How to Use P87 HMRC Form to Claim Tax Relief?

Understanding the P87 HMRC Form for Tax Relief

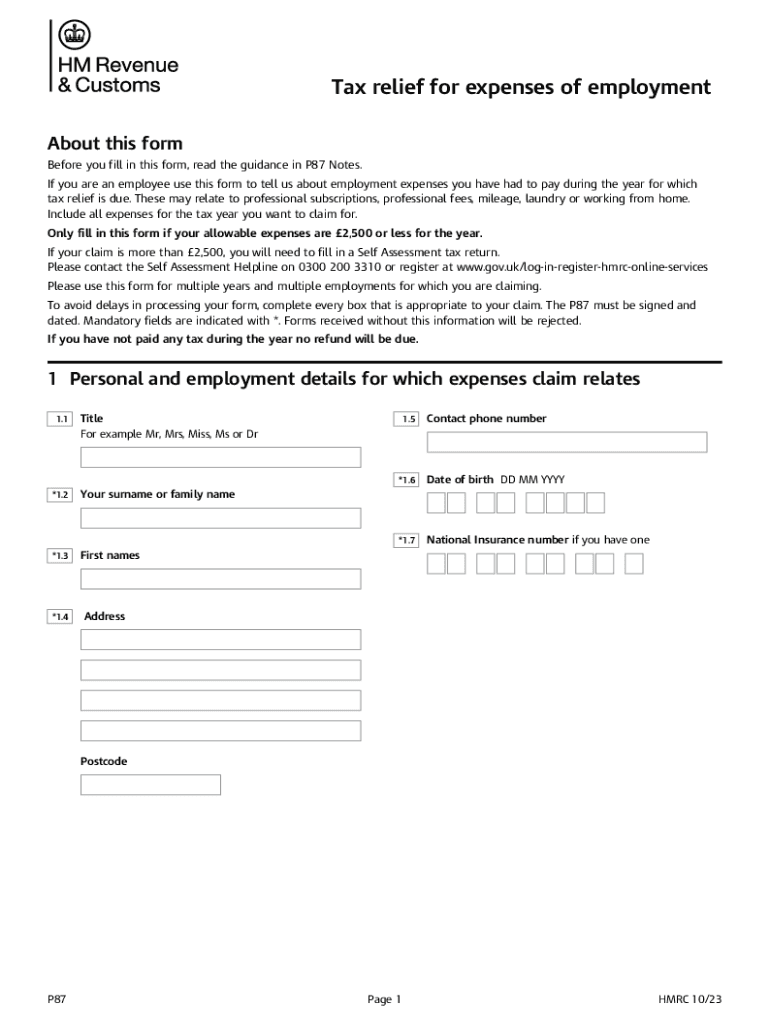

The P87 HMRC Form is a key document used by individuals in the United Kingdom to claim tax relief on expenses incurred while working. This form is particularly relevant for employees who have incurred costs related to their job, such as travel expenses or work-related equipment. Understanding its purpose is essential for anyone looking to reduce their tax liability effectively.

How to Use the P87 HMRC Form

Using the P87 HMRC Form involves several straightforward steps. First, gather all relevant information regarding your employment and the expenses you wish to claim. Next, accurately fill out the form, ensuring that you provide detailed descriptions of each expense. After completing the form, submit it to HMRC either online or via mail, depending on your preference. It is crucial to keep copies of all documents for your records.

Steps to Complete the P87 HMRC Form

Completing the P87 HMRC Form requires careful attention to detail. Begin by entering your personal information, including your name, address, and National Insurance number. Then, list the expenses you are claiming, providing specific amounts and descriptions. Be sure to include any supporting documentation, such as receipts or invoices, to validate your claims. Finally, review the form for accuracy before submission.

Eligibility Criteria for Claiming Tax Relief

To be eligible for tax relief using the P87 HMRC Form, you must meet certain criteria. You should be an employee, not self-employed, and have incurred expenses that are necessary for your job. Additionally, the expenses must not have been reimbursed by your employer. Understanding these eligibility requirements is vital to ensure your claim is valid and accepted by HMRC.

Required Documents for Submission

When submitting the P87 HMRC Form, certain documents are required to support your claim. These may include receipts for expenses, proof of employment, and any other documentation that substantiates your claims. Having these documents ready can facilitate a smoother submission process and help avoid delays in processing your claim.

Form Submission Methods

The P87 HMRC Form can be submitted through various methods. You can complete and submit the form online through the HMRC website, which is often the quickest option. Alternatively, you may choose to print the form and send it via traditional mail. Each method has its own timeline for processing, so consider your needs when deciding how to submit your claim.

Common Scenarios for Using the P87 HMRC Form

The P87 HMRC Form is commonly used in various employment scenarios. For instance, employees who travel for work, incur costs for uniforms, or purchase tools necessary for their job can benefit from this form. Understanding these scenarios can help individuals identify potential claims and maximize their tax relief opportunities.

Handy tips for filling out How To Use P87 HMRC Form To Claim Tax Relief? online

Quick steps to complete and e-sign How To Use P87 HMRC Form To Claim Tax Relief? online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining filling in forms can be. Gain access to a GDPR and HIPAA compliant service for optimum simplicity. Use signNow to electronically sign and share How To Use P87 HMRC Form To Claim Tax Relief? for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to use p87 hmrc form to claim tax relief

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the P87 HMRC Form?

The P87 HMRC Form is a document used by employees to claim tax relief on expenses incurred while performing their job. Understanding how to use the P87 HMRC Form to claim tax relief can help you recover money spent on work-related costs, ensuring you maximize your tax benefits.

-

How do I fill out the P87 HMRC Form?

Filling out the P87 HMRC Form involves providing personal details, employment information, and a breakdown of your expenses. To effectively learn how to use the P87 HMRC Form to claim tax relief, ensure you have all necessary receipts and documentation ready to support your claims.

-

What expenses can I claim using the P87 HMRC Form?

You can claim various work-related expenses such as travel costs, uniforms, and tools using the P87 HMRC Form. Knowing how to use the P87 HMRC Form to claim tax relief allows you to identify eligible expenses that can signNowly reduce your taxable income.

-

Is there a fee for submitting the P87 HMRC Form?

There is no fee for submitting the P87 HMRC Form directly to HMRC. However, if you choose to use a service or software to assist you, there may be associated costs. Understanding how to use the P87 HMRC Form to claim tax relief can help you avoid unnecessary expenses.

-

How long does it take to process the P87 HMRC Form?

Typically, HMRC processes the P87 HMRC Form within 4 to 6 weeks. However, processing times can vary based on the volume of claims. Knowing how to use the P87 HMRC Form to claim tax relief ensures you submit accurate information, which can help expedite the process.

-

Can I amend my P87 HMRC Form after submission?

Yes, you can amend your P87 HMRC Form after submission if you realize there are errors or additional expenses to claim. It’s important to understand how to use the P87 HMRC Form to claim tax relief correctly to minimize the need for amendments.

-

What are the benefits of using airSlate SignNow for my P87 HMRC Form?

Using airSlate SignNow simplifies the process of completing and submitting your P87 HMRC Form. With its easy-to-use interface, you can efficiently manage your documents and ensure that you know how to use the P87 HMRC Form to claim tax relief without hassle.

Get more for How To Use P87 HMRC Form To Claim Tax Relief?

- Schedule k 1 form n 35 rev 2022 shareholders share of income credits deductions etc

- Tax claim franklin county pa form

- N 15 rev 2022 nonresident and part year resident income tax return forms 2022 fillable

- 2022 form 1120 f us income tax return of a foreign corporation

- Filing your tax return oregon division of financial regulation form

- Instructions for form 1042 2022internal revenue service

- Irs publication 596 fill out and sign printable pdf templatesignnow form

- About form 4684 casualties and thefts irs

Find out other How To Use P87 HMRC Form To Claim Tax Relief?

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement