New Bankoh Home EquityLine Increase to Existing Bankoh Home EquityLine No Form

What is the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No

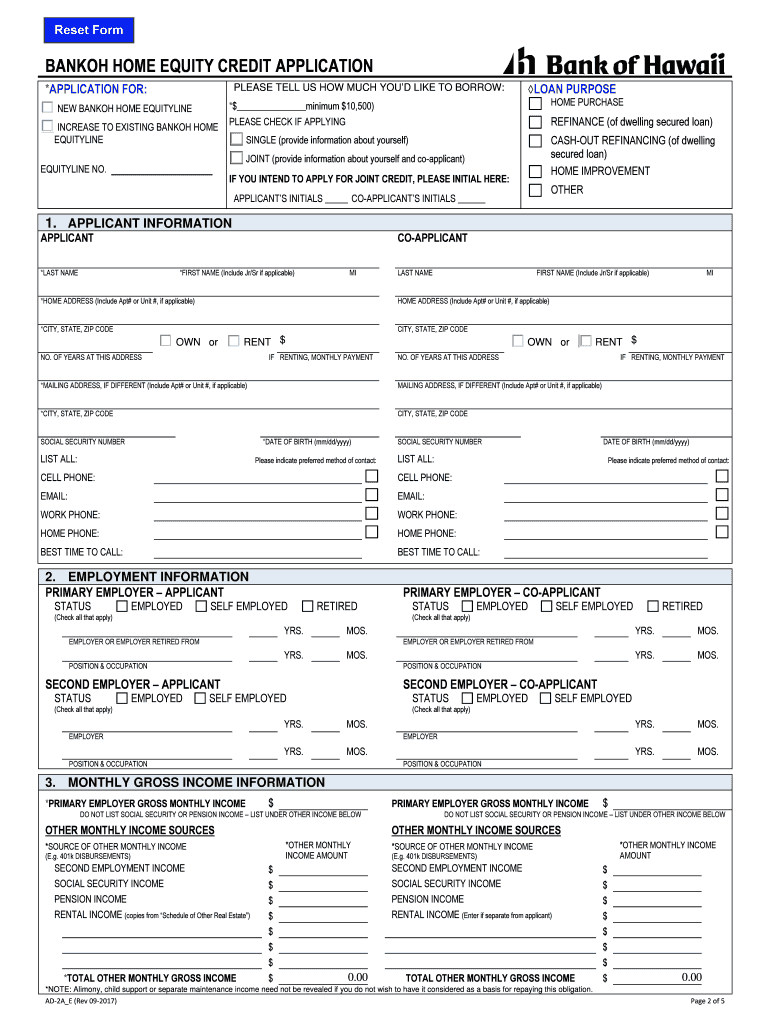

The New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No is a financial form that allows homeowners to request an increase in their existing home equity line of credit. This form is specifically designed for customers of Bank of Hawaii who wish to access additional funds based on the equity they have built in their property. Understanding the purpose of this form is crucial for homeowners looking to leverage their home equity for various financial needs, such as home improvements, debt consolidation, or other significant expenses.

How to use the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No

Using the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No involves a straightforward process. Homeowners must first ensure they meet the eligibility criteria set by Bank of Hawaii. After confirming eligibility, they can fill out the form with accurate information regarding their existing home equity line and the requested increase amount. It is essential to provide any supporting documentation that may be required to facilitate the review process. Once completed, the form should be submitted according to the specified submission methods.

Steps to complete the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No

Completing the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No involves several key steps:

- Review eligibility criteria to ensure you qualify for an increase.

- Gather necessary documentation, such as proof of income and current mortgage statements.

- Fill out the form accurately, including all required fields.

- Double-check the information for accuracy before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Required Documents

When applying for an increase using the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No, certain documents are typically required. These may include:

- Proof of income, such as recent pay stubs or tax returns.

- Current mortgage statements to verify existing debt.

- Documentation of any other outstanding loans or financial obligations.

- Identification documents, such as a driver's license or Social Security number.

Eligibility Criteria

Eligibility for the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No generally depends on various factors. Homeowners must have an existing home equity line of credit with Bank of Hawaii and should demonstrate sufficient equity in their property. Additionally, a good credit score and stable income are often necessary to qualify for an increase. It is advisable to check with Bank of Hawaii for specific eligibility requirements that may apply.

Application Process & Approval Time

The application process for the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No is designed to be efficient. After submitting the completed form along with the required documents, Bank of Hawaii will review the application. The approval time can vary based on the complexity of the request and the volume of applications being processed. Typically, homeowners can expect to receive a decision within a few business days, but it is wise to inquire about specific timelines during the application process.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new bankoh home equityline increase to existing bankoh home equityline no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No.?

The New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No. allows current Bankoh Home EquityLine customers to increase their existing credit limit. This option provides flexibility for homeowners looking to access additional funds for renovations, debt consolidation, or other financial needs.

-

How can I apply for the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No.?

To apply for the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No., you can visit the Bankoh website or contact customer service. The application process is straightforward and typically requires you to provide information about your current financial situation and property.

-

What are the benefits of increasing my existing Bankoh Home EquityLine?

Increasing your existing Bankoh Home EquityLine can provide you with additional funds at a lower interest rate compared to personal loans or credit cards. This can help you manage larger expenses or consolidate debt more effectively, making it a smart financial move.

-

Are there any fees associated with the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No.?

There may be fees associated with the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No., such as appraisal fees or closing costs. It's important to review the terms and conditions provided by Bankoh to understand any potential costs involved.

-

What is the interest rate for the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No.?

The interest rate for the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No. varies based on market conditions and your credit profile. Bankoh typically offers competitive rates, so it's advisable to check their current rates and terms.

-

Can I use the increased funds for any purpose?

Yes, the funds from the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No. can be used for various purposes, including home improvements, education expenses, or consolidating high-interest debt. This flexibility makes it a valuable financial tool.

-

How long does it take to process the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No. application?

The processing time for the New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No. can vary, but it typically takes a few days to a couple of weeks. Factors such as the completeness of your application and current workload at Bankoh can influence the timeline.

Get more for New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No

- Vt will 497429156 form

- Legal last will and testament form for married person with adult and minor children from prior marriage vermont

- Legal last will and testament form for civil union partner with adult and minor children from prior marriage vermont

- Legal last will and testament form for married person with adult and minor children vermont

- Legal last will and testament form for civil union partner with adult and minor children vermont

- Mutual wills package with last wills and testaments for married couple with adult and minor children vermont form

- Legal last will and testament form for a widow or widower with adult children vermont

- Legal last will and testament form for widow or widower with minor children vermont

Find out other New Bankoh Home EquityLine Increase To Existing Bankoh Home EquityLine No

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple