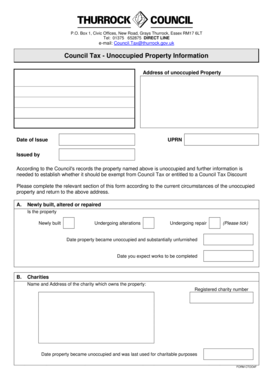

Council Tax Thurrock Form

What is the Council Tax Thurrock

The Council Tax Thurrock is a local taxation system used in the Thurrock area of England to help fund local services such as education, transportation, and public safety. It is calculated based on the estimated value of residential properties, with different bands assigned according to property value. Residents are required to pay this tax annually, and the amount can vary depending on the property band and any applicable discounts or exemptions.

How to use the Council Tax Thurrock

Using the Council Tax Thurrock involves understanding your property band and the associated tax rate. Residents can access their council tax information through the local council's website or contact their office for assistance. It is important to keep track of payment deadlines and any changes in your circumstances that might affect your tax liability, such as moving to a new property or changes in occupancy.

Steps to complete the Council Tax Thurrock

To complete the Council Tax Thurrock, follow these steps:

- Determine your property's council tax band by checking the local council's resources.

- Review the current tax rates for your band, which are typically published annually.

- Calculate your total tax liability, considering any discounts or exemptions for which you may qualify.

- Prepare your payment, ensuring it is made by the due date to avoid penalties.

- Keep records of your payments and any correspondence with the council regarding your tax status.

Eligibility Criteria

Eligibility for the Council Tax Thurrock generally depends on property ownership or residency status. Homeowners and tenants are both liable for council tax. Certain groups may qualify for discounts, including students, individuals with disabilities, and those living alone. It is advisable to check with the local council for specific eligibility requirements and potential exemptions.

Required Documents

When dealing with the Council Tax Thurrock, residents may need to provide various documents, including:

- Proof of identity, such as a driver's license or passport.

- Evidence of residency, such as a utility bill or lease agreement.

- Documentation supporting any claims for discounts or exemptions.

Penalties for Non-Compliance

Failure to comply with Council Tax Thurrock regulations can result in penalties. If payments are not made on time, the local council may impose additional charges or initiate legal action to recover the owed tax. It is crucial for residents to stay informed about their payment obligations to avoid these penalties.

Form Submission Methods

Residents can submit their Council Tax Thurrock forms through various methods:

- Online submission via the local council's website, which often provides a user-friendly portal.

- Mailing completed forms to the council's designated address.

- In-person visits to the local council office for assistance and form submission.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the council tax thurrock

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Council Tax Thurrock and how does it work?

Council Tax Thurrock is a local tax collected by the Thurrock Council to fund local services. It is based on the estimated value of your property and is payable by residents. Understanding how Council Tax Thurrock works can help you manage your payments effectively.

-

How can airSlate SignNow help with Council Tax Thurrock documentation?

airSlate SignNow simplifies the process of signing and sending documents related to Council Tax Thurrock. With our eSignature solution, you can quickly complete necessary forms and agreements, ensuring timely submissions to the Thurrock Council.

-

What are the pricing options for using airSlate SignNow for Council Tax Thurrock?

airSlate SignNow offers flexible pricing plans that cater to various business needs. Whether you are an individual or a business dealing with Council Tax Thurrock, our cost-effective solutions ensure you only pay for what you need.

-

What features does airSlate SignNow offer for managing Council Tax Thurrock documents?

Our platform provides features such as customizable templates, secure eSigning, and document tracking, all designed to streamline your Council Tax Thurrock processes. These tools enhance efficiency and ensure compliance with local regulations.

-

Can I integrate airSlate SignNow with other tools for Council Tax Thurrock management?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing you to manage your Council Tax Thurrock documents alongside your existing tools. This integration enhances workflow efficiency and keeps all your data in one place.

-

What are the benefits of using airSlate SignNow for Council Tax Thurrock?

Using airSlate SignNow for Council Tax Thurrock offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security for your documents. Our platform empowers you to handle your tax-related documents with ease.

-

Is airSlate SignNow secure for handling Council Tax Thurrock documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your Council Tax Thurrock documents. Our platform is compliant with industry standards, ensuring that your sensitive information remains safe and confidential.

Get more for Council Tax Thurrock

- Photoelectric effect gizmo answers form

- Blue cross of illinois claim form fillable

- Medical billing sign up and welcome packet form

- Mde no exposure certification form

- York mega max 3001 manual 473461115 form

- Dimensions of childrens motivation for reading and their relations to reading activity and reading achievement section two msu form

- Amvets ladies auxiliary form

- P14p60 end of year returns 10 sage form

Find out other Council Tax Thurrock

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney