W4 Form Printable 2010-2026

Understanding the W-5 Form

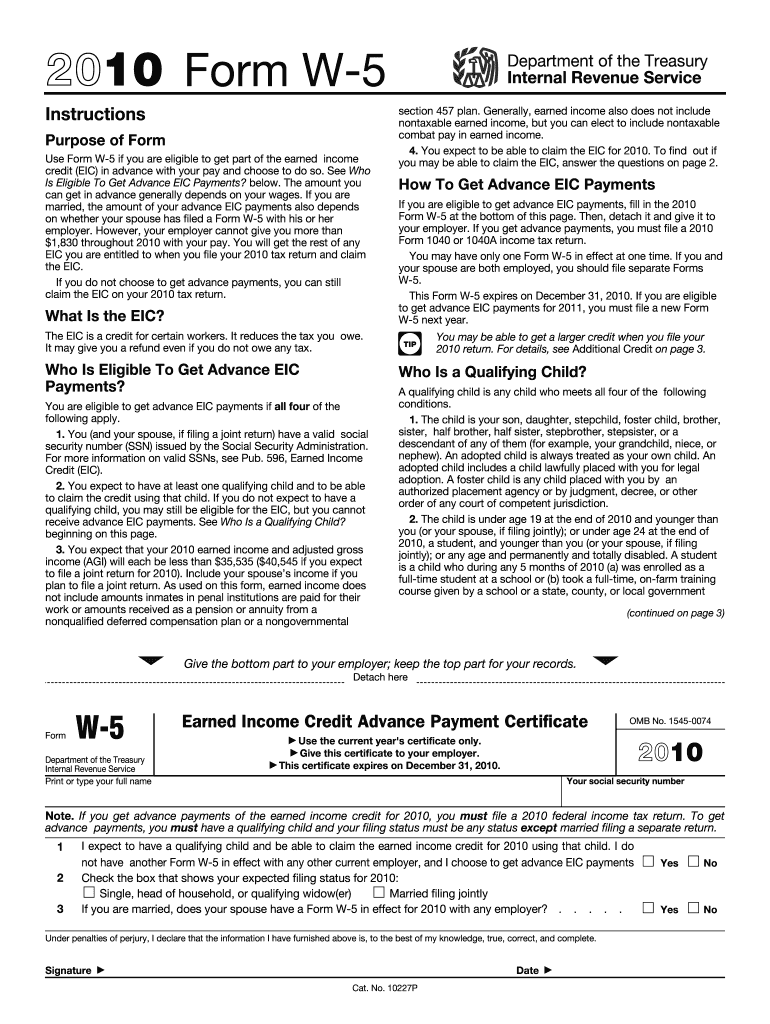

The W-5 form, also known as the Earned Income Credit Advance Payment Certificate, is a crucial document for individuals seeking to receive advance payments of the earned income credit. This form is specifically designed for low to moderate-income earners who qualify for this tax benefit. By submitting the W-5, eligible taxpayers can receive payments throughout the year, rather than waiting until they file their annual tax return. This can provide essential financial support, especially for families with children.

How to Complete the W-5 Form

Completing the W-5 form involves several straightforward steps. First, ensure you have all necessary personal information at hand, including your Social Security number and details about your qualifying children. Next, fill out the form accurately, providing information about your income and tax filing status. It's important to review your entries for accuracy to avoid delays in processing. Once completed, submit the form to your employer, who will use it to determine your eligibility for advance payments.

Legal Considerations for the W-5 Form

The W-5 form must be filled out and submitted in compliance with IRS regulations. This means that all information provided must be truthful and accurate. Misrepresentation or errors can lead to penalties, including the potential loss of the earned income credit. Additionally, the IRS requires that taxpayers keep records of their eligibility for the credit, including any correspondence related to the W-5 form. Understanding these legal requirements helps ensure that you remain compliant and can benefit from the advance payments.

Obtaining the W-5 Form

The W-5 form can be easily obtained through the IRS website or by contacting your employer's payroll department. It is available as a printable PDF, allowing you to fill it out by hand or electronically. Ensure you are using the most recent version of the form to avoid any issues during submission. If you prefer a digital approach, many tax preparation software programs also include the W-5 form, allowing for seamless integration into your overall tax filing process.

Key Elements of the W-5 Form

When filling out the W-5 form, there are several key elements to keep in mind. These include your personal identification information, the number of qualifying children, and your expected income for the year. Additionally, the form requires you to indicate whether you are married and filing jointly or separately. Each of these components plays a vital role in determining your eligibility for the earned income credit and the amount of advance payment you may receive.

Filing Deadlines for the W-5 Form

It is essential to be aware of the filing deadlines associated with the W-5 form. Typically, this form should be submitted to your employer as soon as you determine your eligibility for the earned income credit. While there is no specific deadline for submitting the W-5, it is advisable to complete it at the beginning of the tax year to ensure you receive advance payments in a timely manner. Keep in mind that any changes in your eligibility status should be reported to your employer immediately.

Quick guide on how to complete w4 2020 form printable

Effortlessly Prepare W4 Form Printable on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute to traditional printed and signed documents, as you can easily find the right template and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Handle W4 Form Printable on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

Effortlessly Modify and eSign W4 Form Printable

- Obtain W4 Form Printable and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign W4 Form Printable and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w4 2020 form printable

How to generate an eSignature for a PDF document in the online mode

How to generate an eSignature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The best way to create an eSignature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

What is a W 5 form?

The W 5 form is a tax-related document used by the IRS for certain tax classifications. It allows taxpayers to signNow their eligibility for tax benefits. Understanding the W 5 form can help businesses efficiently manage their tax responsibilities.

-

How does airSlate SignNow facilitate the signing of a W 5 form?

AirSlate SignNow offers an intuitive platform that enables users to easily send, sign, and manage W 5 forms electronically. Our solution enhances document workflow efficiency and ensures that the signing process is secure and legally binding. This streamlines the handling of important tax documents.

-

What features does airSlate SignNow provide for managing W 5 forms?

AirSlate SignNow includes features like customizable templates, audit trails, and reminders for W 5 forms. You can track the status of your documents in real-time, ensuring nothing falls through the cracks. These features help maintain organization and compliance in managing your tax forms.

-

Is there a free trial available for using airSlate SignNow with W 5 forms?

Yes, airSlate SignNow provides a free trial that allows you to explore its features for managing W 5 forms. This trial offers full access to our platform, enabling you to assess how our eSigning solutions can benefit your business without any initial commitment. Sign up today to get started!

-

How can airSlate SignNow integrate with my existing systems for W 5 forms?

AirSlate SignNow offers integrations with various CRM systems, cloud storage services, and business applications, making it easy to incorporate the management of W 5 forms into your existing workflows. This ensures a seamless data flow between platforms, enhancing productivity and saving time on document handling.

-

What are the pricing options for airSlate SignNow to manage W 5 forms?

AirSlate SignNow provides flexible pricing plans based on your business needs, enabling easy management of W 5 forms. We offer a range from basic to advanced plans that include varied features such as bulk signing and advanced templates. Visit our pricing page for detailed information tailored to your business.

-

How secure is the signing process for W 5 forms with airSlate SignNow?

The signing process for W 5 forms using airSlate SignNow is highly secure. We employ industry-leading encryption and comply with legal standards to ensure your documents and data are protected. This built-in security gives you peace of mind when handling sensitive tax information.

Get more for W4 Form Printable

- Rd 108 form

- Wisconsindmv gov mv3735 form

- Wisconsin transportation form

- Free montana motor vehicle bill of sale form mv24 pdf

- Bill of sale wisconsin form

- Wisconsin title ampamp license plate application wisconsin form

- Wisconsin pars form

- Fillable online dmv ne application for certificate of title dmv form

Find out other W4 Form Printable

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast