FORM1022012

What is the FORM1022012

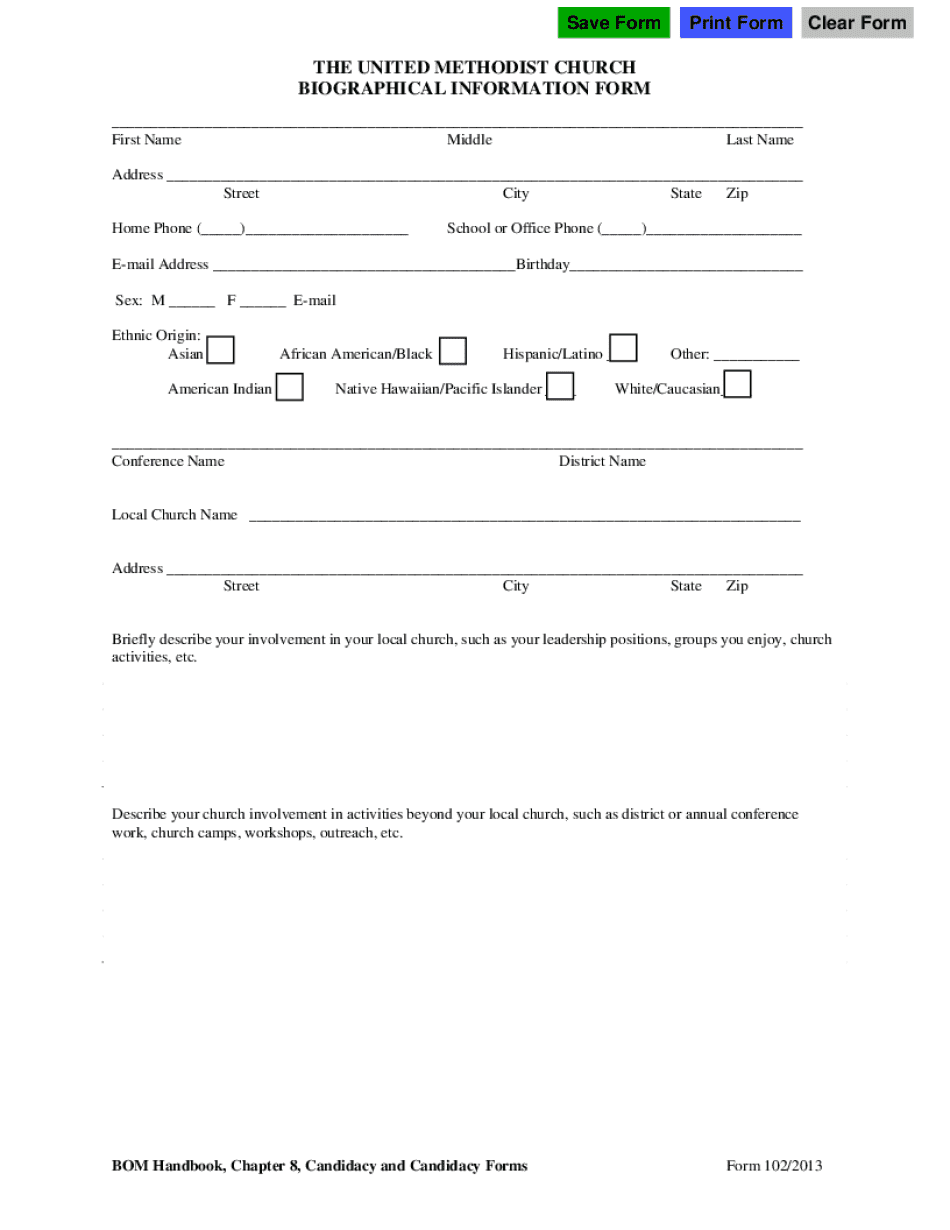

The FORM1022012 is a specific document utilized for various purposes, often related to tax or legal compliance in the United States. It serves as an essential tool for individuals or businesses to report specific information required by regulatory authorities. Understanding the purpose and requirements of this form is crucial for ensuring compliance and avoiding potential penalties.

How to use the FORM1022012

Using the FORM1022012 involves several steps to ensure accurate completion and submission. First, gather all necessary information that pertains to the form's requirements. This may include personal identification details, financial data, or other relevant documentation. Next, fill out the form carefully, ensuring that all sections are completed accurately. Once filled, review the document for any errors before submission. Depending on the specific requirements, the form may need to be submitted online, by mail, or in person.

Steps to complete the FORM1022012

Completing the FORM1022012 requires a systematic approach:

- Review the instructions provided with the form to understand the requirements.

- Collect necessary documents, such as identification and financial records.

- Fill out the form, ensuring all fields are completed truthfully and accurately.

- Double-check for any mistakes or missing information.

- Submit the form through the designated method, whether online or by mail.

Legal use of the FORM1022012

The FORM1022012 must be used in accordance with applicable laws and regulations. It is essential to ensure that the information provided is accurate and truthful, as any discrepancies may lead to legal repercussions. Users should familiarize themselves with the legal implications of submitting this form, including potential audits or penalties for non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the FORM1022012 can vary based on the specific purpose of the form. It is important to be aware of these deadlines to avoid late submissions, which may incur penalties. Users should consult the relevant regulatory authority or the form's instructions for specific dates and timelines associated with filing.

Required Documents

To complete the FORM1022012, certain documents may be required. These could include:

- Personal identification, such as a driver's license or Social Security number.

- Financial documents, including income statements or tax returns.

- Any additional documentation specified in the form's instructions.

Form Submission Methods

The FORM1022012 can typically be submitted through various methods, including:

- Online submission via the appropriate government portal.

- Mailing the completed form to the designated address.

- In-person submission at a local office, if applicable.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form1022012

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM1022012 and how does it work with airSlate SignNow?

FORM1022012 is a specific document type that can be easily managed using airSlate SignNow. Our platform allows users to upload, send, and eSign FORM1022012 documents seamlessly, ensuring compliance and efficiency in your workflow.

-

What are the pricing options for using airSlate SignNow with FORM1022012?

airSlate SignNow offers flexible pricing plans that cater to different business needs when handling FORM1022012. You can choose from monthly or annual subscriptions, with options that scale based on the number of users and features required.

-

What features does airSlate SignNow provide for managing FORM1022012?

With airSlate SignNow, you can easily create, edit, and eSign FORM1022012 documents. Our platform includes features like templates, automated workflows, and real-time tracking, making it a comprehensive solution for document management.

-

How can airSlate SignNow benefit my business when using FORM1022012?

Using airSlate SignNow for FORM1022012 can signNowly streamline your document processes. It enhances productivity by reducing the time spent on paperwork, ensuring that your team can focus on more critical tasks while maintaining compliance.

-

Is it easy to integrate airSlate SignNow with other tools for FORM1022012?

Yes, airSlate SignNow offers seamless integrations with various third-party applications, making it easy to manage FORM1022012 alongside your existing tools. This flexibility allows for a more cohesive workflow and better data management.

-

Can I customize FORM1022012 templates in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize FORM1022012 templates to fit your specific needs. You can add fields, adjust layouts, and incorporate branding elements to ensure that your documents reflect your business identity.

-

What security measures does airSlate SignNow implement for FORM1022012?

airSlate SignNow prioritizes security for all documents, including FORM1022012. Our platform employs advanced encryption, secure access controls, and compliance with industry standards to protect your sensitive information.

Get more for FORM1022012

- Police check brantford form

- Credit card pre authorization form

- Vermont application for lifeline telephone service credit form instructions

- Printable seizure action plan form

- A sample of a superbill form as a pdf hearform

- Note use a separate application form for lotto i

- Prior driving experience application 450372414 form

- Calvcb forms

Find out other FORM1022012

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document