Cal Access Loan 1 Okinsurancequote Com 2018-2026

Understanding the Business Loan 0555

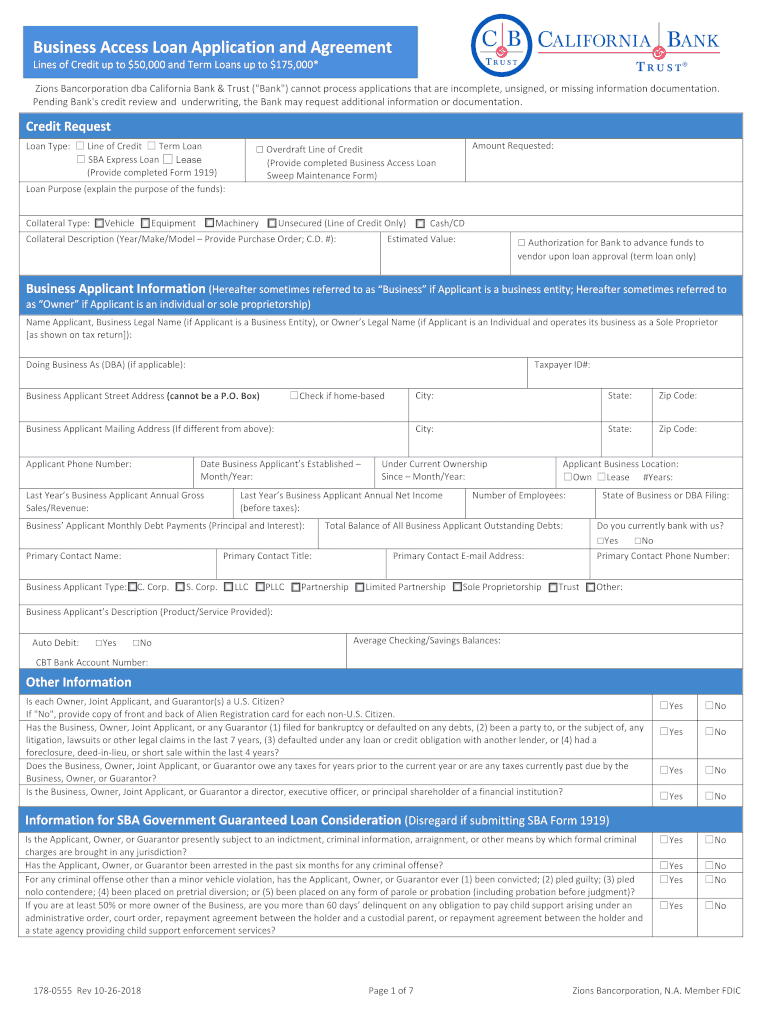

The Business Loan 0555 is a specific financial product designed to assist businesses in securing funding for various operational needs. This loan can be utilized for purposes such as purchasing inventory, expanding operations, or covering unexpected expenses. It is essential for business owners to understand the terms and conditions associated with this loan, including interest rates, repayment schedules, and eligibility criteria. This knowledge helps ensure that businesses can make informed decisions when applying for financial assistance.

Eligibility Criteria for Business Loan 0555

To qualify for the Business Loan 0555, applicants typically need to meet several key criteria. These may include:

- Being a registered business entity in the United States.

- Demonstrating a minimum level of annual revenue.

- Having a positive credit history.

- Providing necessary documentation, such as tax returns and financial statements.

Meeting these criteria is crucial for increasing the likelihood of loan approval, as lenders assess the risk associated with lending to a business.

Required Documents for Application

When applying for the Business Loan 0555, specific documents are generally required to support the application process. These may include:

- Business tax returns for the past two to three years.

- Financial statements, including profit and loss statements.

- Cash flow projections for the upcoming year.

- Personal financial statements of the business owner(s).

Having these documents ready can streamline the application process and improve the chances of approval.

Application Process for Business Loan 0555

The application process for the Business Loan 0555 typically involves several steps. First, businesses should gather all necessary documents and ensure they meet the eligibility criteria. Next, they can fill out the loan application form, providing accurate and detailed information about their business and financial needs. After submission, the lender will review the application and may request additional information or clarification. Once approved, the terms of the loan will be communicated, and funds can be disbursed accordingly.

Legal Considerations for Business Loan 0555

It is important for businesses to understand the legal implications associated with the Business Loan 0555. This includes being aware of the loan agreement's terms, such as interest rates, repayment obligations, and any collateral requirements. Additionally, businesses should ensure compliance with federal and state regulations governing business loans. Understanding these legal aspects can help prevent potential disputes and ensure a smooth borrowing experience.

Common Uses of Business Loan 0555

The Business Loan 0555 can be utilized for various purposes that support business growth and stability. Common uses include:

- Purchasing new equipment or technology to enhance operations.

- Expanding product lines or services offered to customers.

- Covering operational costs during slow business periods.

- Investing in marketing efforts to increase visibility and sales.

By understanding the potential uses of this loan, business owners can align their funding needs with their strategic goals.

Quick guide on how to complete cal access loan 1 okinsurancequotecom

Effortlessly prepare Cal Access Loan 1 Okinsurancequote com on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Cal Access Loan 1 Okinsurancequote com on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign Cal Access Loan 1 Okinsurancequote com with ease

- Obtain Cal Access Loan 1 Okinsurancequote com and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specially designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Choose your preferred method to deliver your form: via email, SMS, invite link, or download it to your PC.

Put an end to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Cal Access Loan 1 Okinsurancequote com to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cal access loan 1 okinsurancequotecom

How to generate an electronic signature for your PDF in the online mode

How to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

How to generate an electronic signature for a PDF file on Android OS

People also ask

-

What benefits does airSlate SignNow offer for California bank business owners?

AirSlate SignNow provides California bank business owners with an efficient platform to manage electronic signatures and document workflows. With its user-friendly interface, you can streamline client interactions and improve operational efficiency, ultimately enhancing customer satisfaction. Additionally, its cost-effective nature makes it an ideal choice for small to large banking institutions.

-

How can airSlate SignNow improve document management for a California bank business?

AirSlate SignNow enhances document management for California bank businesses by enabling seamless e-signatures and real-time collaboration. This allows bank employees to send, track, and sign documents quickly and securely, reducing paperwork and processing times. By digitizing document flow, banks can better meet regulatory compliance and improve overall productivity.

-

What pricing plans does airSlate SignNow offer for California bank businesses?

AirSlate SignNow offers various pricing plans tailored to the needs of California bank businesses, ranging from individual licenses to enterprise solutions. Each plan is designed to provide maximum value according to the size and specific requirements of your bank. Additionally, users can take advantage of a free trial to explore features before committing to a subscription.

-

Can airSlate SignNow integrate with existing systems used by California banks?

Yes, airSlate SignNow is designed to integrate seamlessly with popular CRM, ERP, and financial systems used by California banks. This allows for an efficient exchange of data and minimizes disruption to existing workflows. Key integrations include systems like Salesforce, Google Drive, and Microsoft Office, enhancing functionality and collaboration.

-

Is airSlate SignNow compliant with California banking regulations?

Absolutely, airSlate SignNow adheres to the strict regulations and compliance standards set forth for California bank businesses. The platform ensures that all electronic signatures are legally binding and maintains high-level security protocols to protect sensitive customer information. Compliance with laws such as the ESIGN Act and UETA is assured, making it a trustworthy solution for banks.

-

What features make airSlate SignNow suitable for California bank business?

Key features of airSlate SignNow that make it suitable for California bank businesses include customizable templates, advanced authentication options, and robust tracking capabilities. These features improve customer experience by enabling faster transactions and ensuring security and traceability throughout the signing process. Additionally, the mobile app allows users to manage documents on-the-go.

-

How can airSlate SignNow help with customer onboarding for a California bank business?

AirSlate SignNow streamlines the customer onboarding process for California bank businesses by allowing banks to send and sign necessary documents electronically. This reduces the time required to complete onboarding procedures, improves client interaction, and enhances overall satisfaction. The integration of automated workflows further simplifies the onboarding process, making it more efficient.

Get more for Cal Access Loan 1 Okinsurancequote com

- Ordering birth certificates kansas department of health form

- Deloitte technical proposalrequest for proposaldata form

- E coli infection shiga toxin producing north carolina form

- Dal dal 15 17 attachment adult care facility waiver requestequivalency notification form

- Hospital services corporation 2121 osuna rd ne business form

- Wi probate claim forms fill online printable fillable

- Dshs mailing address form

- Fillable online consumer complaint form medical board of

Find out other Cal Access Loan 1 Okinsurancequote com

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract