Irs Due Dates for Form 2290 for 2014-2026

What is the IRS due date for Form 2290?

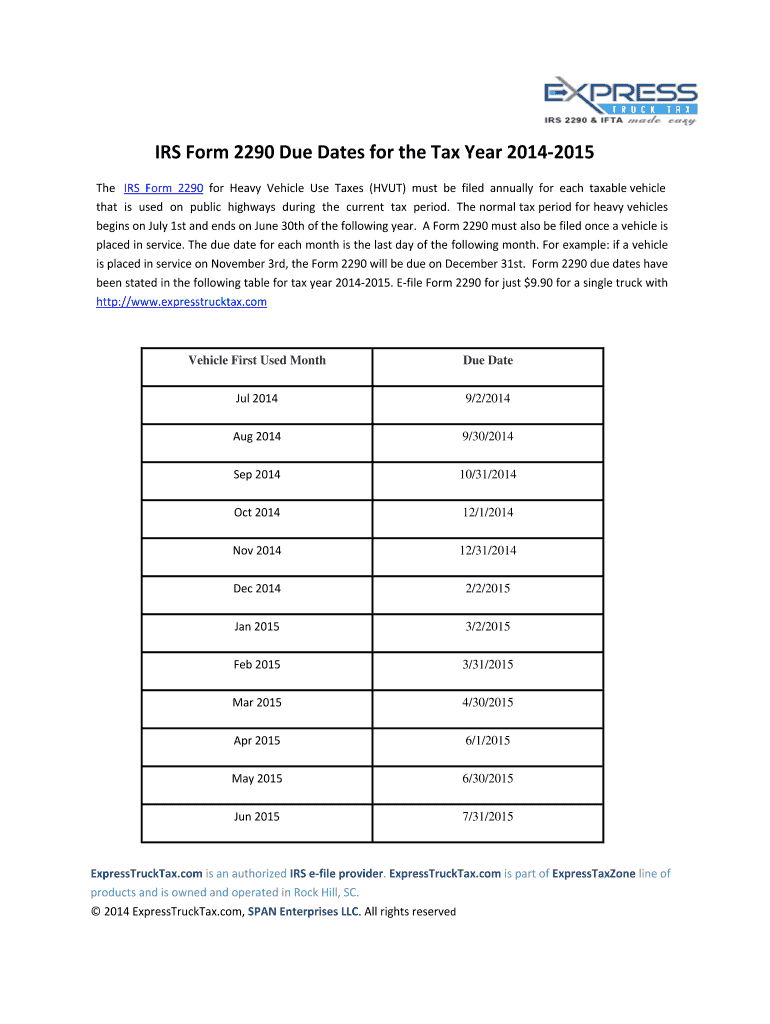

The IRS due date for Form 2290, which is used to report and pay the Heavy Highway Vehicle Use Tax, typically falls on the last day of the month following the end of the tax period. For most taxpayers, this means the due date is August 31 for the tax year that begins on July 1 and ends on June 30 of the following year. If you are filing for the first time or for a new vehicle, it is important to be aware of these deadlines to avoid penalties.

Steps to complete Form 2290

Completing Form 2290 involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN), vehicle identification numbers (VINs), and the total number of vehicles subject to the tax.

- Determine the taxable gross weight of your vehicles to calculate the tax owed.

- Fill out the form accurately, ensuring all details are correct to avoid delays.

- Choose your filing method: electronically or by mail. Electronic filing is often faster and more efficient.

- Submit the form and pay any taxes owed by the due date to avoid penalties.

Filing deadlines and important dates

Understanding the filing deadlines for Form 2290 is crucial for compliance. The primary due date is August 31 for the tax year starting on July 1. If you acquire a new vehicle during the year, you must file within 30 days of its first use. Additionally, if you file late, you may incur penalties, which can add up quickly. Keeping a calendar with these dates marked can help ensure timely submissions.

Penalties for non-compliance

Failing to file Form 2290 by the due date can result in significant penalties. The IRS imposes a penalty of up to five percent of the tax due for each month the return is late, with a maximum penalty of 25 percent. Additionally, if the tax is not paid by the due date, interest will accrue on the unpaid balance. It is essential to adhere to the filing deadlines to avoid these financial repercussions.

Legal use of Form 2290

Form 2290 must be filed in accordance with IRS regulations to be considered legally valid. This includes ensuring that all information is accurate and that the form is submitted by the due date. Electronic signatures are accepted, provided that the eSignature meets the requirements set forth by the IRS. Utilizing a reliable electronic filing service can help ensure compliance with these legal standards.

IRS guidelines for Form 2290

The IRS provides specific guidelines for completing and submitting Form 2290. These guidelines include instructions on how to calculate the tax owed, the types of vehicles that are subject to the tax, and the necessary documentation required for filing. Familiarizing yourself with these guidelines can help streamline the filing process and ensure that you meet all requirements.

Quick guide on how to complete form 2290 due date 2014 2019

Prepare Irs Due Dates For Form 2290 For effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage Irs Due Dates For Form 2290 For on any device using airSlate SignNow's Android or iOS applications and enhance any document-centered process today.

The simplest way to modify and eSign Irs Due Dates For Form 2290 For seamlessly

- Find Irs Due Dates For Form 2290 For and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Due Dates For Form 2290 For and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2290 due date 2014 2019

How to make an electronic signature for the Form 2290 Due Date 2014 2019 online

How to generate an electronic signature for the Form 2290 Due Date 2014 2019 in Chrome

How to generate an eSignature for signing the Form 2290 Due Date 2014 2019 in Gmail

How to make an eSignature for the Form 2290 Due Date 2014 2019 straight from your smart phone

How to generate an electronic signature for the Form 2290 Due Date 2014 2019 on iOS

How to create an eSignature for the Form 2290 Due Date 2014 2019 on Android

People also ask

-

What are the IRS due dates for Form 2290 for 2023?

The IRS due dates for Form 2290 for 2023 typically fall on the last day of the month following the month of the first use of the vehicle. For example, if your vehicle was first used in July, the due date would be August 31, 2023. It's important to mark these dates in your calendar to avoid late penalties.

-

How can airSlate SignNow help me manage IRS due dates for Form 2290 for my business?

airSlate SignNow offers an intuitive platform that allows you to easily track and manage your IRS due dates for Form 2290 for all your vehicles. Our automated reminders ensure you never miss a deadline, thus helping you stay compliant with IRS regulations effortlessly.

-

What features does airSlate SignNow provide for filing Form 2290 on time?

With airSlate SignNow, you have access to features like e-signatures, real-time document tracking, and automated reminders for IRS due dates for Form 2290 for your convenience. These tools streamline the filing process, ensuring your documents are signed and submitted promptly.

-

Is there a cost associated with using airSlate SignNow for Form 2290 filings?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet the needs of different businesses. Our plans are cost-effective and designed to provide excellent value while ensuring you can easily manage your IRS due dates for Form 2290 for multiple vehicles.

-

Can I integrate airSlate SignNow with other software for managing Form 2290?

Absolutely! airSlate SignNow integrates seamlessly with various software applications that help you manage your IRS due dates for Form 2290 for enhanced productivity. This integration allows for a smoother workflow and ensures all your documents are easily accessible.

-

What benefits does airSlate SignNow offer for businesses filing Form 2290?

Using airSlate SignNow benefits businesses by simplifying the e-signing process and ensuring timely submissions of IRS forms, including the IRS due dates for Form 2290 for your fleet. Our platform enhances efficiency, reduces paperwork, and minimizes the risk of errors.

-

How secure is airSlate SignNow for handling my Form 2290 documents?

airSlate SignNow takes security seriously, implementing top-notch encryption and compliance measures to protect your sensitive data. You can confidently manage your IRS due dates for Form 2290 for your business, knowing that your documents are safeguarded.

Get more for Irs Due Dates For Form 2290 For

Find out other Irs Due Dates For Form 2290 For

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple