Md Rule 9 202 Form

What is the Md Rule 9 202

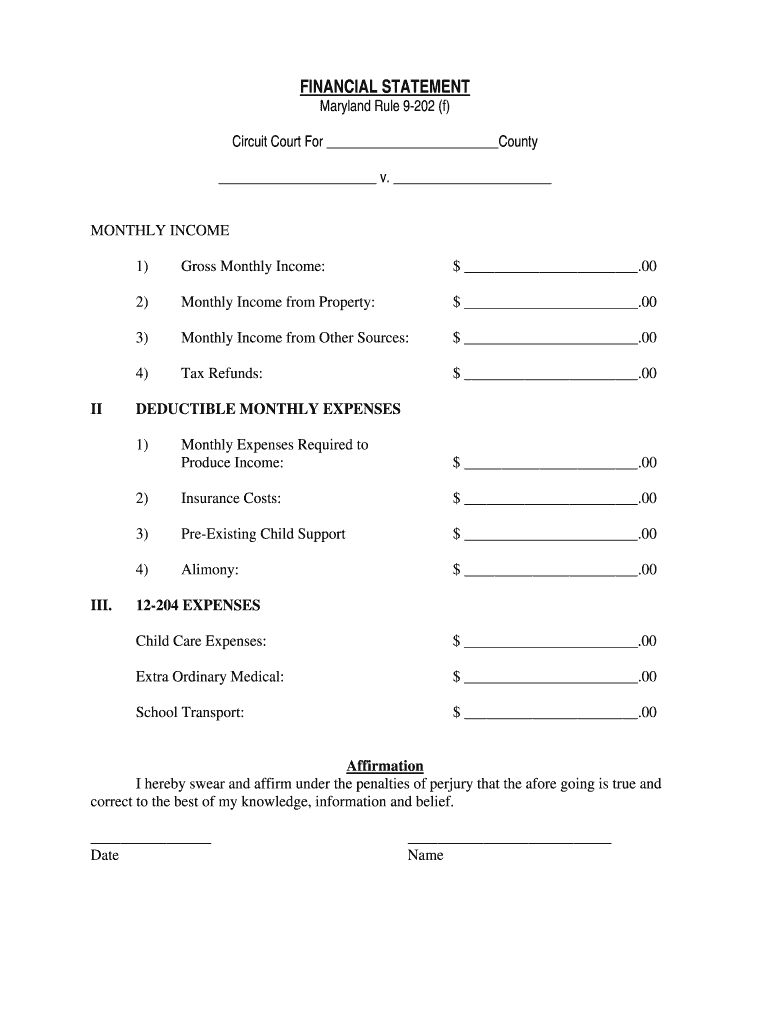

The Maryland Rule 9 202 pertains to the financial statement requirements for certain legal proceedings. It establishes guidelines for the disclosure of financial information in cases such as divorce, child support, and other family law matters. This rule aims to ensure transparency and fairness in the judicial process by requiring parties to provide a comprehensive view of their financial status.

Under this rule, individuals must complete a financial statement that includes details about income, expenses, assets, and liabilities. The form is designed to facilitate equitable decisions by providing the court with essential financial data. Understanding the Md Rule 9 202 is crucial for individuals involved in legal proceedings in Maryland, as it directly impacts the outcome of financial disputes.

How to use the Md Rule 9 202

Using the Md Rule 9 202 involves accurately completing the financial statement required by the court. First, gather all necessary financial documents, including pay stubs, bank statements, and tax returns. This information will help ensure that the financial statement reflects your true financial situation.

Next, fill out the form carefully, providing all requested information. Be honest and thorough, as any discrepancies can lead to legal complications. Once completed, the form must be filed with the appropriate court and served to the other party involved in the case. Utilizing digital tools like signNow can streamline this process, allowing for secure electronic signatures and submissions.

Steps to complete the Md Rule 9 202

Completing the Md Rule 9 202 involves several key steps to ensure accuracy and compliance with legal requirements:

- Gather financial documents, including income statements, expense records, and asset details.

- Access the official Md Rule 9 202 form, which can often be found on the Maryland Judiciary website.

- Fill out the form, ensuring that all sections are completed with accurate information.

- Review the form for any errors or omissions before finalizing it.

- Sign the form electronically if using a digital platform, or print and sign if completing it by hand.

- File the completed form with the court and provide copies to all relevant parties.

Legal use of the Md Rule 9 202

The legal use of the Md Rule 9 202 is essential in family law cases where financial disclosures are necessary. This rule is designed to uphold fairness in legal proceedings by requiring all parties to disclose their financial circumstances fully. Courts rely on the information provided in the financial statement to make informed decisions regarding support obligations, asset division, and other financial matters.

Failure to comply with the Md Rule 9 202 can result in penalties, including the possibility of the court imposing sanctions or making decisions based on incomplete information. Therefore, it is vital to understand and adhere to the requirements set forth by this rule to protect your legal rights and interests.

Key elements of the Md Rule 9 202

Key elements of the Md Rule 9 202 include specific categories of financial information that must be disclosed. These categories typically encompass:

- Income: All sources of income, including wages, bonuses, and any additional earnings.

- Expenses: Monthly living expenses, including housing, utilities, and other recurring costs.

- Assets: Detailed information about property, bank accounts, investments, and other valuable items.

- Liabilities: Outstanding debts, including loans, credit card balances, and other financial obligations.

Accurately reporting these elements is crucial for the court's assessment and decision-making process. Each section must be completed with care to reflect your true financial situation.

Form Submission Methods

The Md Rule 9 202 can be submitted through various methods, depending on the court's requirements. Common submission methods include:

- Online: Many courts now allow electronic filing, which can simplify the submission process.

- Mail: You can send the completed form via postal service to the appropriate court.

- In-Person: Submitting the form directly at the courthouse may also be an option, allowing for immediate confirmation of receipt.

Choosing the right submission method can enhance efficiency and ensure that your financial statement is processed in a timely manner.

Quick guide on how to complete md rule 9 202

Complete Md Rule 9 202 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Md Rule 9 202 on any device using airSlate SignNow’s Android or iOS apps and enhance any document-related process today.

How to modify and eSign Md Rule 9 202 with ease

- Find Md Rule 9 202 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Md Rule 9 202 and ensure excellent communication at every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the md rule 9 202

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is Md Rule 9 202 and how does it relate to eSignature solutions?

Md Rule 9 202 is a regulation that mandates the use of electronic signatures in certain legal documents in Maryland. With airSlate SignNow, you can comply with Md Rule 9 202 while enjoying the benefits of a secure and efficient eSignature platform. Our solution ensures that your documents meet all legal requirements, making the signing process seamless.

-

How does airSlate SignNow ensure compliance with Md Rule 9 202?

airSlate SignNow is designed to comply with Md Rule 9 202 by providing legally binding electronic signatures. Our platform incorporates advanced security features, such as encryption and audit trails, ensuring that your documents are not only compliant but also protected. This compliance helps businesses operate smoothly within Maryland's legal framework.

-

What pricing options does airSlate SignNow offer for businesses needing to comply with Md Rule 9 202?

airSlate SignNow offers flexible pricing plans tailored to fit any business size, including options for those focusing on compliance with Md Rule 9 202. Our pricing is designed to be cost-effective while providing all the essential features necessary for secure electronic signatures. You can choose a plan that best meets your volume of document signing needs.

-

What key features of airSlate SignNow support Md Rule 9 202 compliance?

Key features of airSlate SignNow that support compliance with Md Rule 9 202 include customizable workflows, secure storage, and comprehensive audit trails. These features ensure that all signed documents are tracked and stored securely, meeting legal standards. Additionally, our platform allows for easy integration with existing systems, enhancing overall efficiency.

-

Can airSlate SignNow integrate with other software to help with Md Rule 9 202 compliance?

Yes, airSlate SignNow seamlessly integrates with various business applications to facilitate compliance with Md Rule 9 202. Whether you need to connect with CRMs, document management systems, or other tools, our platform provides the necessary integrations. This versatility helps streamline your document workflows while ensuring legal adherence.

-

What benefits does using airSlate SignNow provide for businesses needing Md Rule 9 202 compliance?

Using airSlate SignNow for Md Rule 9 202 compliance offers numerous benefits, including improved efficiency, cost savings, and enhanced security. Our platform allows you to send, sign, and manage documents quickly, reducing turnaround time. Additionally, you can rest assured that your electronic signatures meet all legal requirements, protecting your business from potential compliance issues.

-

Is airSlate SignNow user-friendly for businesses unfamiliar with Md Rule 9 202 requirements?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for businesses unfamiliar with Md Rule 9 202 to navigate the eSignature process. Our intuitive interface and helpful resources guide users through compliance requirements, ensuring that anyone can use our platform effectively. Training and support are also available to assist with any questions.

Get more for Md Rule 9 202

- Colorado application fee waiver form

- Middlesex comm college transcript pdf form

- Biennial controlled substance inventory form

- Marketing project request form

- Sponsorship authorization form

- Student authorized ferpa third party release wyman center form

- Accident incident investigation form tru

- Form5m14 ltpgt accelerated instruction plan aip grade 5 mathematics student

Find out other Md Rule 9 202

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile