Form 8971 January Information Regarding BeneficiariesAcquiring Property from a Decedent 2016-2026

What is Form 8971: Information Regarding Beneficiaries Acquiring Property From A Decedent

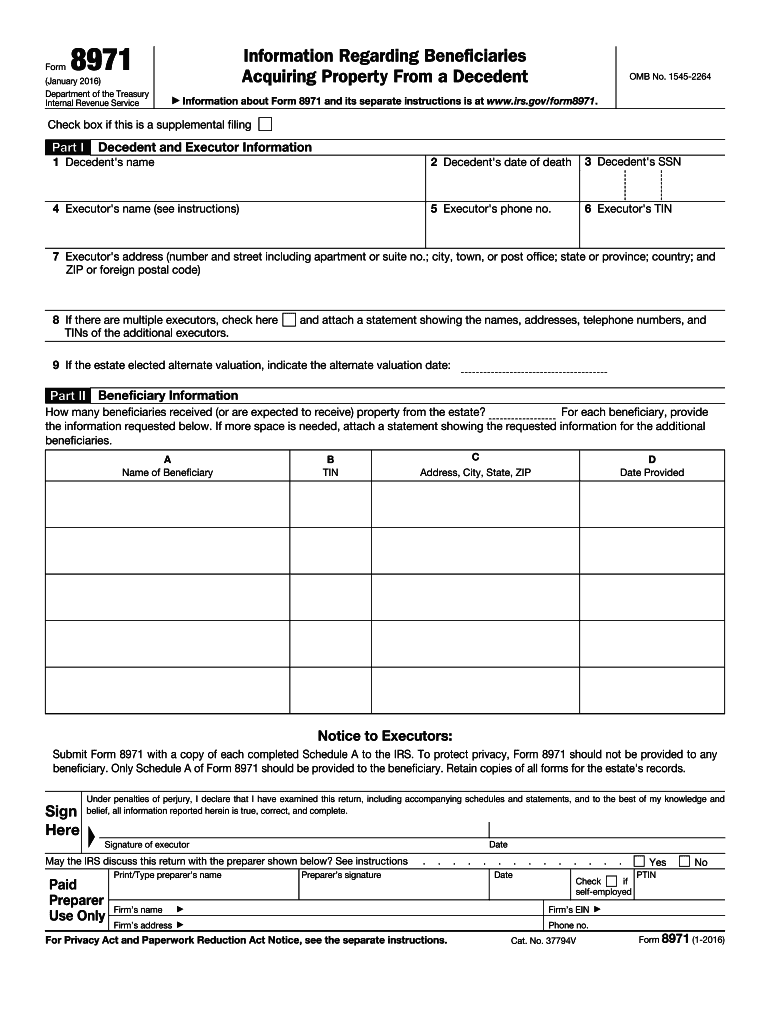

Form 8971 is a crucial document used in the United States to report information regarding beneficiaries who acquire property from a decedent. This form is essential for ensuring that the IRS has accurate data about the beneficiaries of an estate. It helps in the proper assessment of estate taxes and provides transparency in the transfer of property after a person's death. The form requires details such as the names and addresses of beneficiaries, the property they are receiving, and the fair market value of that property at the time of the decedent's passing.

Steps to Complete Form 8971

Completing Form 8971 involves several important steps to ensure accuracy and compliance with IRS requirements. First, gather all necessary information about the decedent and the beneficiaries. This includes full names, addresses, and Social Security numbers. Next, determine the fair market value of the property being transferred to each beneficiary. Once you have this information, fill out the form carefully, ensuring that all entries are correct and complete. After completing the form, review it for any errors before submitting it to the IRS.

Legal Use of Form 8971

The legal use of Form 8971 is vital for estate administration in the United States. It serves as a formal declaration of the beneficiaries who are entitled to receive property from a decedent's estate. Filing this form is not just a matter of compliance; it also protects the rights of beneficiaries and ensures that the estate is settled according to legal standards. Failure to file Form 8971 can lead to penalties and complications in the estate settlement process.

IRS Guidelines for Form 8971

The IRS provides specific guidelines for the completion and submission of Form 8971. It is important to follow these guidelines to avoid any issues with the IRS. The form must be filed within a specified timeframe after the decedent's death, typically within nine months. Additionally, the IRS requires that the form be submitted alongside the estate tax return, if applicable. Understanding these guidelines helps ensure that the form is filed correctly and on time.

Required Documents for Form 8971

When preparing to file Form 8971, certain documents are necessary to support the information provided. These documents may include the decedent's death certificate, the will or trust documents, and any appraisals or valuations of the property being transferred. Having these documents ready will facilitate the completion of the form and ensure that all required information is accurately reported.

Filing Deadlines for Form 8971

Filing deadlines for Form 8971 are critical to avoid penalties and ensure compliance. Generally, the form must be filed within nine months of the decedent's death. If an estate tax return is required, Form 8971 should be filed with that return. It is advisable to keep track of these deadlines to ensure timely submission, as late filings can result in additional scrutiny from the IRS and potential penalties.

Quick guide on how to complete form 8971 january 2016 information regarding beneficiariesacquiring property from a decedent

Complete Form 8971 January Information Regarding BeneficiariesAcquiring Property From A Decedent effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the needed form and safely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Manage Form 8971 January Information Regarding BeneficiariesAcquiring Property From A Decedent on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and electronically sign Form 8971 January Information Regarding BeneficiariesAcquiring Property From A Decedent with ease

- Locate Form 8971 January Information Regarding BeneficiariesAcquiring Property From A Decedent and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for such tasks.

- Create your electronic signature with the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, frustrating form searches, or errors that necessitate reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 8971 January Information Regarding BeneficiariesAcquiring Property From A Decedent to ensure seamless communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8971 january 2016 information regarding beneficiariesacquiring property from a decedent

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What features does airSlate SignNow offer for the 8971 solution?

The airSlate SignNow platform, particularly with the 8971 solution, provides features such as customizable templates, an intuitive drag-and-drop editor, and robust security options. These features help streamline the eSigning process, ensuring document authenticity and compliance. Users can send, sign, and manage documents effortlessly.

-

How much does the 8971 plan cost for businesses?

Pricing for the airSlate SignNow 8971 plan is designed to be cost-effective, catering to businesses of all sizes. Monthly subscriptions are available with discounts for annual commitments, providing flexibility based on your business needs. To get the most accurate pricing, visit the airSlate SignNow website.

-

What are the benefits of using the 8971 eSignature solution?

The airSlate SignNow 8971 eSignature solution benefits businesses by increasing efficiency and reducing turnaround times for document signing. This not only enhances productivity but also improves customer satisfaction. With its easy-to-use interface, anyone can adopt it without extensive training.

-

Can I integrate airSlate SignNow 8971 with other applications?

Yes, the airSlate SignNow 8971 solution offers seamless integrations with a variety of applications, including CRM systems and project management tools. This capability enhances workflow automation and ensures that your documents are always aligned with your business processes. Check the integrations page for a full list.

-

Is the 8971 solution secure for handling sensitive documents?

Absolutely, the airSlate SignNow 8971 solution is built with security in mind. It complies with industry standards like GDPR and HIPAA, ensuring that your documents are encrypted and safely stored. With features like two-factor authentication and secure cloud storage, you can trust that your sensitive information is protected.

-

How can I start using the 8971 solution from airSlate SignNow?

To start using the airSlate SignNow 8971 solution, simply sign up for a free trial on their website. This allows you to explore all features and capabilities without any commitment. Once you see how it can enhance your document workflow, you can choose the plan that suits your business best.

-

What sets the airSlate SignNow 8971 apart from other eSigning solutions?

The airSlate SignNow 8971 stands out due to its user-friendly interface and comprehensive feature set that caters to both small and large businesses. The combination of affordability and advanced capabilities makes it an ideal choice. Plus, ongoing customer support ensures that users get the assistance they need at any time.

Get more for Form 8971 January Information Regarding BeneficiariesAcquiring Property From A Decedent

- Camosun form

- Mv1510v prorate vehicle application icbc form

- Anthem member claim form

- Wsib ontario guarantor form

- Fillable secu application we appreciate your interest in our organization please complete the application as fully as possible form

- Fillable online verification of student status salve form

- Save your spot form

- Graduate studies and continuing educationsalve regina form

Find out other Form 8971 January Information Regarding BeneficiariesAcquiring Property From A Decedent

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form