Eigenkapitalbescheinigung Form

What is the Eigenkapitalbescheinigung

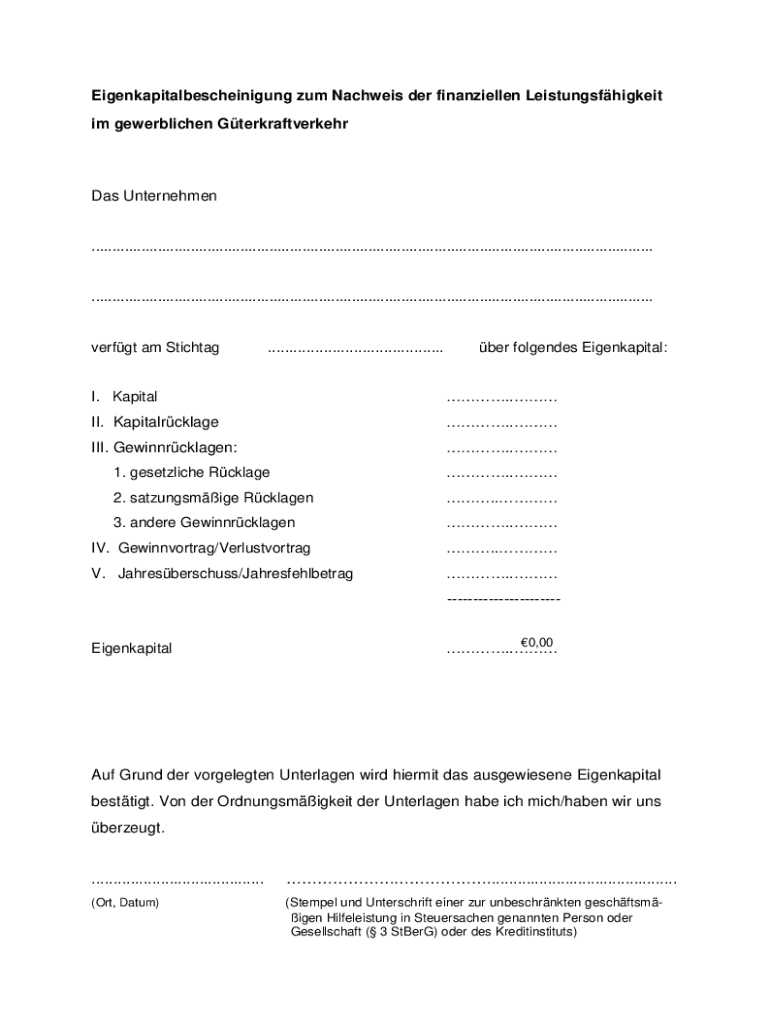

The Eigenkapitalbescheinigung, or equity certificate, is a formal document that verifies an individual's or a business's equity position. This certificate is often required in various financial transactions, including loan applications and real estate purchases. It serves as proof of available equity, which can be crucial for lenders and investors assessing financial stability and creditworthiness.

How to obtain the Eigenkapitalbescheinigung

To obtain an Eigenkapitalbescheinigung, individuals or businesses typically need to request it from their financial institution or a certified accountant. The process usually involves providing documentation that outlines current assets, liabilities, and any relevant financial statements. Institutions may have specific forms or requirements that must be fulfilled, so it's advisable to check directly with the issuing body for precise instructions.

Key elements of the Eigenkapitalbescheinigung

An Eigenkapitalbescheinigung generally includes several key elements: the name and address of the issuer, the date of issuance, the name of the individual or business, and a detailed breakdown of equity. Additionally, it may outline the methodology used to calculate equity, including any assumptions made during the assessment. This transparency helps ensure that the document is credible and can be trusted by third parties.

Legal use of the Eigenkapitalbescheinigung

The Eigenkapitalbescheinigung has specific legal implications, particularly in financial and real estate transactions. It is often required by lenders as part of the due diligence process to ensure that borrowers have sufficient equity to support their financing requests. Misrepresentation or failure to provide an accurate Eigenkapitalbescheinigung can lead to legal consequences, including potential fraud charges or loan defaults.

Steps to complete the Eigenkapitalbescheinigung

Completing an Eigenkapitalbescheinigung involves several steps:

- Gather financial documents, including balance sheets and income statements.

- Calculate total assets and total liabilities to determine net equity.

- Fill out the required form provided by the issuing institution.

- Review the document for accuracy and completeness.

- Submit the Eigenkapitalbescheinigung to the appropriate parties as needed.

Examples of using the Eigenkapitalbescheinigung

Common scenarios where an Eigenkapitalbescheinigung is utilized include:

- Applying for a mortgage to purchase a home, where lenders require proof of equity.

- Seeking investment for a startup, where investors need assurance of the founder's financial stability.

- Refinancing existing loans, which often necessitates an updated equity assessment.

Required Documents

When applying for an Eigenkapitalbescheinigung, the following documents are typically required:

- Recent financial statements, including balance sheets and profit and loss statements.

- Tax returns for the past few years.

- Documentation of any outstanding debts or liabilities.

- Proof of ownership for any assets being claimed as equity.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the eigenkapitalbescheinigung

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Eigenkapitalbescheinigung?

An Eigenkapitalbescheinigung is a certificate that verifies the equity capital of a business. It is often required by banks and financial institutions when applying for loans or financing. With airSlate SignNow, you can easily create and sign your Eigenkapitalbescheinigung electronically, streamlining the process.

-

How can airSlate SignNow help with creating an Eigenkapitalbescheinigung?

airSlate SignNow provides templates and tools that simplify the creation of an Eigenkapitalbescheinigung. You can customize the document to meet your specific needs and ensure all necessary information is included. The platform also allows for easy collaboration with stakeholders to finalize the document.

-

Is airSlate SignNow cost-effective for generating an Eigenkapitalbescheinigung?

Yes, airSlate SignNow offers a cost-effective solution for generating an Eigenkapitalbescheinigung. With various pricing plans available, businesses can choose an option that fits their budget while still benefiting from powerful eSigning features. This helps save both time and money in document management.

-

What features does airSlate SignNow offer for managing Eigenkapitalbescheinigungen?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for managing Eigenkapitalbescheinigungen. These features ensure that your documents are not only professional but also compliant with legal standards. Additionally, you can store and access your documents securely in the cloud.

-

Can I integrate airSlate SignNow with other tools for my Eigenkapitalbescheinigung?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, enhancing your workflow for managing Eigenkapitalbescheinigungen. Whether you use CRM systems, cloud storage, or project management tools, you can connect them to streamline your document processes.

-

What are the benefits of using airSlate SignNow for my Eigenkapitalbescheinigung?

Using airSlate SignNow for your Eigenkapitalbescheinigung offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick eSigning, which accelerates the approval process. Additionally, you can easily track the status of your documents in real-time.

-

Is it safe to use airSlate SignNow for sensitive documents like Eigenkapitalbescheinigungen?

Yes, airSlate SignNow prioritizes security and compliance, making it safe to use for sensitive documents like Eigenkapitalbescheinigungen. The platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are secure while being processed and stored.

Get more for Eigenkapitalbescheinigung

- Ban notice form

- Aircraft squawk sheet form

- Application for consumer exemption form

- The monkeys paw vocabulary pdf form

- Authorized signatory list template 423026331 form

- 4 point inspection checklist form

- Angle angle similarity worksheet pdf form

- Discipline and guidance policy for not just another daycare form

Find out other Eigenkapitalbescheinigung

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip