California Addendum to Loan Estimate 2015-2026

What is the California Addendum to Loan Estimate

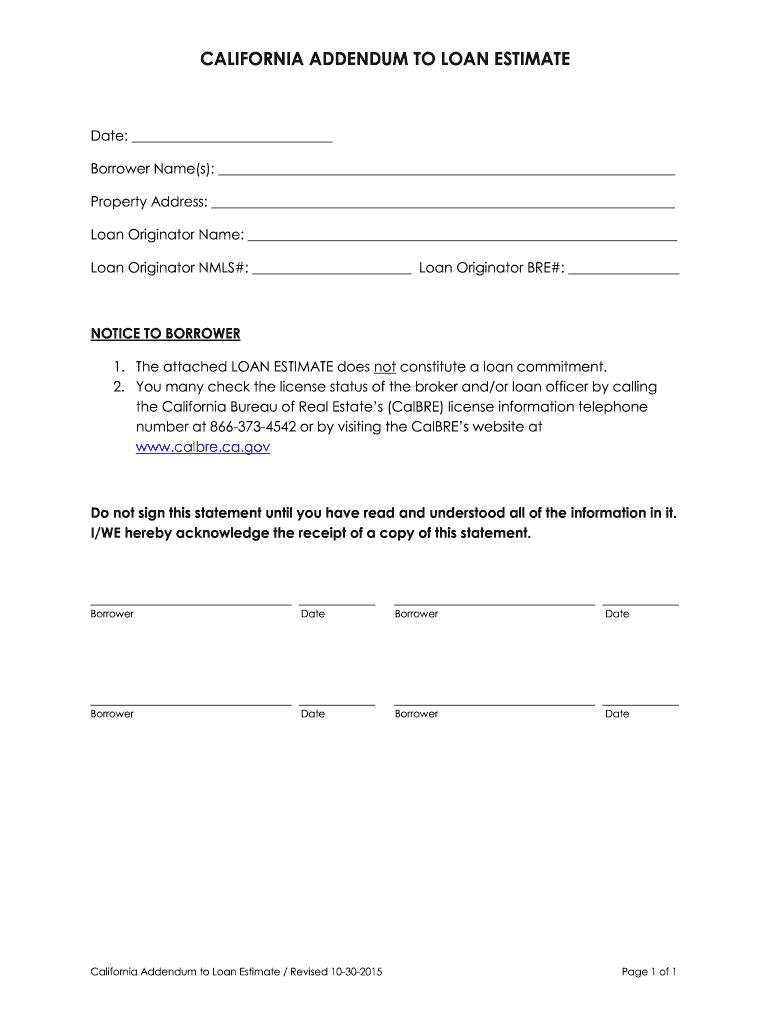

The California Addendum to Loan Estimate is a critical document that supplements the standard loan estimate provided to borrowers in California. This addendum outlines specific terms and conditions that may differ from federal requirements, ensuring compliance with state regulations. It serves to clarify loan details, including interest rates, fees, and other essential information that borrowers need to make informed decisions about their mortgage options.

Key Elements of the California Addendum to Loan Estimate

Understanding the key elements of the California Addendum to Loan Estimate is essential for both lenders and borrowers. This addendum typically includes:

- Loan Terms: Detailed information about the loan amount, interest rate, and repayment schedule.

- Estimated Closing Costs: A breakdown of fees associated with the loan, including origination fees, appraisal costs, and title insurance.

- Monthly Payment Estimates: Projections of monthly payments, including principal, interest, taxes, and insurance.

- Disclosure of Changes: Information on how changes in circumstances may affect the loan terms.

Steps to Complete the California Addendum to Loan Estimate

Completing the California Addendum to Loan Estimate involves a series of straightforward steps:

- Gather Necessary Information: Collect all relevant financial details, including income, credit history, and property information.

- Fill Out the Addendum: Accurately input the required information into the addendum, ensuring all fields are completed.

- Review for Accuracy: Double-check all entries for correctness to avoid potential issues during the loan process.

- Obtain Required Signatures: Ensure all necessary parties sign the document to validate it.

Legal Use of the California Addendum to Loan Estimate

The legal use of the California Addendum to Loan Estimate is governed by both state and federal regulations. To be considered valid, the addendum must meet specific legal requirements, including proper disclosures and compliance with the California Residential Mortgage Lending Act. This ensures that borrowers are fully informed of their rights and obligations under the loan agreement.

How to Obtain the California Addendum to Loan Estimate

Obtaining the California Addendum to Loan Estimate is a straightforward process. Borrowers can request this addendum from their lender or mortgage broker during the loan application process. Additionally, many lenders provide downloadable versions of the addendum on their websites, making it accessible for borrowers to review and complete as needed.

Examples of Using the California Addendum to Loan Estimate

Examples of using the California Addendum to Loan Estimate can help clarify its application in real-world scenarios. For instance, if a borrower is seeking a loan for a property in California, they may encounter specific fees unique to the state, such as additional escrow fees or state-specific taxes. The addendum allows these fees to be documented clearly, ensuring that borrowers understand their financial obligations before finalizing the loan agreement.

Quick guide on how to complete california addendum to loan estimate

Effortlessly Prepare California Addendum To Loan Estimate on Any Device

Digital document management has gained increased traction among businesses and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and without hold-ups. Manage California Addendum To Loan Estimate from any device using the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign California Addendum To Loan Estimate effortlessly

- Locate California Addendum To Loan Estimate and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal standing as a conventional wet ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form hunts, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign California Addendum To Loan Estimate to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the california addendum to loan estimate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an eSignature for signing PDFs in Gmail

The best way to create an eSignature right from your smartphone

How to create an eSignature for a PDF on iOS

The best way to create an eSignature for a PDF on Android

People also ask

-

What is a loan estimate example?

A loan estimate example refers to a document that outlines the terms and details of a loan, providing borrowers with a clear understanding of their mortgage costs. It serves as a valuable tool for comparing loan offers and aids in the decision-making process. Familiarizing yourself with a loan estimate example can help you recognize essential information such as interest rates and closing costs.

-

How do I create a loan estimate example with airSlate SignNow?

Creating a loan estimate example with airSlate SignNow is straightforward. You can easily upload your document and use our intuitive eSigning features to customize it for your clients. This functionality streamlines the process, making it easier for both you and your clients to manage loan estimates efficiently.

-

What are the benefits of using airSlate SignNow for loan estimate examples?

Using airSlate SignNow to generate loan estimate examples simplifies the document workflow. It ensures secure eSigning, reduces turnaround times, and enhances client engagement through a user-friendly interface. Plus, our platform allows for real-time tracking, ensuring transparent communication throughout the process.

-

Can I integrate airSlate SignNow with my existing loan management software?

Yes, airSlate SignNow offers seamless integrations with a variety of loan management software systems. This allows you to incorporate eSigning capabilities directly into your current workflow, making the creation and management of loan estimate examples even more efficient. Our platform is designed to work in harmony with your existing tools.

-

Is there a cost associated with using airSlate SignNow for loan estimate examples?

airSlate SignNow provides competitive pricing plans that cater to various business needs. You can choose a plan that includes access to features like creating loan estimate examples and eSigning at an affordable rate. This cost-effective solution optimizes your document handling without sacrificing quality or security.

-

How does airSlate SignNow ensure the security of my loan estimate examples?

airSlate SignNow prioritizes the security of your loan estimate examples by employing robust encryption and secure data storage practices. Every document is handled with the utmost care, ensuring that sensitive information remains protected throughout the signing process. Our platform is fully compliant with industry standards for data security.

-

What features does airSlate SignNow offer for managing loan estimate examples?

airSlate SignNow offers a variety of features tailored for managing loan estimate examples, including customizable templates, multi-user collaboration, and automated reminders for signers. These features enhance the efficiency of your document workflow, ensuring that your loan estimates are processed quickly and accurately.

Get more for California Addendum To Loan Estimate

Find out other California Addendum To Loan Estimate

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe