Cook County Senior Form

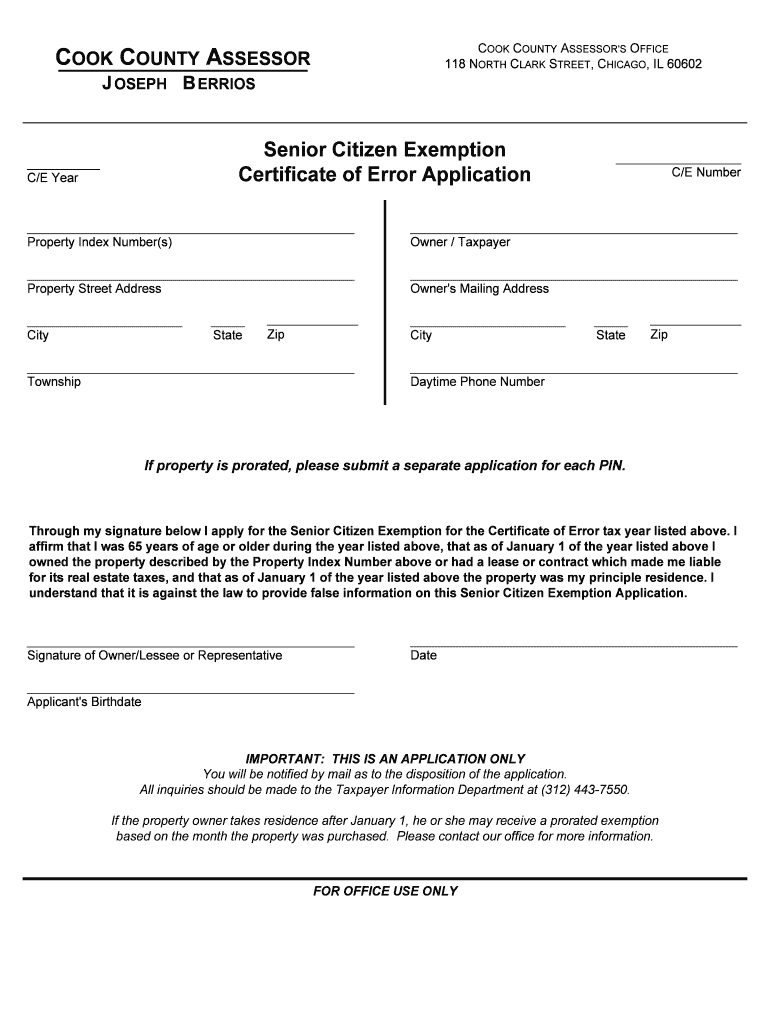

What is the Cook County Senior Form

The Cook County Senior Form, often referred to as the senior citizen exemption application, is a document designed to provide property tax relief to eligible senior citizens in Cook County, Illinois. This form allows qualifying seniors to apply for exemptions that can significantly reduce their property tax burden. The exemptions are intended to assist seniors who may be on fixed incomes, ensuring they can maintain their homes without facing overwhelming financial pressure from property taxes.

Eligibility Criteria

To qualify for the Cook County Senior Exemption, applicants must meet specific criteria. Generally, applicants must be at least sixty-five years old by the end of the tax year for which they are applying. They must also own the property and occupy it as their principal residence. Additionally, applicants should not have a total household income exceeding a certain threshold, which is adjusted annually. It is essential for applicants to review the eligibility requirements carefully to ensure they qualify for the exemption.

Steps to Complete the Cook County Senior Form

Completing the Cook County Senior Form involves several straightforward steps. First, gather necessary documentation, including proof of age, proof of residency, and income statements. Next, fill out the form with accurate information, ensuring all sections are completed, including personal details and property information. After filling out the form, review it for accuracy and completeness. Finally, submit the form by the specified deadline, either online or through traditional mail, ensuring that all required documents are included.

How to Obtain the Cook County Senior Form

The Cook County Senior Form can be obtained through several channels. Residents can visit the Cook County Assessor's Office website to download a digital copy of the form. Alternatively, physical copies are available at local government offices, including the Assessor's Office and community centers. It is advisable to check the official website for any updates or changes to the form or application process.

Form Submission Methods

Applicants have multiple options for submitting the Cook County Senior Form. The form can be submitted online through the Cook County Assessor's Office portal, which provides a convenient and efficient way to apply. Alternatively, applicants may choose to mail the completed form to the Assessor's Office or deliver it in person. It is important to keep a copy of the submitted form for personal records and to confirm that it has been received by the office.

Required Documents

When applying for the Cook County Senior Exemption, several documents are typically required to support the application. These may include:

- Proof of age, such as a birth certificate or driver's license.

- Proof of residency, such as a utility bill or lease agreement.

- Income documentation, including tax returns or Social Security statements.

Ensuring that all required documents are included with the application can help prevent delays in processing.

Quick guide on how to complete cook county senior citizens exemption certificate of error form

Complete Cook County Senior Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, adjust, and electronically sign your documents swiftly without setbacks. Manage Cook County Senior Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

The easiest way to alter and electronically sign Cook County Senior Form without hassle

- Obtain Cook County Senior Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Cook County Senior Form and guarantee outstanding communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cook county senior citizens exemption certificate of error form

How to create an electronic signature for your Cook County Senior Citizens Exemption Certificate Of Error Form online

How to make an electronic signature for the Cook County Senior Citizens Exemption Certificate Of Error Form in Chrome

How to create an eSignature for signing the Cook County Senior Citizens Exemption Certificate Of Error Form in Gmail

How to generate an eSignature for the Cook County Senior Citizens Exemption Certificate Of Error Form straight from your smart phone

How to generate an electronic signature for the Cook County Senior Citizens Exemption Certificate Of Error Form on iOS

How to make an electronic signature for the Cook County Senior Citizens Exemption Certificate Of Error Form on Android

People also ask

-

What is the Cook County Senior Form and how can airSlate SignNow help?

The Cook County Senior Form is a specific document used for various senior-related services in Cook County. With airSlate SignNow, you can easily fill out, send, and eSign the Cook County Senior Form online, simplifying the submission process and ensuring that your documents are securely managed.

-

How much does using airSlate SignNow for the Cook County Senior Form cost?

airSlate SignNow offers flexible pricing plans suitable for individuals and businesses needing to manage the Cook County Senior Form. You can choose from different tiers based on your usage needs, with competitive rates that ensure an affordable solution for electronic signatures and document management.

-

What features does airSlate SignNow provide for the Cook County Senior Form?

airSlate SignNow offers a range of features for the Cook County Senior Form, including customizable templates, secure eSigning, and easy document sharing. These tools help streamline the process, reduce paperwork, and enhance the overall efficiency of managing senior-related documentation.

-

Is airSlate SignNow compliant with legal standards for the Cook County Senior Form?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, ensuring that your Cook County Senior Form is legally binding. This compliance helps you maintain the integrity of your documents while providing peace of mind when managing important paperwork.

-

Can I integrate airSlate SignNow with other applications for managing the Cook County Senior Form?

Absolutely! airSlate SignNow offers integration capabilities with various applications such as Google Drive, Dropbox, and CRM systems. This flexibility allows you to easily manage and access your Cook County Senior Form along with other essential documents from a single platform.

-

What are the benefits of using airSlate SignNow for the Cook County Senior Form?

Using airSlate SignNow for the Cook County Senior Form provides numerous benefits, including reduced turnaround times, enhanced security for sensitive information, and increased convenience for both sender and signer. These advantages make it an ideal solution for seniors and their caregivers managing necessary documentation.

-

How secure is my information when using airSlate SignNow for the Cook County Senior Form?

Your information is extremely secure with airSlate SignNow, as it employs advanced encryption methods and adheres to strict privacy policies. This ensures that data related to your Cook County Senior Form and any other documents remain confidential and protected throughout the signing process.

Get more for Cook County Senior Form

- Being of sound and disposing mind memory and understanding form

- Courts state co form

- 12 05 cfri new york state office of mental health omh ny form

- Judith a herndon fellowship program form

- Collective bargaining agreement delaware state university desu form

- Ap 2012 2015 negotiated agreement northern michigan university nmu form

- Correctional managed number b 14133 health care infection form

- Limited authorization forum ific mutual fund dealers association form

Find out other Cook County Senior Form

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT