1100 1099 2006-2026

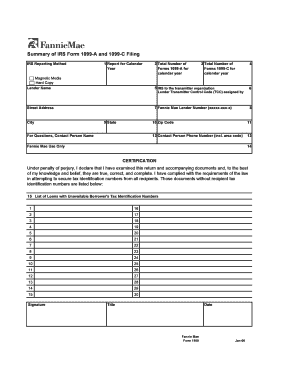

What is the Fannie Mae 1099?

The Fannie Mae 1099 is a tax form used to report various types of income, typically related to real estate transactions and mortgage interest. It is essential for individuals and businesses that have received payments from Fannie Mae or have engaged in transactions that require reporting to the Internal Revenue Service (IRS). This form helps ensure compliance with tax regulations by accurately documenting income received throughout the tax year.

How to Obtain the Fannie Mae 1099

Obtaining the Fannie Mae 1099 involves a few straightforward steps. First, individuals or businesses should check their records for any payments made by Fannie Mae during the tax year. If a 1099 form is required, it is typically sent directly to the recipient by Fannie Mae. Recipients can also access their forms through their online account on the Fannie Mae website or by contacting their customer service for assistance. It is crucial to ensure that the information on the form is accurate and matches the records kept for tax purposes.

Steps to Complete the Fannie Mae 1099

Completing the Fannie Mae 1099 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all relevant financial records, including any payment statements from Fannie Mae.

- Fill out the form with the correct recipient information, including name, address, and taxpayer identification number.

- Report the total amount of income received from Fannie Mae in the appropriate box on the form.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline, ensuring that copies are provided to the recipients as well.

Legal Use of the Fannie Mae 1099

The Fannie Mae 1099 is legally binding when completed and submitted according to IRS guidelines. It serves as an official record of income and is necessary for tax reporting purposes. To ensure its legal validity, it is essential to comply with all relevant tax laws and regulations. This includes accurate reporting of income and timely submission of the form to the IRS. Failure to comply can result in penalties or additional scrutiny from tax authorities.

IRS Guidelines for the Fannie Mae 1099

The IRS provides specific guidelines for completing and submitting the Fannie Mae 1099. These guidelines include:

- Filing deadlines, which typically fall on January thirty-first for recipients and February twenty-eighth for the IRS.

- Requirements for reporting income accurately, ensuring that all amounts are correctly calculated and reported.

- Instructions on how to correct any errors found after submission, including the process for filing amended returns.

Penalties for Non-Compliance

Failure to file the Fannie Mae 1099 correctly or on time can result in penalties imposed by the IRS. These penalties may include fines for late filing, inaccuracies, or failure to provide a copy to the recipient. It is crucial to adhere to all filing requirements to avoid these potential penalties. Keeping accurate records and submitting forms promptly can help mitigate the risk of non-compliance.

Quick guide on how to complete 1100 1099

Complete 1100 1099 effortlessly on any device

Web-based document management has become widely embraced by businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without any delays. Manage 1100 1099 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign 1100 1099 with ease

- Locate 1100 1099 and click on Get Form to begin.

- Utilize the features we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text (SMS), invite link, or download it to your computer.

Dismiss the worries of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1100 1099 to ensure outstanding communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1100 1099

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

How to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

How to create an eSignature for a PDF document on Android OS

People also ask

-

What is the form summary 1099 c used for?

The form summary 1099 c is used to report the cancellation of debt, providing important tax documentation for individuals and businesses. It summarizes the amount of debt canceled and helps recipients accurately report their income to the IRS. Understanding the form summary 1099 c is crucial for tax compliance and avoidance of penalties.

-

How can airSlate SignNow help with form summary 1099 c?

AirSlate SignNow streamlines the process of getting your form summary 1099 c signed and sent quickly. With our user-friendly eSignature features, you can ensure that all documents are completed accurately and securely. This easy-to-use platform saves you time and resources while maintaining compliance with tax requirements.

-

Is there a cost associated with filing a form summary 1099 c using airSlate SignNow?

Yes, using airSlate SignNow does involve a nominal subscription fee, but this cost is outweighed by the efficiency it offers in managing your documentation, including the form summary 1099 c. Our pricing plans are designed to be cost-effective, making it easier for businesses to stay compliant without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing form summary 1099 c?

Absolutely! AirSlate SignNow seamlessly integrates with various accounting and document management systems. This allows you to link the eSigning process of your form summary 1099 c with your existing workflows, ensuring that everything is organized and accessible in one platform.

-

What features does airSlate SignNow offer for handling form summary 1099 c?

AirSlate SignNow offers features like customizable templates, real-time tracking, and secure document storage, all helpful when dealing with form summary 1099 c. Users can easily create templates for rapid deployment of these forms, enhancing efficiency while ensuring compliance with tax regulations.

-

How does airSlate SignNow ensure the security of form summary 1099 c documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption methods and secure cloud storage to protect sensitive information found in your form summary 1099 c. This ensures that all your documents remain confidential and are only accessible to authorized users.

-

Can I track the status of my form summary 1099 c once sent for signature?

Yes, airSlate SignNow provides real-time status tracking for all documents sent for signature, including your form summary 1099 c. You can see when a document has been viewed, signed, or completed, which helps with accountability and ensures timely submission to the IRS.

Get more for 1100 1099

- Duly filled meaning form

- Amendment to agreement of purchase and sale form

- Sunjoy gazebo replacement frame parts form

- Self harm safety contract pdf form

- Punjab and sind bank atm card apply online form

- Health card application form download

- Www pdffiller com246489461 lhinamechangeleisure horse ireland fill online printable fillable form

- Claim for commemorative urn or plaque for veterans cremains not interred form

Find out other 1100 1099

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease