Printable Gift Deed Form Texas

What is the Printable Gift Deed Form Texas

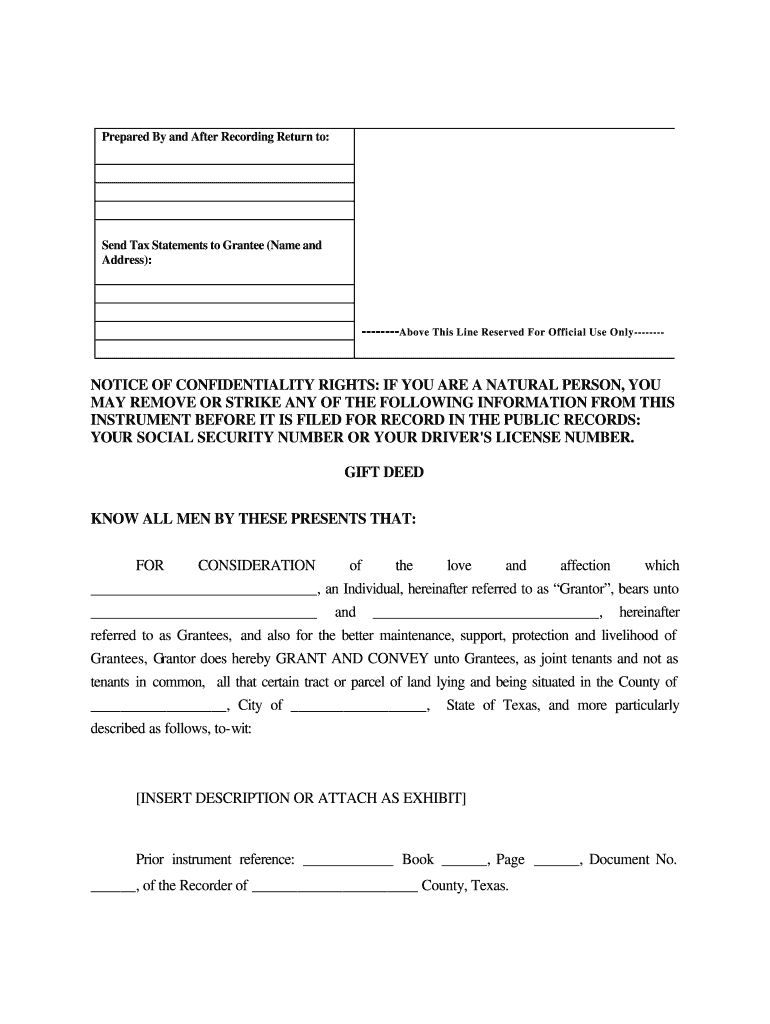

The printable gift deed form in Texas is a legal document used to transfer ownership of property from one individual to another as a gift. This form serves as evidence of the donor's intent to give the property without expecting anything in return. It is essential for ensuring that the transfer is recognized by the state and can help avoid potential disputes in the future. The form typically includes details about the property, the parties involved, and the terms of the gift, making it a crucial component in the gifting process.

How to Use the Printable Gift Deed Form Texas

Using the printable gift deed form involves several straightforward steps. First, download the Texas gift deed PDF from a reliable source. Next, fill in the required information, including the names of the donor and recipient, a description of the property, and any specific terms related to the gift. After completing the form, both parties should sign it in the presence of a notary public to ensure its legal validity. Once notarized, the document should be filed with the county clerk's office where the property is located to make the transfer official.

Steps to Complete the Printable Gift Deed Form Texas

Completing the printable gift deed form in Texas requires careful attention to detail. Follow these steps:

- Download the Texas gift deed PDF.

- Provide the full names and addresses of both the donor and recipient.

- Describe the property being gifted, including the legal description and address.

- Specify any conditions or terms associated with the gift, if applicable.

- Sign the document in front of a notary public.

- File the completed deed with the appropriate county office.

Key Elements of the Printable Gift Deed Form Texas

Several key elements must be included in the printable gift deed form to ensure its legality and effectiveness. These elements include:

- Donor and Recipient Information: Full names and addresses of both parties.

- Property Description: A detailed legal description of the property being transferred.

- Intent to Gift: A clear statement indicating that the property is being given as a gift.

- Signatures: Signatures of both the donor and recipient, along with a notary's acknowledgment.

Legal Use of the Printable Gift Deed Form Texas

The legal use of the printable gift deed form in Texas is crucial for ensuring that the transfer of property is recognized by the law. This form must be executed correctly to avoid any issues regarding ownership. It is important to comply with state laws regarding property transfers, including having the document notarized and filed appropriately. Failure to follow these legal requirements may result in disputes or challenges to the validity of the gift.

State-Specific Rules for the Printable Gift Deed Form Texas

Texas has specific rules governing the use of gift deeds. For instance, the gift deed must be in writing and signed by the donor. Additionally, the deed should be notarized to be enforceable. It is also advisable to file the deed with the county clerk to provide public notice of the transfer. Understanding these state-specific requirements helps ensure that the gift deed is legally binding and protects the interests of both the donor and recipient.

Quick guide on how to complete texas gift deed for individual to individual form

Complete Printable Gift Deed Form Texas effortlessly on any device

Managing documents online has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Printable Gift Deed Form Texas on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Printable Gift Deed Form Texas without hassle

- Obtain Printable Gift Deed Form Texas and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Printable Gift Deed Form Texas and ensure excellent communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

If a couple is applying for a US B-1 visa, do they need to fill out a form for individuals or groups?

Go for group.

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

What is the format of a deed to form body of individuals?

Deed should contain, name of proposed body, registered address of proposed body, objectives of the proposed body, names and addresses of persons who want to register the body, and rules and regulations of the proposed body to be enclosed as an annexure to the deed.

-

Can an individual form a company on the MCA service? Is it mandatory to fill out MCA forms for a company formed by a CA only?

Yes an individual can form a company on the MCA service by filling mca form 18, it is not mandatory that only a chartered accountant can fill out MCA forms for a company but is mostly prefered by many companies to do so.

-

How do I fill out the Amazon Affiliate W-8 Tax Form as a non-US individual?

It depends on your circumstances.You will probably have a form W8 BEN (for individuals/natural persons) or a form W8 BEN E (for corporations or other businesses that are not natural persons).Does your country have a double tax convention with the USA? Check here United States Income Tax Treaties A to ZDoes your income from Amazon relate to a business activity and does it specifically not include Dividends, Interest, Royalties, Licensing Fees, Fees in return for use of a technology, rental of property or offshore oil exploration?Is all the work carried out to earn this income done outside the US, do you have no employees, assets or offices located in the US that contributed to earning this income?Were you resident in your home country in the year that you earned this income and not resident in the US.Are you registered to pay tax on your business profits in your home country?If you meet these criteria you will probably be looking to claim that the income is taxable at zero % withholding tax under article 7 of your tax treaty as the income type is business profits arises solely from business activity carried out in your home country.

Create this form in 5 minutes!

How to create an eSignature for the texas gift deed for individual to individual form

How to create an eSignature for your Texas Gift Deed For Individual To Individual Form in the online mode

How to make an electronic signature for your Texas Gift Deed For Individual To Individual Form in Chrome

How to create an electronic signature for putting it on the Texas Gift Deed For Individual To Individual Form in Gmail

How to generate an eSignature for the Texas Gift Deed For Individual To Individual Form right from your mobile device

How to make an eSignature for the Texas Gift Deed For Individual To Individual Form on iOS devices

How to generate an eSignature for the Texas Gift Deed For Individual To Individual Form on Android OS

People also ask

-

What is a Printable Gift Deed Form Texas?

A Printable Gift Deed Form Texas is a legal document used to transfer ownership of property as a gift without monetary compensation. This form outlines the details of the property and the parties involved, ensuring that the transfer is legally recognized in Texas. Using a printable format allows for easy completion and signing.

-

How can I obtain a Printable Gift Deed Form Texas?

You can easily obtain a Printable Gift Deed Form Texas through airSlate SignNow's document library. Our platform offers customizable templates that you can fill out, print, and sign, ensuring a smooth process for your property transfer needs. Simply visit our website to access the form.

-

Is the Printable Gift Deed Form Texas legally valid?

Yes, the Printable Gift Deed Form Texas is legally valid when completed and executed correctly according to Texas laws. It must be signed by the donor and acknowledged by a notary public to ensure its enforceability. Always check local requirements to ensure compliance.

-

What are the benefits of using airSlate SignNow for the Printable Gift Deed Form Texas?

Using airSlate SignNow for your Printable Gift Deed Form Texas offers numerous benefits, including ease of use, cost-effectiveness, and secure document handling. Our platform allows you to quickly fill out, sign, and send documents electronically, streamlining the entire gifting process.

-

Can I customize the Printable Gift Deed Form Texas on airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize the Printable Gift Deed Form Texas to fit your specific needs. You can add additional clauses, modify the template, and ensure that all necessary details are included before printing or sending it for e-signature.

-

What integrations does airSlate SignNow offer for managing the Printable Gift Deed Form Texas?

airSlate SignNow integrates seamlessly with various applications, allowing you to manage your Printable Gift Deed Form Texas alongside other business tools. You can connect with platforms like Google Drive, Dropbox, and more for easy access and storage of your documents.

-

How much does it cost to use airSlate SignNow for the Printable Gift Deed Form Texas?

The pricing for airSlate SignNow is competitive and offers various plans to suit different needs. You can access the Printable Gift Deed Form Texas and other features at a reasonable cost, making it an affordable solution for individuals and businesses alike.

Get more for Printable Gift Deed Form Texas

Find out other Printable Gift Deed Form Texas

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple