Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version

What is the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version

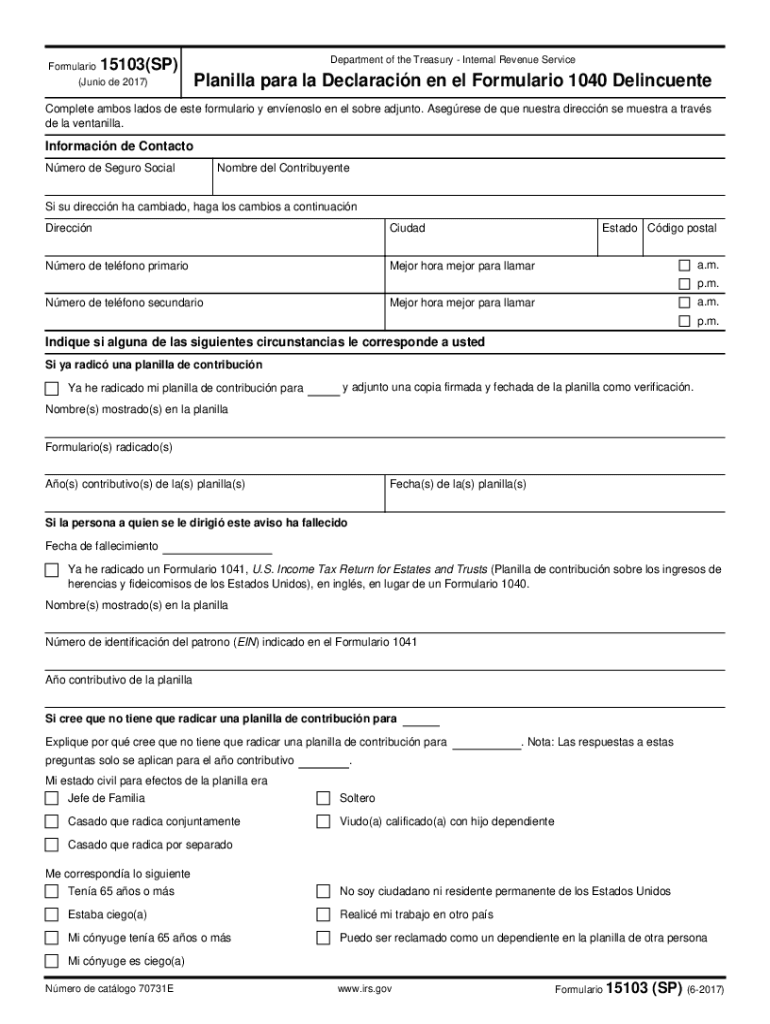

The Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version is a specialized tax form used by Spanish-speaking individuals in the United States. This form is designed for taxpayers who have not filed their federal income tax returns on time. It provides the necessary information to the IRS regarding the delinquency of the tax return and outlines the steps for compliance. This version is particularly important for ensuring that Spanish-speaking taxpayers understand their obligations and the implications of their tax status.

How to use the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version

Using the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version involves several key steps. First, gather all necessary financial documents, including income statements and any previous tax returns. Next, accurately complete the form, providing all required information about your income and tax situation. After filling out the form, review it for accuracy before submission. This ensures that the IRS receives the correct information, which can help mitigate any penalties associated with late filing.

Steps to complete the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version

Completing the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version involves a step-by-step process:

- Begin by downloading the form from the IRS website or obtaining a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide details about your income sources and any deductions applicable to your situation.

- Indicate the reason for the delinquency, if applicable.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version

The Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version is legally recognized by the IRS as a valid document for addressing tax return delinquencies. It is essential for taxpayers to understand that submitting this form does not exempt them from penalties or interest on unpaid taxes. However, it serves as a formal notification to the IRS of the taxpayer's situation and intent to comply with tax obligations. Proper use of this form can facilitate communication with the IRS and help resolve outstanding issues.

Filing Deadlines / Important Dates

Filing deadlines for the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version align with standard tax return deadlines. Typically, individual tax returns are due on April fifteenth each year. If you file for an extension, the deadline may be extended to October fifteenth. It is crucial to submit this form as soon as possible to minimize potential penalties for late filing. Being aware of these deadlines helps ensure compliance with IRS regulations.

Form Submission Methods (Online / Mail / In-Person)

The Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version can be submitted through various methods:

- Online: Some taxpayers may have the option to file electronically using approved tax software that supports this form.

- By Mail: Completed forms can be mailed to the appropriate IRS address specified in the form instructions.

- In-Person: Taxpayers may also visit local IRS offices for assistance and to submit the form directly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 15103 sp 6 form 1040 return delinquency spanish version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version?

The Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version is a specific tax form designed for Spanish-speaking individuals to address delinquent tax returns. This form helps taxpayers understand their obligations and provides a clear pathway to compliance with the IRS. Utilizing this form can simplify the process for those who prefer to communicate in Spanish.

-

How can airSlate SignNow help with the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version?

airSlate SignNow offers an efficient platform for electronically signing and sending the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version. Our user-friendly interface ensures that you can complete and submit your forms quickly and securely. This streamlines the process, making it easier for Spanish-speaking users to manage their tax obligations.

-

What are the pricing options for using airSlate SignNow for the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version?

airSlate SignNow provides flexible pricing plans that cater to different business needs, including options for individuals and teams. Our plans are designed to be cost-effective, ensuring that you can access the necessary tools for managing the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version without breaking the bank. Visit our pricing page for detailed information on available plans.

-

What features does airSlate SignNow offer for the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version?

With airSlate SignNow, you can enjoy features such as customizable templates, secure eSigning, and real-time tracking for the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version. These features enhance your document management experience, making it easier to handle tax forms efficiently. Additionally, our platform ensures compliance with legal standards for electronic signatures.

-

Is airSlate SignNow compliant with legal requirements for the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version?

Yes, airSlate SignNow is fully compliant with legal requirements for electronic signatures, ensuring that your Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version is valid and enforceable. Our platform adheres to the ESIGN Act and UETA, providing peace of mind when signing important documents. You can trust that your submissions will meet all necessary legal standards.

-

Can I integrate airSlate SignNow with other applications for the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow when handling the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect with them to enhance your document management process.

-

What benefits does airSlate SignNow provide for managing the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version?

Using airSlate SignNow for the Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform simplifies the signing process, allowing you to focus on what matters most—completing your tax obligations. Additionally, our secure environment protects your sensitive information.

Get more for Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version

- Security watch request form citrus county sheriffamp39s office sheriffcitrus

- President cleveland where are you pdf form

- Energy vampires activity elementarydoc esseacourses strategies form

- Gisido larp form

- Td f 90 22 54 ffiec form

- Final wishes planning guide osborninsurancegroup com form

- Saskatchewan divorce kit form

- Fundraising contract smsonthebaycom form

Find out other Form 15103 SP 6 Form 1040 Return Delinquency Spanish Version

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later

- Electronic signature Utah Outsourcing Services Contract Online

- How To Electronic signature Wisconsin Debit Memo

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy