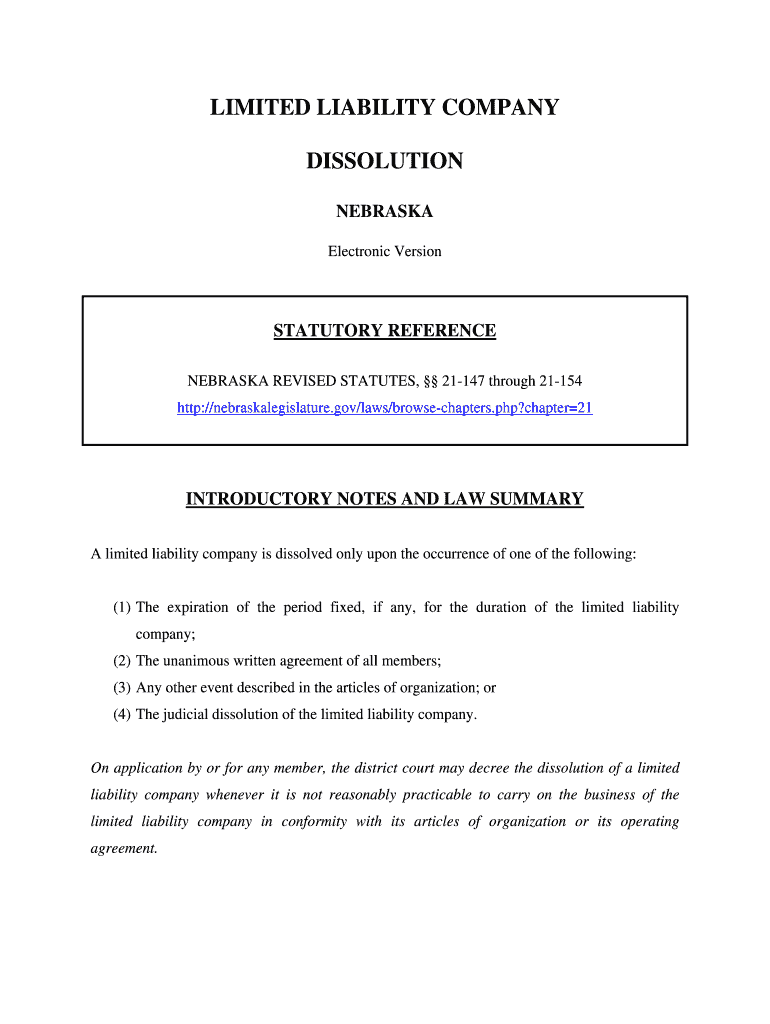

Nebraska Revised Statutes Range Search Nebraska Legislature Form

Understanding the Nebraska Limited Liability Company (LLC)

The Nebraska Limited Liability Company (LLC) is a popular business structure that combines the flexibility of a partnership with the liability protection of a corporation. This structure allows business owners to protect their personal assets from business debts and liabilities. Forming an LLC in Nebraska requires compliance with specific state laws and regulations, which can be navigated effectively using digital tools.

Steps to Form a Nebraska LLC

To establish a Nebraska LLC, follow these key steps:

- Choose a unique name: The name must include "Limited Liability Company" or its abbreviations (LLC or L.L.C.) and should not be similar to existing businesses.

- Appoint a registered agent: This individual or business must be designated to receive legal documents on behalf of the LLC.

- File Articles of Organization: Submit this document to the Nebraska Secretary of State, which officially creates the LLC.

- Create an Operating Agreement: Although not mandatory, this document outlines the management structure and operating procedures of the LLC.

- Obtain necessary licenses and permits: Depending on the business type, additional local, state, or federal licenses may be required.

Required Documents for Nebraska LLC Formation

When forming a Nebraska LLC, the following documents are essential:

- Articles of Organization: This form includes details about the LLC, such as its name, registered agent, and management structure.

- Operating Agreement: This internal document outlines the rights and responsibilities of members and managers.

- Employer Identification Number (EIN): This is necessary for tax purposes and is obtained from the IRS.

Filing Methods for Nebraska LLC

In Nebraska, you can file your LLC formation documents through various methods:

- Online: The Nebraska Secretary of State's website allows for electronic filing of the Articles of Organization.

- By Mail: You can print the form, complete it, and send it to the Secretary of State's office.

- In-Person: Submissions can also be made at the Secretary of State's office in Lincoln.

Legal Considerations for Nebraska LLCs

Understanding the legal framework surrounding Nebraska LLCs is crucial for compliance and protection. This includes:

- Compliance with state laws: Adhering to the Nebraska Revised Statutes is essential for maintaining the LLC's legal standing.

- Annual reporting: Nebraska requires LLCs to file biennial reports to keep their status active.

- Tax obligations: LLCs may be subject to state taxes, and understanding these requirements is vital for financial planning.

Penalties for Non-Compliance

Failing to comply with Nebraska LLC regulations can lead to significant penalties. These may include:

- Fines: Monetary penalties may be imposed for late filings or failure to maintain necessary documentation.

- Dissolution: Non-compliance can result in the state dissolving the LLC, which may jeopardize personal asset protection.

Quick guide on how to complete nebraska revised statutes range search nebraska legislature

Complete Nebraska Revised Statutes Range Search Nebraska Legislature smoothly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without any holdups. Manage Nebraska Revised Statutes Range Search Nebraska Legislature on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Nebraska Revised Statutes Range Search Nebraska Legislature effortlessly

- Find Nebraska Revised Statutes Range Search Nebraska Legislature and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Nebraska Revised Statutes Range Search Nebraska Legislature to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska revised statutes range search nebraska legislature

How to generate an electronic signature for the Nebraska Revised Statutes Range Search Nebraska Legislature in the online mode

How to create an eSignature for your Nebraska Revised Statutes Range Search Nebraska Legislature in Chrome

How to generate an eSignature for signing the Nebraska Revised Statutes Range Search Nebraska Legislature in Gmail

How to create an electronic signature for the Nebraska Revised Statutes Range Search Nebraska Legislature from your smart phone

How to generate an electronic signature for the Nebraska Revised Statutes Range Search Nebraska Legislature on iOS

How to create an electronic signature for the Nebraska Revised Statutes Range Search Nebraska Legislature on Android devices

People also ask

-

What is the process for setting up a ne llc with airSlate SignNow?

Setting up a ne llc with airSlate SignNow is straightforward. Start by creating an account, then utilize our document templates to draft your LLC formation documents. You can eSign them seamlessly and send them to the relevant state authorities, ensuring efficiency in your business setup.

-

What features does airSlate SignNow offer for managing ne llc documents?

airSlate SignNow offers a robust set of features for managing ne llc documents, including electronic signatures, document storage, and collaboration tools. You can track document status in real-time and automate reminders, making it easy to keep your LLC documentation in order.

-

Is airSlate SignNow cost-effective for businesses forming a ne llc?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to form a ne llc. Our pricing plans are designed to cater to different business sizes, ensuring that you only pay for the features you need. We also offer a free trial to explore our service before committing.

-

How does airSlate SignNow ensure the security of ne llc documents?

Security is a priority for airSlate SignNow, especially for ne llc documents. We utilize advanced encryption protocols and secure cloud storage to protect your sensitive information. Additionally, our platform complies with various regulations to give you peace of mind.

-

Can airSlate SignNow integrate with my existing business tools for ne llc management?

Absolutely! airSlate SignNow integrates seamlessly with various business tools to enhance your ne llc management. This includes popular applications like Google Drive, Dropbox, and CRM systems, enabling you to streamline your processes without disruption.

-

What are the benefits of using airSlate SignNow for a ne llc?

Using airSlate SignNow for your ne llc offers numerous benefits, including faster document turnaround, reduced paper usage, and improved workflow efficiency. The user-friendly interface ensures that anyone can easily navigate the platform, making the process hassle-free.

-

Does airSlate SignNow provide support for forming a ne llc?

Yes, airSlate SignNow offers comprehensive support for businesses forming a ne llc. Our customer support team is available to assist you with any questions or issues that may arise during the process, ensuring that you have the guidance you need.

Get more for Nebraska Revised Statutes Range Search Nebraska Legislature

- 22 nebraska change request nebraska department of revenue form

- 941n 2018 2019 form

- Ne form request 2016 2019

- Meals and rooms rentals tax faqnh department of revenue form

- Dp 14 print new hampshire department of revenue administration form

- Cd57s 2017 2019 form

- Nh dra form dp2848 2018 2019

- Nh dra form dp2848 2015

Find out other Nebraska Revised Statutes Range Search Nebraska Legislature

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe