Marital Status Married Form

Understanding the Direct Rollover Process

A direct rollover is a method that allows individuals to transfer funds from one retirement account to another without incurring tax penalties. This process is particularly beneficial for those moving from a 401(k) plan to an IRA or another qualified retirement plan. By opting for a direct rollover, the funds remain tax-deferred, ensuring that the individual does not face immediate tax liabilities. Understanding the mechanics of a direct rollover is essential for effective retirement planning.

Steps to Complete a Direct Rollover

Completing a direct rollover involves several key steps:

- Contact the current plan administrator to request a direct rollover.

- Choose the new retirement account where the funds will be transferred.

- Complete any necessary paperwork provided by both the current and new plan administrators.

- Ensure that the funds are transferred directly between the two accounts to avoid tax penalties.

Following these steps carefully can help ensure a smooth transition of retirement funds.

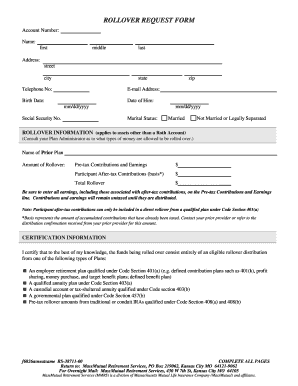

Required Documents for a Direct Rollover

To facilitate a direct rollover, certain documents may be required:

- Direct rollover request form from the current retirement plan.

- Account information for the new retirement account, including account number and institution details.

- Identification documents to verify your identity, such as a driver’s license or Social Security card.

Having these documents ready can expedite the rollover process and minimize potential delays.

IRS Guidelines on Direct Rollovers

The IRS provides specific guidelines regarding direct rollovers to ensure compliance and avoid penalties. According to IRS regulations, a direct rollover must occur within 60 days of receiving the distribution to avoid tax implications. Additionally, the rollover must be executed directly between the financial institutions involved. Understanding these IRS guidelines is crucial for maintaining the tax-deferred status of retirement funds.

Legal Use of Direct Rollovers

Direct rollovers are legally recognized transactions that allow individuals to transfer retirement funds without tax penalties. The Employee Retirement Income Security Act (ERISA) governs these transactions, ensuring that they are executed in accordance with federal regulations. Compliance with these legal standards is essential for protecting retirement assets and ensuring that individuals can access their funds when needed.

Eligibility Criteria for Direct Rollovers

Not everyone may qualify for a direct rollover. Eligibility typically depends on the type of retirement account and the specific plan rules. Generally, individuals who have left their job or are retiring may initiate a direct rollover. It is important to review the specific terms of the current retirement plan to determine eligibility. Consulting with a financial advisor can provide clarity on individual circumstances.

Quick guide on how to complete marital status married

Effortlessly Create Marital Status Married on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to produce, modify, and electronically sign your documents quickly without delays. Handle Marital Status Married on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused workflow today.

How to Modify and Electronically Sign Marital Status Married with Ease

- Locate Marital Status Married and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign Marital Status Married and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the marital status married

The way to generate an eSignature for a PDF online

The way to generate an eSignature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The way to generate an eSignature right from your smartphone

The way to create an eSignature for a PDF on iOS

The way to generate an eSignature for a PDF on Android

People also ask

-

What is the massmutual direct form?

The massmutual direct form is a streamlined document format provided by airSlate SignNow, designed to facilitate easy signing and submission of essential documents. This form is user-friendly and ensures that clients can complete necessary paperwork efficiently, enhancing productivity in your business operations.

-

How does the massmutual direct form benefit my business?

Utilizing the massmutual direct form helps your business save time and resources by reducing manual paperwork processes. It allows for quick eSigning and processing, ultimately leading to faster transaction times and enhanced customer satisfaction.

-

Are there any costs associated with using the massmutual direct form?

The massmutual direct form is part of the cost-effective solutions offered by airSlate SignNow. Pricing plans are competitive and designed to accommodate various business sizes, ensuring you receive great value while optimizing your document management processes.

-

What features are included with the massmutual direct form?

The massmutual direct form includes numerous features such as customizable templates, secure storage, and real-time tracking of document status. These features enhance your workflow efficiency and ensure that all signing processes are compliant and secure.

-

Can I integrate the massmutual direct form with other applications?

Yes, airSlate SignNow allows seamless integration of the massmutual direct form with various applications and tools that your business may already use. This flexibility ensures that you can incorporate eSigning efficiently into your existing workflows.

-

Is the massmutual direct form mobile-friendly?

Absolutely! The massmutual direct form is fully optimized for mobile devices, allowing users to sign and manage documents on-the-go. This feature is particularly beneficial for customers and employees who may need to complete paperwork away from their desks.

-

How secure is the massmutual direct form?

Security is a priority when it comes to the massmutual direct form. airSlate SignNow employs advanced encryption and compliance measures to protect your documents and sensitive information, ensuring peace of mind while you manage your signing processes.

Get more for Marital Status Married

Find out other Marital Status Married

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself