies. Understanding the purpose of this form is essential for individuals and businesses to ensure they meet necessary legal obligations.

How to obtain the Form 2 01

Obtaining the Form 2 01 is straightforward. It is typically available through official government websites or designated agencies. Users can download the form in a digital format, which allows for easy access and completion. In some cases, physical copies may be available at local offices or service centers, depending on the issuing authority.

Steps to complete the Form 2 01

Completing the Form 2 01 involves several key steps:

- Read the instructions carefully to understand the requirements.

- Gather all necessary information and documents required for completion.

- Fill out the form accurately, ensuring all fields are completed as instructed.

- Review the form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the Form 2 01

The Form 2 01 is legally binding once completed and submitted. It is crucial for users to ensure that all information provided is truthful and accurate, as any discrepancies may lead to legal repercussions. Understanding the legal implications of this form helps users navigate compliance requirements effectively.

Key elements of the Form 2 01

Key elements of the Form 2 01 typically include:

- Identification information of the individual or entity submitting the form.

- Specific details regarding the purpose of the form.

- Signature and date fields to validate the submission.

- Any additional documentation that may need to accompany the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 2 01 can vary based on the specific requirements of the issuing authority. It is essential to be aware of these deadlines to avoid penalties or delays in processing. Users should check the official guidelines for the most accurate and up-to-date information regarding important dates related to this form.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2 01

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 2 01 and how does it work?

Form 2 01 is a digital document that allows users to collect signatures electronically. With airSlate SignNow, you can easily create, send, and manage Form 2 01 documents, streamlining your workflow and ensuring compliance. The platform provides a user-friendly interface that simplifies the signing process for both senders and recipients.

-

How much does it cost to use airSlate SignNow for Form 2 01?

airSlate SignNow offers competitive pricing plans tailored to different business needs. You can choose from various subscription options that provide access to features specifically designed for managing Form 2 01 documents. Additionally, a free trial is available, allowing you to explore the platform before committing to a plan.

-

What features does airSlate SignNow offer for Form 2 01?

airSlate SignNow includes a range of features for Form 2 01, such as customizable templates, automated workflows, and real-time tracking of document status. These features enhance efficiency and ensure that you can manage your documents effectively. The platform also supports multiple file formats, making it versatile for various business needs.

-

Can I integrate Form 2 01 with other applications?

Yes, airSlate SignNow allows seamless integration with various applications, enhancing your ability to manage Form 2 01 documents. You can connect it with popular tools like Google Drive, Salesforce, and Microsoft Office, ensuring that your workflow remains uninterrupted. This integration capability helps streamline processes and improve productivity.

-

What are the benefits of using airSlate SignNow for Form 2 01?

Using airSlate SignNow for Form 2 01 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security for your documents. The platform ensures that all signatures are legally binding and compliant with regulations. Additionally, it provides a cost-effective solution for businesses looking to digitize their document management.

-

Is airSlate SignNow secure for handling Form 2 01?

Absolutely, airSlate SignNow prioritizes security when handling Form 2 01 documents. The platform employs advanced encryption and security protocols to protect your data. Furthermore, it complies with industry standards, ensuring that your documents are safe from unauthorized access.

-

How can I track the status of my Form 2 01 documents?

airSlate SignNow provides real-time tracking for all your Form 2 01 documents. You can easily monitor who has viewed or signed your documents and receive notifications when actions are taken. This feature helps you stay informed and manage your document workflow effectively.

Get more for Form 2 01

- Renovate credit card form

- 401k beneficiary form template

- Pasco county roof affidavit form

- Application for retention re acquisition of philippine citizenship form

- Virginia mason financial assistance form

- Biopsy request form 290183422

- Neuromuscular home page form

- Www assurechildcare com now available online form

Find out other Form 2 01

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple