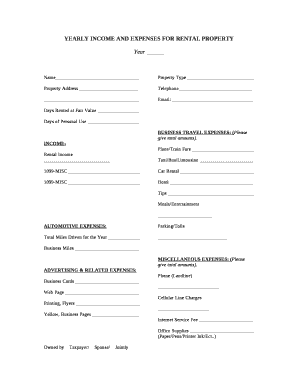

YEARLY INCOME and EXPENSES for RENTAL PROPERTY Form

Understanding the yearly income and expenses for rental property

The yearly income and expenses for rental property form serves as a crucial tool for property owners and landlords. It allows them to track their financial performance over a year, detailing the income generated from rental activities and the associated expenses incurred in managing the property. This form is essential for tax reporting, providing a clear overview of profitability and aiding in financial decision-making.

Key components of the yearly income and expenses for rental property

This form typically includes several key components that are vital for accurate reporting. These components may consist of:

- Rental income: Total income received from tenants, including any additional fees.

- Operating expenses: Costs related to property maintenance, management fees, utilities, and repairs.

- Depreciation: A non-cash expense that reflects the wear and tear on the property over time.

- Mortgage interest: Interest paid on any loans taken to finance the property.

- Property taxes: Annual taxes levied by local governments based on property value.

Steps to complete the yearly income and expenses for rental property

Completing the yearly income and expenses for rental property form involves several systematic steps:

- Gather all relevant financial documents, including rental agreements, receipts, and bank statements.

- Calculate total rental income from all sources over the year.

- Itemize all operating expenses, ensuring to include every cost associated with property management.

- Determine depreciation and mortgage interest amounts for accurate reporting.

- Review the completed form for accuracy before submission.

Legal considerations for the yearly income and expenses for rental property

Understanding the legal implications of the yearly income and expenses for rental property form is essential for compliance. Property owners must ensure that all reported income and expenses adhere to IRS guidelines. Accurate reporting can help avoid penalties and legal issues related to tax discrepancies. Additionally, maintaining records for at least three years is advisable in case of audits or inquiries from tax authorities.

Examples of using the yearly income and expenses for rental property

Practical examples can illustrate how to effectively use the yearly income and expenses for rental property form. For instance, a landlord might report:

- Rental income from multiple units, detailing each tenant's contribution.

- Expenses such as repairs for a broken HVAC system, advertising costs for new tenants, and property management fees.

These examples highlight the importance of thorough documentation and categorization of income and expenses for accurate financial reporting.

IRS guidelines for the yearly income and expenses for rental property

The IRS provides specific guidelines regarding the reporting of rental income and expenses. Property owners should familiarize themselves with the relevant tax codes that govern these reports. Key points include:

- Rental income must be reported in the year it is received, regardless of when it is earned.

- All ordinary and necessary expenses related to managing the property can be deducted.

- Failure to report income accurately can lead to significant penalties.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the yearly income and expenses for rental property

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key components of yearly income and expenses for rental property?

The key components of yearly income and expenses for rental property include rental income, property management fees, maintenance costs, property taxes, and insurance. Understanding these elements helps landlords effectively manage their finances and maximize profitability. Tracking these figures accurately is essential for assessing the overall performance of your rental property.

-

How can airSlate SignNow help manage yearly income and expenses for rental property?

airSlate SignNow provides an efficient platform for managing documents related to yearly income and expenses for rental property. With features like eSigning and document templates, landlords can streamline their financial documentation process. This ensures that all agreements and receipts are organized and easily accessible, simplifying financial management.

-

What features does airSlate SignNow offer for tracking rental property finances?

airSlate SignNow offers features such as customizable templates for lease agreements and expense tracking forms. These tools help landlords document and manage yearly income and expenses for rental property effectively. Additionally, the platform allows for secure eSigning, ensuring that all financial documents are legally binding and easily shared.

-

Is airSlate SignNow cost-effective for managing rental property finances?

Yes, airSlate SignNow is a cost-effective solution for managing yearly income and expenses for rental property. With various pricing plans, users can choose an option that fits their budget while still accessing essential features. This affordability makes it an attractive choice for landlords looking to streamline their financial processes.

-

Can airSlate SignNow integrate with accounting software for rental properties?

Absolutely! airSlate SignNow can integrate with various accounting software solutions, allowing for seamless tracking of yearly income and expenses for rental property. This integration helps landlords maintain accurate financial records and simplifies the process of managing their rental property finances. Users can easily sync data between platforms for better financial oversight.

-

What benefits does eSigning provide for rental property agreements?

eSigning through airSlate SignNow offers numerous benefits for rental property agreements, including speed, security, and convenience. Landlords can quickly obtain signatures on important documents related to yearly income and expenses for rental property, reducing delays in the leasing process. This efficiency enhances the overall management of rental properties.

-

How does airSlate SignNow ensure the security of financial documents?

airSlate SignNow prioritizes the security of financial documents by employing advanced encryption and secure storage solutions. This ensures that all documents related to yearly income and expenses for rental property are protected from unauthorized access. Users can confidently manage their sensitive financial information knowing it is safeguarded.

Get more for YEARLY INCOME AND EXPENSES FOR RENTAL PROPERTY

- Temporary licensepermit application packet texas alcoholic tabc state tx form

- Form c 220 tabc 2011

- Dars form 2013

- Ex parte temporary restraining order texas attorney general oag state tx form

- Certification letter for victim of family violence for waiver of electric oag state tx form

- Temporary restraining order against candelaria ranch llc and oag state tx form

- Paternity acknowledgment form texas

- Completed grievance form

Find out other YEARLY INCOME AND EXPENSES FOR RENTAL PROPERTY

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast