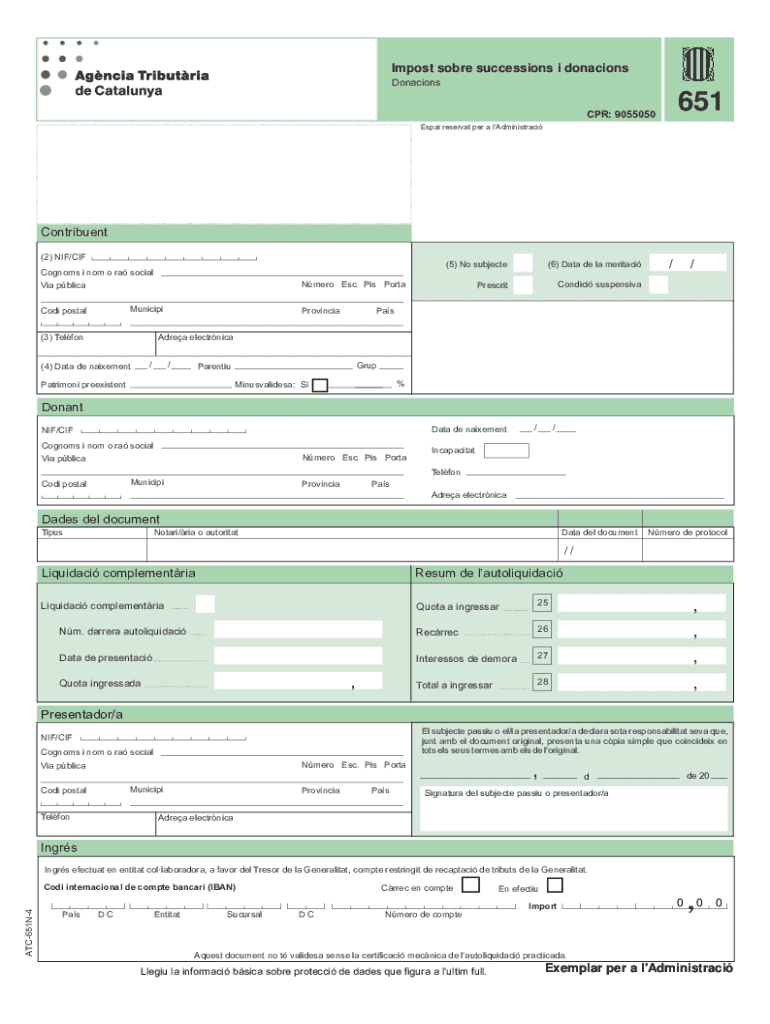

Impost Sobre Successions I Donacions Form

What is the Impost Sobre Successions I Donacions

The Impost Sobre Successions I Donacions is a tax levied on inheritances and donations in certain jurisdictions. This tax applies when an individual receives assets, property, or money as a result of a bequest or gift. The rate and structure of this tax can vary based on the value of the assets and the relationship between the donor and the recipient.

This tax is important for ensuring that wealth transfer is subject to taxation, helping to fund public services and infrastructure. Understanding the specifics of this tax is essential for individuals involved in estate planning or those who may receive significant gifts or inheritances.

How to use the Impost Sobre Successions I Donacions

Using the Impost Sobre Successions I Donacions involves several steps, primarily focused on accurately reporting the value of the assets received. Recipients of inheritances or gifts must declare the value of the assets on the appropriate tax forms, which may vary by state.

To correctly utilize this tax, individuals should gather all necessary documentation related to the inheritance or gift, including appraisals of property and records of the donor’s estate. Properly completing the required forms ensures compliance and helps avoid potential penalties.

Steps to complete the Impost Sobre Successions I Donacions

Completing the Impost Sobre Successions I Donacions typically involves the following steps:

- Gather all relevant documentation, including wills, property appraisals, and any records of gifts.

- Determine the total value of the assets received, considering any debts or liabilities associated with the estate.

- Complete the required tax forms accurately, ensuring all information is current and correct.

- Submit the forms by the designated deadline, which may vary depending on the jurisdiction.

- Keep copies of all submitted documents for your records.

Required Documents

To file the Impost Sobre Successions I Donacions, several documents are typically required:

- A copy of the will or trust documents, if applicable.

- Property appraisals to determine the fair market value of the assets.

- Records of any debts or liabilities associated with the estate.

- Identification documents for both the donor and the recipient.

Having these documents ready will facilitate a smoother filing process and help ensure compliance with tax regulations.

Penalties for Non-Compliance

Failure to comply with the Impost Sobre Successions I Donacions can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. The severity of the penalties often depends on the nature of the non-compliance, such as late filing or underreporting the value of assets.

To avoid these consequences, it is essential to understand the filing requirements and deadlines associated with this tax. Seeking assistance from a tax professional can also be beneficial in navigating these complexities.

Eligibility Criteria

Eligibility for the Impost Sobre Successions I Donacions generally depends on the relationship between the donor and the recipient, as well as the value of the assets transferred. Different jurisdictions may have specific thresholds that determine whether the tax applies.

Typically, closer relatives may benefit from lower tax rates or exemptions, while distant relatives or non-relatives may face higher rates. Understanding these criteria is crucial for recipients to determine their tax obligations accurately.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the impost sobre successions i donacions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Impost Sobre Successions I Donacions?

The Impost Sobre Successions I Donacions is a tax levied on inheritances and donations in Spain. Understanding this tax is crucial for individuals and businesses involved in estate planning or asset transfer. airSlate SignNow can help streamline the documentation process related to these transactions.

-

How can airSlate SignNow assist with Impost Sobre Successions I Donacions?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to the Impost Sobre Successions I Donacions. Our solution simplifies the paperwork involved, ensuring compliance and accuracy in your tax-related documents. This can save you time and reduce the stress associated with tax obligations.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet various business needs. Whether you are a small business or a large enterprise, you can find a plan that suits your budget while effectively managing documents related to the Impost Sobre Successions I Donacions. Visit our pricing page for detailed information on each plan.

-

Are there any features specifically designed for handling Impost Sobre Successions I Donacions?

Yes, airSlate SignNow includes features that facilitate the management of documents related to the Impost Sobre Successions I Donacions. These features include customizable templates, secure eSigning, and automated workflows that help ensure all necessary documentation is completed accurately and efficiently.

-

What benefits does airSlate SignNow provide for managing Impost Sobre Successions I Donacions?

Using airSlate SignNow for managing Impost Sobre Successions I Donacions offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to track document status in real-time, ensuring that all parties are informed and that the process is seamless. This ultimately leads to a smoother experience when dealing with tax obligations.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow can integrate with various accounting and tax management software, making it easier to handle the Impost Sobre Successions I Donacions. These integrations allow for a more streamlined workflow, ensuring that all your financial data is synchronized and accessible when preparing tax documents.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents related to the Impost Sobre Successions I Donacions. Our platform employs advanced encryption and security protocols to protect your data, ensuring that your information remains confidential and secure throughout the signing process.

Get more for Impost Sobre Successions I Donacions

Find out other Impost Sobre Successions I Donacions

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple