Printable Blank W 9 Form 2013-2026

What is the Printable Blank W-9 Form

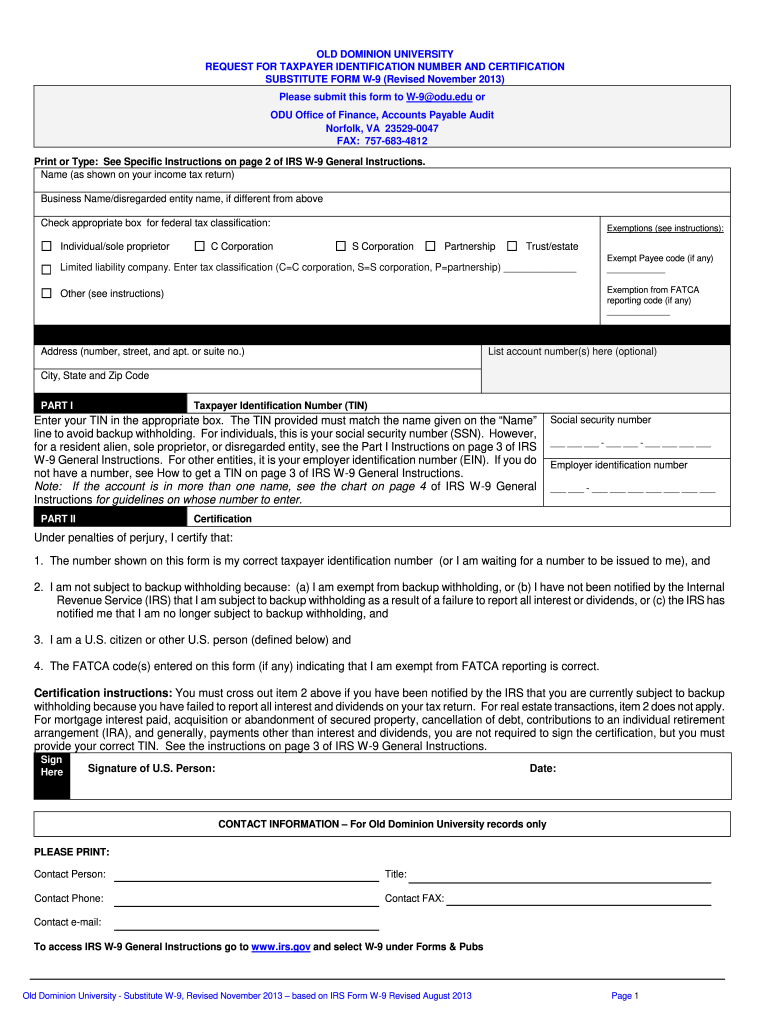

The Printable Blank W-9 Form is an essential document used in the United States for tax purposes. It is issued by the Internal Revenue Service (IRS) and is primarily used by individuals and businesses to provide their taxpayer identification information. This form is crucial for those who are required to report income paid to contractors or freelancers. By completing the W-9, the requester can accurately report payments made to the IRS, ensuring compliance with federal tax laws.

How to Use the Printable Blank W-9 Form

Using the Printable Blank W-9 Form involves a straightforward process. First, download the form from a reliable source, ensuring it is the most current version. Next, fill in your name, business name (if applicable), and taxpayer identification number, which can be your Social Security Number (SSN) or Employer Identification Number (EIN). After completing the form, you can submit it to the requester, who will use the information for tax reporting purposes. It is important to keep a copy for your records.

Steps to Complete the Printable Blank W-9 Form

Completing the Printable Blank W-9 Form requires attention to detail. Follow these steps:

- Download the W-9 form from the IRS website or a trusted source.

- Enter your name as it appears on your tax return.

- If you operate a business, include your business name.

- Provide your address, ensuring it matches IRS records.

- Indicate your taxpayer identification number (SSN or EIN).

- Sign and date the form to certify that the information is accurate.

Legal Use of the Printable Blank W-9 Form

The Printable Blank W-9 Form serves a legal purpose in tax compliance. When filled out correctly, it provides the necessary information for payers to report payments to the IRS. It is important to ensure that the information provided is accurate and up to date, as discrepancies can lead to penalties or issues with tax reporting. The form is legally binding once signed, meaning that any false information can result in legal consequences.

IRS Guidelines

The IRS has specific guidelines regarding the use of the W-9 Form. It is essential to understand that the form should be requested by the payer, not the payee. The IRS does not require individuals to submit the W-9 directly; rather, it is used to furnish the necessary information to the requester. Additionally, the IRS recommends keeping the form secure, as it contains sensitive information that could lead to identity theft if mishandled.

Filing Deadlines / Important Dates

While the Printable Blank W-9 Form itself does not have a filing deadline, it is crucial to submit it promptly when requested. The requester typically needs the W-9 to prepare Form 1099, which has its own deadlines. Generally, Form 1099 must be filed with the IRS by January thirty-first of the following year. Therefore, submitting the W-9 in a timely manner ensures that the requester can meet their reporting obligations.

Quick guide on how to complete printable blank w 9 form

Complete Printable Blank W 9 Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to create, alter, and eSign your documents quickly and without delays. Manage Printable Blank W 9 Form on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to alter and eSign Printable Blank W 9 Form with ease

- Obtain Printable Blank W 9 Form and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes seconds and holds the same legal weight as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Printable Blank W 9 Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the printable blank w 9 form

The best way to generate an electronic signature for your PDF document in the online mode

The best way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is an odu w9 taxpayer form?

The odu w9 taxpayer form is a tax document used by businesses to collect information from vendors and contractors. This form helps determine how much tax to withhold on payments made to these entities. Using tools like airSlate SignNow, you can easily manage and eSign your odu w9 taxpayer forms.

-

How can airSlate SignNow simplify the odu w9 taxpayer process?

airSlate SignNow streamlines the odu w9 taxpayer process by allowing you to create, send, and sign forms electronically. This reduces the paperwork needed and saves time in managing tax documentation. Our user-friendly platform ensures a smooth experience for both parties involved.

-

Is there a cost associated with using airSlate SignNow for odu w9 taxpayer forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. The cost-effective solution ensures you can manage your odu w9 taxpayer forms efficiently without breaking the bank. You can choose a plan that best fits your business needs.

-

What features does airSlate SignNow offer for managing odu w9 taxpayer documents?

airSlate SignNow includes various features such as customizable templates, secure cloud storage, and real-time tracking for your odu w9 taxpayer documents. You can also access a comprehensive audit trail to ensure compliance. These features enhance the overall efficiency of document management.

-

Can I integrate airSlate SignNow with other software for odu w9 taxpayer purposes?

Absolutely! airSlate SignNow offers seamless integrations with various applications such as CRM systems and accounting software. This allows you to manage your odu w9 taxpayer forms in conjunction with other business processes, enhancing your workflow.

-

How secure is my information when using airSlate SignNow for odu w9 taxpayer forms?

Security is a top priority for airSlate SignNow. We implement robust encryption and authentication measures to ensure your odu w9 taxpayer information remains confidential and safe. You can trust that your documents are protected while in transit and at rest.

-

What are the benefits of using airSlate SignNow for odu w9 taxpayer forms?

By using airSlate SignNow for your odu w9 taxpayer forms, you benefit from enhanced efficiency, reduced paperwork, and better tracking of document statuses. Our platform eliminates the hassle of manual processes, allowing you to focus on your core business activities.

Get more for Printable Blank W 9 Form

- The kansas city southern railway company credit application form

- Gunstock rental waiver form

- Aquatic venue general regulatory waiver request form

- Start deposit stop deposit clark county school district form

- Aquatic facility forms and documentation southern nevada

- Parental consent for evaluation form

- Clark county school district student services division form

- Primerica presentation pdf form

Find out other Printable Blank W 9 Form

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast