State of Ohio, Hereinafter Referred to as the Trustor, Whether One or More, and Form

Understanding the Ohio Trust

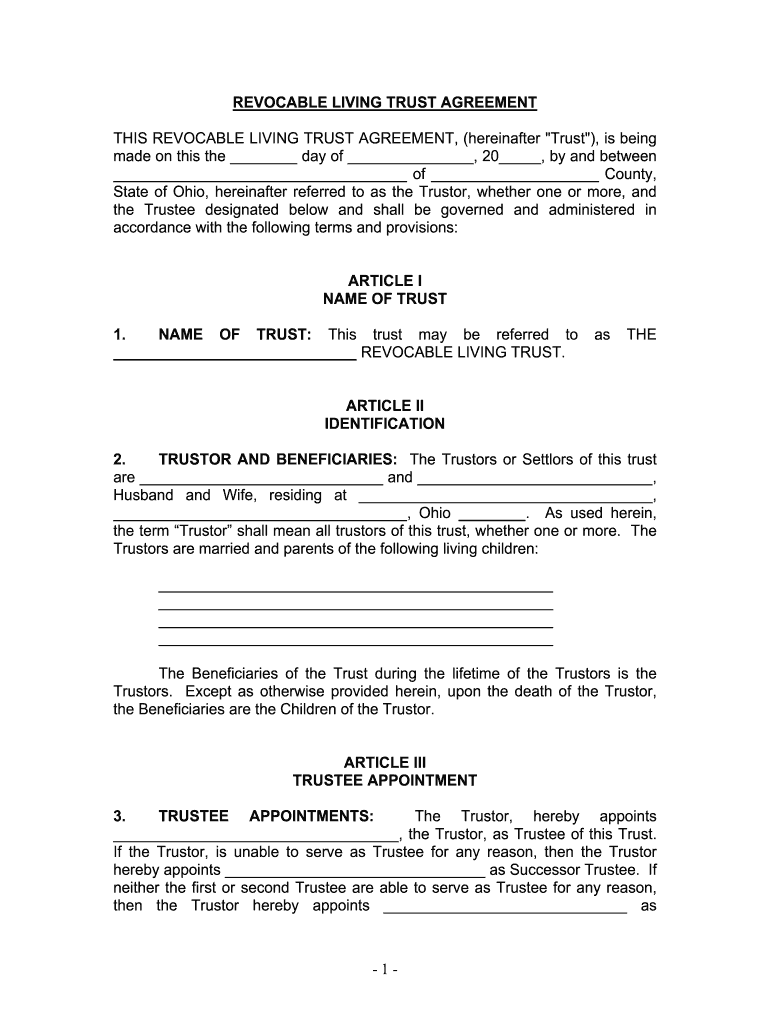

The Ohio Trust, often referred to in legal contexts as the trustor, is a legal entity created to manage assets for the benefit of designated beneficiaries. This type of trust can be established by individuals or groups and can serve various purposes, such as estate planning or asset protection. Trusts can be set up to benefit minor children, adult children, or other family members, allowing the trustor to dictate how and when assets are distributed. Understanding the specific provisions and legal requirements associated with Ohio trusts is essential for ensuring compliance and protecting the interests of beneficiaries.

Steps to Complete the Ohio Trust

Completing an Ohio Trust involves several key steps to ensure it is legally binding and effective. First, the trustor must clearly identify the assets to be placed in the trust. Next, the trustor should select beneficiaries, which can include minor or adult children. It is important to outline the terms of the trust, including how the assets will be managed and distributed. Once the trust document is drafted, it must be signed and notarized to meet legal requirements. Finally, transferring the ownership of the assets into the trust is crucial for its functionality.

Legal Use of the Ohio Trust

The legal use of an Ohio Trust provides significant advantages in estate planning. Trusts can help avoid probate, allowing for a smoother transition of assets upon the trustor's passing. They also offer privacy, as trust documents are not public records. Additionally, trusts can provide protections against creditors and ensure that assets are managed according to the trustor's wishes, especially when minor children are involved. Understanding the legal framework surrounding trusts in Ohio is vital for effective planning and execution.

Required Documents for the Ohio Trust

To establish an Ohio Trust, several documents are typically required. The primary document is the trust agreement, which outlines the terms, conditions, and beneficiaries of the trust. Additionally, any property titles or deeds must be prepared for transfer into the trust. Identification documents for the trustor and beneficiaries may also be needed to verify identities and establish legal standing. It is advisable to consult with a legal professional to ensure that all necessary documents are properly prepared and executed.

Examples of Using the Ohio Trust

Ohio Trusts can be utilized in various scenarios to meet the needs of different families. For instance, a trust can be established to manage assets for minor children until they reach a certain age, ensuring responsible management of funds. Alternatively, a trust can be set up for adult children to provide financial support while also protecting assets from potential creditors. Each trust can be tailored to reflect the unique circumstances and wishes of the trustor, making it a versatile tool in estate planning.

State-Specific Rules for the Ohio Trust

Ohio has specific laws governing the creation and management of trusts. These rules dictate how trusts must be structured, the rights of beneficiaries, and the responsibilities of trustees. For instance, Ohio law requires trusts to be in writing and signed by the trustor. Additionally, the state recognizes both revocable and irrevocable trusts, each with distinct implications for asset management and control. Familiarity with these state-specific regulations is essential for ensuring that the trust operates within the legal framework and effectively meets the trustor's goals.

Quick guide on how to complete state of ohio hereinafter referred to as the trustor whether one or more and

Finalize State Of Ohio, Hereinafter Referred To As The Trustor, Whether One Or More, And effortlessly on any gadget

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents quickly and without delays. Handle State Of Ohio, Hereinafter Referred To As The Trustor, Whether One Or More, And on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The easiest method to modify and electronically sign State Of Ohio, Hereinafter Referred To As The Trustor, Whether One Or More, And seamlessly

- Locate State Of Ohio, Hereinafter Referred To As The Trustor, Whether One Or More, And and click Get Form to begin.

- Use the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to submit your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign State Of Ohio, Hereinafter Referred To As The Trustor, Whether One Or More, And and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of ohio hereinafter referred to as the trustor whether one or more and

How to make an electronic signature for your State Of Ohio Hereinafter Referred To As The Trustor Whether One Or More And online

How to make an eSignature for the State Of Ohio Hereinafter Referred To As The Trustor Whether One Or More And in Chrome

How to create an eSignature for signing the State Of Ohio Hereinafter Referred To As The Trustor Whether One Or More And in Gmail

How to create an electronic signature for the State Of Ohio Hereinafter Referred To As The Trustor Whether One Or More And right from your mobile device

How to create an eSignature for the State Of Ohio Hereinafter Referred To As The Trustor Whether One Or More And on iOS devices

How to create an eSignature for the State Of Ohio Hereinafter Referred To As The Trustor Whether One Or More And on Android OS

People also ask

-

What is an Ohio trust and how does it work?

An Ohio trust is a legal arrangement that allows you to manage and protect your assets. By setting up an Ohio trust, you can ensure that your assets are distributed according to your wishes after your passing. Additionally, it can help reduce estate taxes and avoid probate, making the process more efficient.

-

How can airSlate SignNow assist with creating an Ohio trust?

airSlate SignNow offers an intuitive platform that allows you to eSign and manage documents related to setting up an Ohio trust. With our easy-to-use interface, you can ensure that all your legal documents are signed quickly and securely. This streamlines the process of establishing your trust and keeps everything organized.

-

What features does airSlate SignNow provide for Ohio trust documents?

airSlate SignNow includes features like customizable templates, in-app document editing, and secure eSignatures for Ohio trust documents. Our platform also allows for collaboration, so multiple parties can input and authorize changes seamlessly. These features make managing your Ohio trust straightforward and efficient.

-

Is airSlate SignNow a cost-effective solution for managing Ohio trust documents?

Absolutely! airSlate SignNow offers competitive pricing compared to traditional methods of managing Ohio trust documents. Our subscription plans are designed to be budget-friendly while providing you with all the necessary tools to create, sign, and manage your documents efficiently.

-

Can airSlate SignNow integrate with other tools for managing an Ohio trust?

Yes, airSlate SignNow can integrate with various tools and platforms to enhance your management of an Ohio trust. Whether you use CRM systems, cloud storage solutions, or project management tools, our platform's integrations make it easy to synchronize your workflows. This ensures a smooth experience across all your applications.

-

What are the benefits of using airSlate SignNow for an Ohio trust?

Using airSlate SignNow to manage your Ohio trust provides several key benefits, including enhanced security, ease of use, and time-efficient processes. With our electronic signature capabilities, you can sign documents anywhere, anytime, which simplifies the entire experience. Additionally, you reduce the risk of paper document loss or mismanagement.

-

How secure is airSlate SignNow when handling Ohio trust documents?

airSlate SignNow prioritizes the security of your Ohio trust documents by implementing industry-standard encryption and secure access protocols. We ensure that all your documents are protected from unauthorized access, giving you peace of mind as you manage sensitive information. Our commitment to security is designed to safeguard your data along every step.

Get more for State Of Ohio, Hereinafter Referred To As The Trustor, Whether One Or More, And

Find out other State Of Ohio, Hereinafter Referred To As The Trustor, Whether One Or More, And

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile