Irrevocable Insurance Trusts Michael R Brown, a Law Corporation Form

Understanding Irrevocable Insurance Trusts

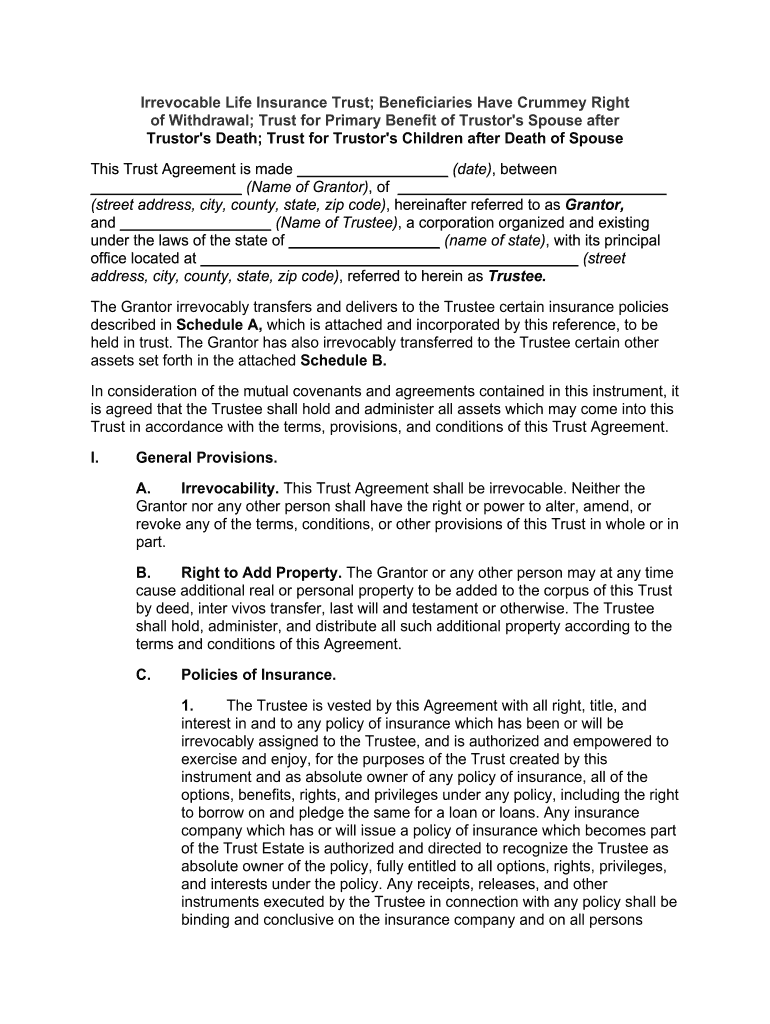

An irrevocable insurance trust is a legal arrangement that allows an individual to transfer ownership of a life insurance policy to a trust. This means that the policyholder cannot change the terms of the trust or reclaim the policy once it is established. The primary purpose of this type of trust is to remove the life insurance proceeds from the policyholder's estate, potentially reducing estate taxes and providing financial security for beneficiaries. The trust becomes the owner and beneficiary of the policy, ensuring that the proceeds are distributed according to the terms set forth in the trust document.

Steps to Establish an Irrevocable Insurance Trust

Creating an irrevocable insurance trust involves several key steps:

- Consult with an estate planning attorney to understand the implications and benefits.

- Draft the trust document, clearly outlining the terms, beneficiaries, and trustee.

- Transfer ownership of the life insurance policy to the trust.

- Ensure that the trust is properly funded and that all necessary documentation is completed.

- Review the trust periodically to ensure it meets current legal and financial needs.

Key Elements of Irrevocable Insurance Trusts

Several important components define an irrevocable insurance trust:

- Trustee: The individual or institution responsible for managing the trust and ensuring that the terms are followed.

- Beneficiaries: The individuals or entities designated to receive the benefits from the trust, typically family members or loved ones.

- Trust Document: A legal document that outlines the terms of the trust, including how and when distributions will be made.

- Life Insurance Policy: The specific policy that is transferred to the trust, which will provide the death benefit upon the policyholder's passing.

Legal Considerations for Irrevocable Insurance Trusts

Establishing an irrevocable insurance trust requires adherence to specific legal requirements. It is essential to ensure that the trust is properly drafted and executed to avoid complications. This includes compliance with state laws regarding trust formation and the transfer of assets. Additionally, understanding the tax implications is crucial, as the trust may affect estate and gift tax liabilities. Consulting with legal professionals who specialize in estate planning can help navigate these complexities.

IRS Guidelines for Irrevocable Insurance Trusts

The Internal Revenue Service (IRS) provides guidelines that govern the taxation of irrevocable insurance trusts. Generally, the death benefit from a life insurance policy held in an irrevocable trust is not included in the policyholder's estate for tax purposes. However, specific conditions must be met, such as ensuring that the policyholder does not retain any incidents of ownership over the policy. It is important to stay informed about IRS regulations to maintain compliance and optimize tax benefits.

Required Documents for Irrevocable Insurance Trusts

To establish an irrevocable insurance trust, several documents are typically required:

- Trust agreement outlining the terms and conditions.

- Life insurance policy documentation.

- Identification and contact information for the trustee and beneficiaries.

- Any additional documents required by state law or specific financial institutions.

Quick guide on how to complete irrevocable insurance trusts michael r brown a law corporation

Effortlessly prepare Irrevocable Insurance Trusts Michael R Brown, A Law Corporation on any device

Managing documents online has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Irrevocable Insurance Trusts Michael R Brown, A Law Corporation on any device using airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to edit and electronically sign Irrevocable Insurance Trusts Michael R Brown, A Law Corporation with ease

- Obtain Irrevocable Insurance Trusts Michael R Brown, A Law Corporation and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click Done to save your changes.

- Choose how you prefer to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form navigation, and errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Irrevocable Insurance Trusts Michael R Brown, A Law Corporation and ensure effective communication at every stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irrevocable insurance trusts michael r brown a law corporation

How to make an eSignature for your Irrevocable Insurance Trusts Michael R Brown A Law Corporation online

How to generate an electronic signature for your Irrevocable Insurance Trusts Michael R Brown A Law Corporation in Chrome

How to make an eSignature for putting it on the Irrevocable Insurance Trusts Michael R Brown A Law Corporation in Gmail

How to make an electronic signature for the Irrevocable Insurance Trusts Michael R Brown A Law Corporation from your mobile device

How to generate an electronic signature for the Irrevocable Insurance Trusts Michael R Brown A Law Corporation on iOS

How to make an eSignature for the Irrevocable Insurance Trusts Michael R Brown A Law Corporation on Android devices

People also ask

-

What is an irrevocable trust spouse?

An irrevocable trust spouse is a legal arrangement where assets are placed in a trust that cannot be altered or revoked without the consent of the beneficiary. This type of trust provides protection from creditors and helps in estate planning by ensuring that the spouse's assets are managed according to predetermined terms.

-

How does an irrevocable trust spouse benefit the family?

An irrevocable trust spouse secures financial stability for the family by ensuring that assets are preserved and managed according to the grantor's wishes. It minimizes tax liabilities and shields assets from potential lawsuits or claims, providing peace of mind for both spouses.

-

What are the costs associated with setting up an irrevocable trust spouse?

Setting up an irrevocable trust spouse typically involves legal fees, which vary based on the complexity of the trust and the attorney's rates. While there may be initial costs, the long-term savings on taxes and asset protection often outweigh these expenses, making it a worthwhile investment.

-

Can I integrate airSlate SignNow with my irrevocable trust spouse documents?

Yes, airSlate SignNow easily integrates with document management systems, allowing you to streamline the signing process for your irrevocable trust spouse documents. With our user-friendly platform, you can send, sign, and manage documents efficiently, ensuring a smooth experience.

-

What features does airSlate SignNow offer for irrevocable trust spouse agreements?

airSlate SignNow provides essential features such as customizable templates, secure eSigning, and document tracking, making it ideal for managing irrevocable trust spouse agreements. Our platform ensures that all parties involved can sign documents easily and securely from any device.

-

How does having an irrevocable trust spouse affect tax obligations?

Forming an irrevocable trust spouse can lead to tax benefits, such as reduced estate taxes and protecting assets from being included in your taxable estate. By transferring assets into this trust, the grantor often removes them from their taxable estate, resulting in potential savings for your family.

-

What is the difference between a revocable and irrevocable trust spouse?

The key difference between a revocable and irrevocable trust spouse lies in control; a revocable trust can be changed or revoked by the grantor, while an irrevocable trust spouse cannot be modified without consent from the beneficiaries. This distinction is crucial for estate planning and asset protection strategies.

Get more for Irrevocable Insurance Trusts Michael R Brown, A Law Corporation

- Personal reference form jwu school of online online jwu

- Tsp 90tsp 90 withdrawal request for beneficiary participants withdrawal request for bps beneificiary participants withdrawal form

- Excavation and ground preparation permit municipality of mariveles marivelesbataan gov form

- Form 540nr 2016

- Form 109 2016

- Form 416a caption full

- My aradcom form

- Withdrawal notice of an assumed name form

Find out other Irrevocable Insurance Trusts Michael R Brown, A Law Corporation

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast