S03 Form

What is the S03

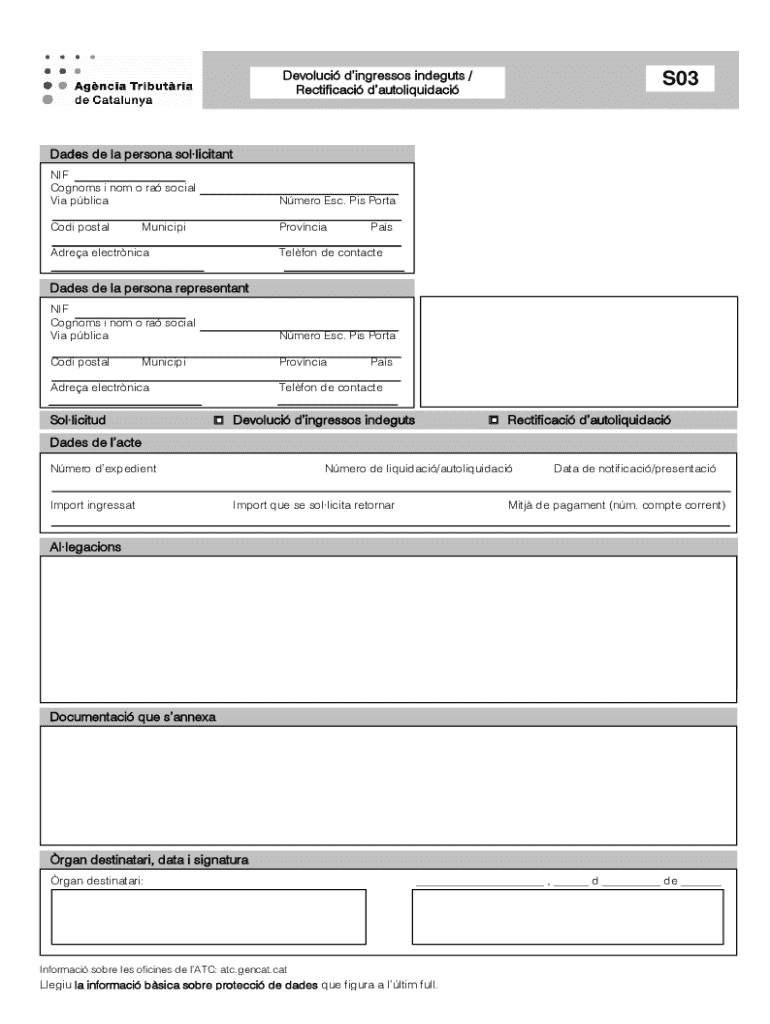

The S03 form is a specific document used in various administrative processes, primarily related to tax and regulatory compliance. It serves as a means for individuals or businesses to provide necessary information to the relevant authorities. Understanding the purpose and structure of the S03 is essential for ensuring accurate and timely submissions.

How to use the S03

Using the S03 form involves several key steps. First, gather all required information and documentation that pertains to the form. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, review it for any errors or omissions before submission. It is crucial to follow any specific instructions provided with the form to avoid delays or issues.

Steps to complete the S03

Completing the S03 form can be broken down into a few straightforward steps:

- Gather necessary information, including personal identification and financial details.

- Obtain the latest version of the S03 form from the appropriate authority.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Review the form for errors or missing information.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the S03

The S03 form must be used in accordance with applicable laws and regulations. Failure to comply with legal requirements can result in penalties or complications. It is important to understand the legal implications of submitting the S03, including any deadlines and specific criteria that must be met. Consulting a legal professional may be beneficial for complex situations.

Key elements of the S03

Several key elements are essential to the S03 form. These include:

- Identification information: This typically includes the name, address, and taxpayer identification number of the individual or business.

- Financial details: Relevant financial information must be accurately reported to ensure compliance.

- Signature: The form must be signed by the individual or an authorized representative to validate the submission.

Filing Deadlines / Important Dates

Awareness of filing deadlines is crucial when submitting the S03 form. Important dates may vary based on the specific purpose of the form, such as annual deadlines for tax submissions or other regulatory requirements. Keeping a calendar of these dates can help prevent late submissions and associated penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the s03

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is S03 and how does it benefit my business?

S03 is a powerful feature of airSlate SignNow that streamlines the document signing process. It allows businesses to send and eSign documents quickly and efficiently, reducing turnaround time. By utilizing S03, companies can enhance productivity and improve customer satisfaction.

-

How much does the S03 feature cost?

The S03 feature is included in the airSlate SignNow pricing plans, which are designed to be cost-effective for businesses of all sizes. Pricing varies based on the number of users and features required. For detailed pricing information, visit our pricing page.

-

What features are included with S03?

S03 includes a range of features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to simplify the document management process and enhance collaboration. With S03, users can easily manage their documents from anywhere.

-

Can S03 integrate with other software applications?

Yes, S03 seamlessly integrates with various software applications, including CRM systems and cloud storage services. This integration allows for a more streamlined workflow and enhances overall efficiency. Users can connect S03 with their existing tools to maximize productivity.

-

Is S03 secure for sensitive documents?

Absolutely, S03 prioritizes security with advanced encryption and compliance with industry standards. This ensures that all documents signed through airSlate SignNow are protected against unauthorized access. Businesses can confidently use S03 for their sensitive document needs.

-

How does S03 improve the document signing experience?

S03 enhances the document signing experience by providing an intuitive interface and fast processing times. Users can easily send documents for eSignature and track their status in real-time. This efficiency leads to quicker approvals and a smoother workflow.

-

What types of documents can I send using S03?

With S03, you can send a variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, making it versatile for different business needs. This flexibility allows users to manage all their document signing requirements in one place.

Get more for S03

Find out other S03

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure