Reverse Mortgage Business Asset Purchase Agreement FDIC Form

Understanding the Reverse Mortgage Business Asset Purchase Agreement

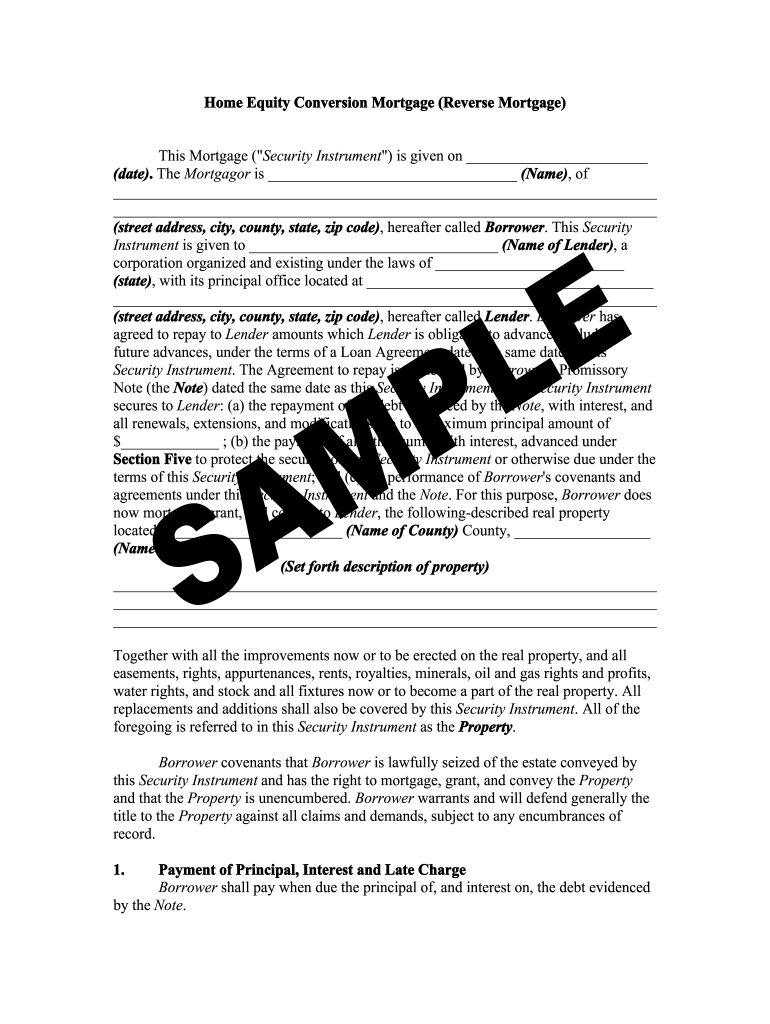

The Reverse Mortgage Business Asset Purchase Agreement is a crucial document for businesses looking to leverage reverse mortgages as a method for acquiring assets. This agreement outlines the terms and conditions under which a business can purchase assets using funds obtained through a reverse mortgage. It is essential to understand the legal implications and requirements associated with this form to ensure compliance and protect your business interests.

Steps to Complete the Reverse Mortgage Business Asset Purchase Agreement

Completing the Reverse Mortgage Business Asset Purchase Agreement involves several key steps:

- Gather necessary documentation, including financial statements and asset valuations.

- Consult with a legal or financial advisor to ensure compliance with state and federal regulations.

- Fill out the form accurately, ensuring all sections are completed and signed as required.

- Submit the agreement to the appropriate financial institution for review and approval.

Following these steps can help streamline the process and minimize potential delays.

Key Elements of the Reverse Mortgage Business Asset Purchase Agreement

Several critical components must be included in the Reverse Mortgage Business Asset Purchase Agreement:

- Parties Involved: Clearly identify the business and lender.

- Asset Description: Provide detailed information about the assets being purchased.

- Terms of the Agreement: Outline the financing terms, including interest rates and repayment schedules.

- Legal Compliance: Ensure that all legal requirements are met, including disclosures and consent.

Including these elements helps protect all parties involved and ensures clarity in the agreement.

Legal Use of the Reverse Mortgage Business Asset Purchase Agreement

The legal use of the Reverse Mortgage Business Asset Purchase Agreement is governed by various federal and state regulations. It is important to ensure that the agreement complies with the relevant laws, including the Truth in Lending Act and the Real Estate Settlement Procedures Act. Consulting with a legal professional can help navigate these complexities and ensure that the agreement is enforceable in a court of law.

Obtaining the Reverse Mortgage Business Asset Purchase Agreement

To obtain the Reverse Mortgage Business Asset Purchase Agreement, businesses can typically access the form through their lender or financial institution. It may also be available on legal document websites or through legal counsel. Ensure that you are using the most current version of the form to avoid any compliance issues.

Eligibility Criteria for Reverse Mortgages

Eligibility for a reverse mortgage can vary based on several factors, including:

- Age of the business owner or primary borrower, typically requiring a minimum age of sixty-two.

- Equity in the property being used as collateral for the reverse mortgage.

- Creditworthiness and financial stability of the business.

Understanding these criteria is essential for businesses considering this financing option.

Quick guide on how to complete reverse mortgage business asset purchase agreement fdic

Complete Reverse Mortgage Business Asset Purchase Agreement FDIC effortlessly on any gadget

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly without interruptions. Manage Reverse Mortgage Business Asset Purchase Agreement FDIC on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Reverse Mortgage Business Asset Purchase Agreement FDIC without hassle

- Obtain Reverse Mortgage Business Asset Purchase Agreement FDIC and click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that reason.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about missing or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Alter and eSign Reverse Mortgage Business Asset Purchase Agreement FDIC and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the reverse mortgage business asset purchase agreement fdic

How to create an eSignature for the Reverse Mortgage Business Asset Purchase Agreement Fdic online

How to generate an electronic signature for your Reverse Mortgage Business Asset Purchase Agreement Fdic in Chrome

How to make an electronic signature for putting it on the Reverse Mortgage Business Asset Purchase Agreement Fdic in Gmail

How to make an eSignature for the Reverse Mortgage Business Asset Purchase Agreement Fdic right from your mobile device

How to create an electronic signature for the Reverse Mortgage Business Asset Purchase Agreement Fdic on iOS

How to make an electronic signature for the Reverse Mortgage Business Asset Purchase Agreement Fdic on Android devices

People also ask

-

What are business mortgages and how do they work?

Business mortgages are loans specifically designed for purchasing or refinancing commercial properties. Typically, these mortgages require a business to submit a detailed application that includes financial statements and projections. Once approved, borrowers can use the funds to acquire or improve business premises, helping facilitate growth and operations.

-

What features should I look for in a business mortgage?

When considering business mortgages, look for features such as flexible repayment terms, competitive interest rates, and an easy application process. It's important to choose a lender who provides support throughout the entire process to ensure your business meets its financial goals. Additional features like the ability to consolidate existing business loans can also be beneficial.

-

How can airSlate SignNow assist with business mortgages?

airSlate SignNow allows businesses to streamline the documentation process necessary for securing business mortgages. With easy-to-use eSignature features, you can quickly sign and send documents, minimizing delays in your application. This efficiency can help you secure funding faster and move forward with your business plans.

-

What are the benefits of using digital signatures for business mortgage applications?

Using digital signatures for business mortgage applications simplifies the signing process, reduces paperwork, and saves time. With airSlate SignNow, you can ensure that all documentation is signed securely and instantly, helping you meet tight deadlines often associated with business mortgages. Additionally, this method enhances overall organization and record-keeping.

-

What is the typical approval timeframe for business mortgages?

The approval timeframe for business mortgages can vary, typically ranging from a few days to several weeks. This timeline can depend on the complexity of your application and the lender's requirements. By utilizing platforms like airSlate SignNow to handle your documentation efficiently, you may expedite the approval process.

-

Are there different types of business mortgages available?

Yes, there are several types of business mortgages, including fixed-rate, adjustable-rate, and government-backed loans. Each type comes with different conditions, interest rates, and repayment options. Understanding the various options can help you choose the best business mortgage tailored to your financial situation and goals.

-

What are the common eligibility criteria for business mortgages?

Common eligibility criteria for business mortgages include a strong credit score, established business history, and adequate cash flow. Lenders typically assess these factors to gauge your business's financial stability. To improve your chances of securing a favorable business mortgage, ensure that your financial documentation is accurate and well-prepared.

Get more for Reverse Mortgage Business Asset Purchase Agreement FDIC

- Energy partner consultants inc search commission files form

- Claim for disability insurance di benefits the s form

- Physicians reporting form

- Disability enrollment for ceip endorsed plans form

- Form 13715internal revenue service

- How to generate form 8082 notice of inconsistent

- Form 8038 information return for tax exempt private activity

- Modifications to adjusted gross incomeschedule m f form

Find out other Reverse Mortgage Business Asset Purchase Agreement FDIC

- Sign Washington Affidavit of Death Easy

- Help Me With Sign Pennsylvania Cohabitation Agreement

- Sign Montana Child Support Modification Online

- Sign Oregon Last Will and Testament Mobile

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist