Form Abs 1

What is the Form ABS-1

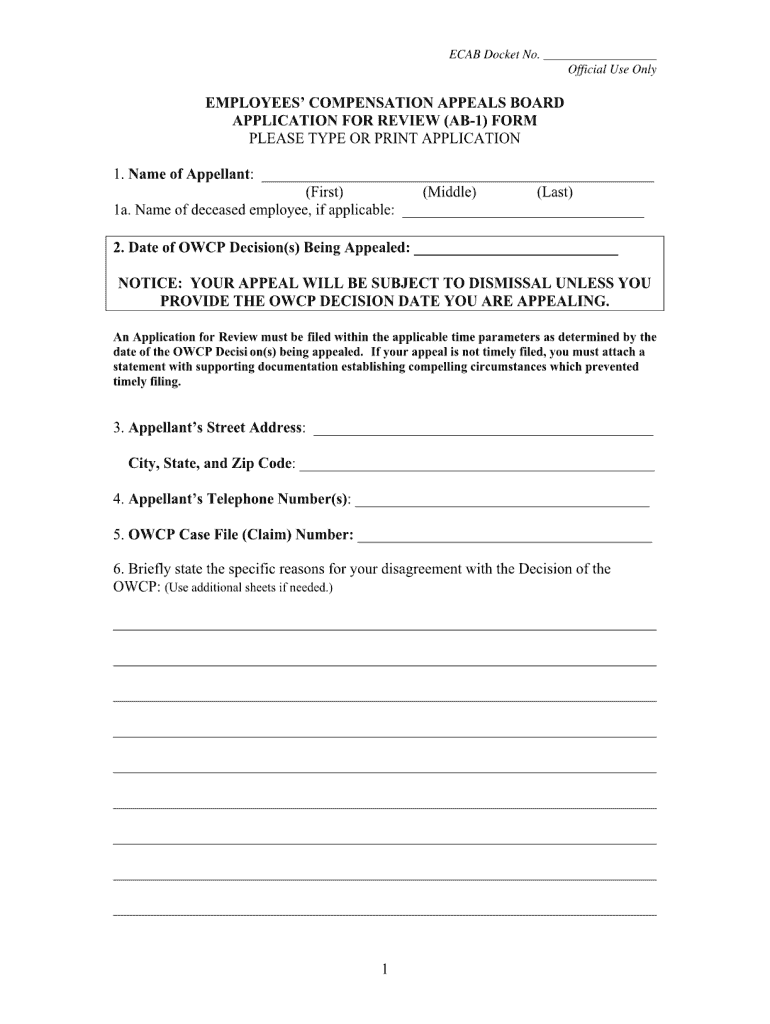

The Form ABS-1 is a specific document used in the context of employee compensation. This form is essential for employers to report various aspects of compensation structures, including wages, bonuses, and benefits provided to employees. Understanding the purpose of this form helps ensure compliance with labor laws and regulations.

How to use the Form ABS-1

Using the Form ABS-1 involves several steps to ensure that all necessary information is accurately reported. First, gather all relevant employee compensation data, including salary details, bonuses, and any additional benefits. Next, fill out the form with precise figures and ensure that all required fields are completed. Once the form is filled out, it should be submitted to the appropriate department or agency as specified by local regulations.

Steps to complete the Form ABS-1

Completing the Form ABS-1 requires careful attention to detail. Follow these steps:

- Collect all necessary employee compensation information.

- Ensure that you have the latest version of the form.

- Fill in the employee details, including name, position, and compensation amounts.

- Review the form for accuracy and completeness.

- Submit the form as instructed, either online or via mail.

Legal use of the Form ABS-1

The legal use of the Form ABS-1 is critical for compliance with employment laws. Employers must ensure that the information reported is truthful and accurate to avoid potential legal repercussions. Misreporting or failing to submit the form can lead to penalties or fines from regulatory bodies.

Required Documents

When completing the Form ABS-1, certain documents may be required to support the information provided. These documents can include:

- Employee contracts outlining compensation agreements.

- Payroll records detailing wages and bonuses.

- Tax documents that reflect employee earnings.

Form Submission Methods (Online / Mail / In-Person)

The Form ABS-1 can typically be submitted through various methods, depending on the regulations in your state. Common submission methods include:

- Online submission through the designated government portal.

- Mailing the completed form to the appropriate agency.

- Hand-delivering the form to a local office, if applicable.

Eligibility Criteria

Eligibility to use the Form ABS-1 generally pertains to employers who are required to report employee compensation. This includes businesses of various sizes and types, such as corporations, partnerships, and sole proprietorships. It is important for employers to verify their eligibility based on local labor laws and regulations.

Quick guide on how to complete ab 1 form

Discover the simplest method to complete and authenticate your Form Abs 1

Are you still spending time preparing your official documents on paper instead of submitting them online? airSlate SignNow presents a superior approach to finalize and authenticate your Form Abs 1 and associated forms for public services. Our intelligent electronic signature platform equips you with all the tools necessary for rapid document processing that meets official standards - comprehensive PDF editing, management, security, signing, and sharing functionalities are all available within a user-friendly interface.

Only a few steps are required to fill out and authenticate your Form Abs 1:

- Upload the fillable template to the editor using the Get Form button.

- Identify the information you need to input in your Form Abs 1.

- Switch between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your details.

- Alter the content with Text boxes or Images from the top toolbar.

- Emphasize what is crucial or Obscure sections that are no longer relevant.

- Press Sign to create a legally binding electronic signature using any method you prefer.

- Insert the Date beside your signature and complete your task with the Done button.

Store your completed Form Abs 1 in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our platform also offers versatile form sharing options. There’s no need to print your forms when you must submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

What is your favorite example of "illegal math"?

A rich man had 35 chickens and 3 sons.One day, they trampled the rich man to death (the chickens, not the sons!)The rich man died.They buried the rich man (the sons, not the chickens).When the rich man’s will was opened, it read -“To my useless sons — you sit around all day eating my food and doing nothing. As a punishment, I’m leaving you with nothing but my chickens. Divide them amongst yourselves as follows - the eldest one gets 1/2 of the chickens, the middle one gets 1/3 of the chickens. The youngest one gets 1/9 of the chickens.”The sons were weak at math. Besides, you can’t divide 35 by 2, or 3 or 9.They came to the wisest man in the village for help. Me.I patiently heard their story (like all wise men in old stories are supposed to do).I pondered deeply on their problem.And then I, very wisely, spoke thus -“Ha ha ha… OMG… Your dad was trampled to death by chickens! He must have been such a loser. Oh my God! What the actual fuck… this is hilarious.”Obviously, they got their butts hurt and were about to angrily leave my shack (all wise men live in wooden shacks, duh!) when I stopped them -“Wait, my chickeldren! I know how to divide your chicken. Gimme a moment.”I got up and hurried off to my backyard. When I returned, I had one of my own chickens in my hands.“Listen, bitches. Here’s what I’m gonna do. Since I’m all benevolent and shit, I’ll give you one chicken of my own.”I put my chicken with theirs.Their faces lit up like the bulb in a firefly’s ass.“There, now you have 36 chickens. And now if we divide them according to your loser dad’s will, you’ll each have more than your actual share, since we’re starting with one extra chicken. Agreed?”All of them nodded.“Okay... Eldest one, come forward. 36 divided by 2 is 18. Here are your 18 chicken. Now, off you go!”He took his chicken and left.“Middle child, step forth. 36 divided by 3 is 12. Here’s your 12 chicken. Go, live your life like a free bird.”He took them and left.“Li’l one, hop up. 36 divided by 9 is 4. Here’s your 4 chicken, thank you very much. Now, off you fuck!”The kid took ’em and hurried after his brothers.Here’s the funny part though. I gave 18 chicken to the eldest son, 12 to middle one and 4 to the youngest.18+12+4 = 34Which means I have 2 chicken left!One of them was my own.And the other one?Ladies and gentlemen, while you’re trying to figure out where that extra chicken came from, I’ll be in the kitchen preparing my *ahem *ahem “dinner”.Valar chickulis!

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out Address Line 1 on an Online Form?

(street number) (street name) (street suffix)101 Main StreetYou can query the post office on your address, best as you know it, for the “standard” way of presenting your address. USPS.com® - ZIP Code Lookup or whatever service is offered in your country. That will tell you the standard way to fill out address lines.

Create this form in 5 minutes!

How to create an eSignature for the ab 1 form

How to generate an eSignature for the Ab 1 Form online

How to generate an electronic signature for the Ab 1 Form in Chrome

How to create an electronic signature for putting it on the Ab 1 Form in Gmail

How to make an electronic signature for the Ab 1 Form right from your smart phone

How to generate an electronic signature for the Ab 1 Form on iOS

How to make an eSignature for the Ab 1 Form on Android

People also ask

-

What is Form Abs 1 and how can airSlate SignNow help with it?

Form Abs 1 is a specific document used for various administrative purposes. With airSlate SignNow, you can easily create, send, and eSign your Form Abs 1, streamlining your workflow and ensuring that all signatures are secured electronically. Our platform simplifies the process, making it user-friendly for anyone needing to manage this form.

-

How does airSlate SignNow ensure the security of Form Abs 1?

Security is a top priority at airSlate SignNow. When handling your Form Abs 1, our platform employs encryption and secure cloud storage, ensuring that your data remains confidential and protected. You can trust that your signed documents are safe from unauthorized access.

-

Is there a free trial available for using airSlate SignNow with Form Abs 1?

Yes, airSlate SignNow offers a free trial that allows you to test all features, including those for managing Form Abs 1. This trial period lets you explore our easy-to-use interface and see how our eSigning capabilities can benefit your business without any upfront costs.

-

What are the pricing options for using airSlate SignNow with Form Abs 1?

airSlate SignNow provides flexible pricing plans tailored to meet different business needs. Whether you're an individual or a large organization needing to manage Form Abs 1, we offer competitive pricing that includes various features to enhance your document signing process.

-

Can I integrate airSlate SignNow with other software while handling Form Abs 1?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, allowing you to enhance your workflow while working on Form Abs 1. Whether it's CRM systems, cloud storage, or productivity tools, our integrations help you manage documents more efficiently.

-

What features does airSlate SignNow offer for optimizing Form Abs 1?

With airSlate SignNow, you can enjoy features such as customizable templates, automated reminders, and real-time tracking for your Form Abs 1. These tools help ensure that your document management is efficient and organized, saving you time and effort.

-

How can airSlate SignNow improve the efficiency of processing Form Abs 1?

By utilizing airSlate SignNow for your Form Abs 1, you can signNowly enhance processing efficiency. Our platform allows for instant eSigning, automated workflows, and easy document sharing, which collectively reduce turnaround times and increase productivity.

Get more for Form Abs 1

- Bof 116 2015 form

- East bay paratransit purchase tickets on line 2015 2019 form

- Sf live scan formdoc

- Los angeles regional water quality control board noi form 2015 2019

- Intake stormwater 2014 2019 form

- Entry permit for hunting fg994 form

- A general information cf1r alt 02 is applicable to multiple space

- Shasta county filable local forms 2012 2019

Find out other Form Abs 1

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now