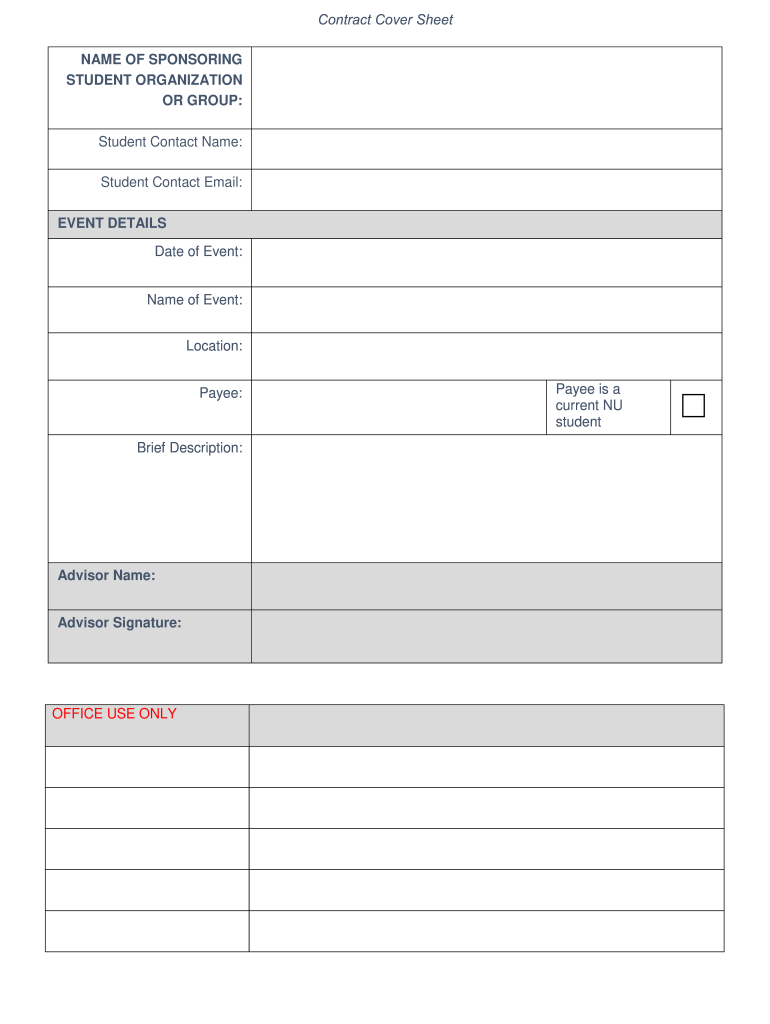

Or GROUP Form

What is the OR GROUP

The OR GROUP form is a specific document used primarily for tax purposes in the United States. It allows individuals or businesses to report various types of income or deductions. This form is essential for ensuring compliance with federal regulations and helps taxpayers accurately reflect their financial activities during a given tax year. Understanding the purpose and requirements of the OR GROUP is crucial for anyone looking to maintain proper tax records and avoid potential penalties.

How to use the OR GROUP

Using the OR GROUP form involves several steps to ensure accurate completion. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to follow the instructions provided with the form to avoid errors that could lead to delays or rejections. Once completed, the form can be submitted electronically or via mail, depending on the preferred submission method.

Steps to complete the OR GROUP

Completing the OR GROUP form requires attention to detail. Begin by entering your personal information, including your name, address, and taxpayer identification number. Next, report your income in the designated sections, ensuring that you include all relevant sources. If applicable, list any deductions you are claiming. Double-check all entries for accuracy before finalizing the form. Finally, sign and date the form to certify its authenticity before submission.

Legal use of the OR GROUP

The OR GROUP form must be used in accordance with IRS regulations to ensure its legal validity. It is essential to understand the specific guidelines governing the use of this form, including deadlines for submission and the types of income or deductions that can be reported. Compliance with these regulations not only protects taxpayers from potential audits but also ensures that all reported information is legally recognized by the IRS.

Key elements of the OR GROUP

Key elements of the OR GROUP form include sections for personal identification, income reporting, and deduction claims. Each section is designed to capture specific financial information, which is crucial for accurate tax reporting. Additionally, the form includes instructions for completing each part, ensuring that users can navigate the process effectively. Understanding these elements helps taxpayers provide the necessary information while reducing the risk of errors.

IRS Guidelines

The IRS provides specific guidelines for the use of the OR GROUP form, detailing the requirements for completion and submission. These guidelines include information on eligibility, acceptable income sources, and documentation needed to support claims. Adhering to these guidelines is essential for ensuring compliance and avoiding penalties. Taxpayers should consult the IRS website or official publications for the most current information regarding the OR GROUP form.

Quick guide on how to complete or group

Effortlessly Create OR GROUP on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle OR GROUP on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign OR GROUP Effortlessly

- Locate OR GROUP and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select your preferred method to send your form via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and eSign OR GROUP and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the or group

How to create an eSignature for your PDF file online

How to create an eSignature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

The way to generate an eSignature for a PDF on Android devices

People also ask

-

What is the OR GROUP and how does airSlate SignNow fit into it?

The OR GROUP is essential for businesses looking to streamline their document signing processes. airSlate SignNow integrates seamlessly within the OR GROUP framework, enabling users to manage eSignatures efficiently and enhance collaboration.

-

How does airSlate SignNow pricing work for the OR GROUP?

airSlate SignNow offers flexible pricing plans suitable for the OR GROUP. Depending on your organization's size and needs, you can choose between various tiers, ensuring cost-effectiveness while maximizing features tailored for seamless document management.

-

What features does airSlate SignNow provide for the OR GROUP?

airSlate SignNow includes a plethora of features ideal for the OR GROUP, such as customizable templates, advanced analytics, and team collaboration tools. These features enhance productivity by allowing users to create, sign, and manage documents all in one place.

-

Can airSlate SignNow integrate with other tools in the OR GROUP?

Absolutely! airSlate SignNow offers integrations with popular applications within the OR GROUP, making it easy to sync documents and data. This ensures that your teams can efficiently work across different platforms without losing valuable time.

-

What are the benefits of using airSlate SignNow for the OR GROUP?

Using airSlate SignNow within the OR GROUP offers numerous benefits, including enhanced efficiency, reduced turnaround times, and improved compliance. Additionally, its user-friendly interface ensures that team members can adopt and utilize the platform with ease.

-

Is airSlate SignNow secure for handling sensitive documents in the OR GROUP?

Yes, airSlate SignNow prioritizes security, implementing industry-leading protocols to protect sensitive documents. The platform is compliant with various regulations, ensuring that your information remains safe while collaborating within the OR GROUP.

-

How can I get started with airSlate SignNow for the OR GROUP?

Getting started with airSlate SignNow for the OR GROUP is simple! You can sign up for a free trial on our website, allowing you to explore features and capabilities before committing to a subscription tailored for your organization's unique needs.

Get more for OR GROUP

- Corrective action root cause analysis form

- Medication error report from form

- Dhs 1139f rev med quest form

- Background check form pdf barnes jewish hospital barnesjewish

- Wind mitigation form 2010

- Delta dental address change form

- Dhr cdc 1951 adobe 2001 form

- Threshold override application for medicaid ny 2010 form

Find out other OR GROUP

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself