Appalachain State University W9 Form

What is the Appalachian State University W-9?

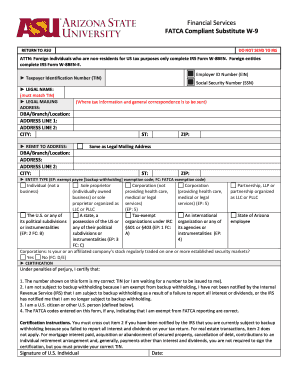

The Appalachian State University W-9 form is a tax document used by the university to collect necessary information from individuals or entities that provide services to the institution. This form is essential for compliance with IRS regulations, as it helps the university accurately report payments made to contractors, vendors, and other service providers. By completing the W-9, individuals confirm their taxpayer identification number (TIN) and provide their legal name and business structure, which is crucial for tax reporting purposes.

Steps to Complete the Appalachian State University W-9

Filling out the Appalachian State University W-9 form involves several straightforward steps:

- Download the W-9 form from the university's official website or request a copy from the relevant department.

- Provide your legal name as it appears on your tax return in the first section of the form.

- Indicate your business structure, such as individual, corporation, partnership, or LLC, in the appropriate box.

- Enter your taxpayer identification number (TIN), which can be your Social Security number or Employer Identification Number (EIN).

- Complete the address section with your current mailing address.

- Sign and date the form to certify that the information provided is accurate.

Legal Use of the Appalachian State University W-9

The Appalachian State University W-9 form serves a critical legal function by ensuring compliance with federal tax laws. It allows the university to accurately report payments to the IRS, which is essential for maintaining transparency and accountability in financial transactions. Failure to submit a completed W-9 may result in withholding taxes from payments made to the individual or entity, as the university must comply with IRS regulations regarding backup withholding.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines regarding the completion and submission of the W-9 form. According to IRS regulations, the form must be filled out accurately to avoid potential penalties. Taxpayers are required to provide their correct TIN and ensure that the information matches the IRS records. The form should be submitted to the requester (in this case, Appalachian State University) and not directly to the IRS. Keeping a copy of the completed form for personal records is also advisable.

Required Documents for the Appalachian State University W-9

When completing the Appalachian State University W-9 form, you may need to have certain documents on hand to ensure accuracy. These documents include:

- Your Social Security card or Employer Identification Number (EIN) documentation.

- A government-issued photo ID for identity verification.

- Any previous tax documents that may assist in confirming your legal name and TIN.

Form Submission Methods for the Appalachian State University W-9

The completed Appalachian State University W-9 form can be submitted through various methods, depending on the university's preferences. Common submission methods include:

- Online submission through a secure portal if available.

- Mailing the completed form to the appropriate department within the university.

- In-person delivery to the designated office for immediate processing.

Eligibility Criteria for Completing the Appalachian State University W-9

To complete the Appalachian State University W-9 form, individuals or entities must meet certain eligibility criteria. These include:

- Being a U.S. citizen or resident alien, or a business entity operating in the U.S.

- Providing accurate and truthful information regarding your taxpayer identification number.

- Being engaged in a business relationship with Appalachian State University that requires reporting of payments.

Quick guide on how to complete appalachain state university w9

Prepare Appalachain State University W9 easily on any gadget

Web-based document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the features necessary to create, edit, and eSign your documents swiftly without delays. Manage Appalachain State University W9 on any device with airSlate SignNow apps for Android or iOS and enhance any document-related procedure today.

How to edit and eSign Appalachain State University W9 effortlessly

- Obtain Appalachain State University W9 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the document or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Choose your delivery method for the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, time-consuming form searches, or inaccuracies requiring new document copies. airSlate SignNow addresses your needs in document management within a few clicks from your preferred device. Edit and eSign Appalachain State University W9 and ensure exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the appalachain state university w9

The way to create an eSignature for your PDF document online

The way to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

How to create an eSignature from your smart phone

The best way to generate an electronic signature for a PDF document on iOS

How to create an eSignature for a PDF file on Android OS

People also ask

-

What is a compliant W9 form and why is it important?

A compliant W9 form is essential for businesses to gather accurate information about their contractors and service providers. It ensures that the information reported to the IRS is correct, helping avoid potential penalties. Using airSlate SignNow allows businesses to easily manage and send compliant W9 forms securely.

-

How does airSlate SignNow ensure my W9 forms are compliant?

airSlate SignNow utilizes robust security measures, including encryption and compliance with eSignature laws, to ensure that your W9 forms meet IRS requirements. Our platform allows for easy tracking and management of signed forms, confirming that they are compliant and safely stored. This helps businesses maintain accurate records while staying compliant with regulations.

-

Is there a cost associated with using airSlate SignNow for compliant W9 forms?

Yes, airSlate SignNow offers various pricing plans that are affordable and tailored to meet the needs of different businesses. Our pricing is competitive, offering exceptional value for features such as secure storage of compliant W9 forms and easy eSigning. You can choose a plan that best fits your organization's requirements.

-

What features does airSlate SignNow provide for managing compliant W9 forms?

airSlate SignNow offers a range of features including customizable templates for compliant W9 forms, automated reminders, and integration with other applications for seamless workflow. You can also track the status of documents in real-time, which enhances efficiency and ensures compliance. This makes managing W9 forms easier and more organized.

-

Can I integrate airSlate SignNow with other tools I use for managing W9 forms?

Absolutely! airSlate SignNow seamlessly integrates with various tools such as accounting software and CRM systems to optimize the management of compliant W9 forms. This integration helps streamline your processes and enhances productivity. You'll be able to sync data efficiently, ensuring all your documentation is in one place.

-

What are the benefits of using airSlate SignNow for compliant W9 forms?

Using airSlate SignNow to handle your compliant W9 forms offers numerous benefits, including enhanced accuracy, time savings, and improved security. It automates the signing process, reduces paperwork, and keeps your records organized. Businesses can ensure they remain compliant while providing a hassle-free experience for their contractors.

-

How user-friendly is the airSlate SignNow platform for submitting compliant W9 forms?

The airSlate SignNow platform is designed with user-friendliness in mind, making it easy for businesses and contractors alike to submit compliant W9 forms. The intuitive interface allows users to navigate quickly and sign documents effortlessly. This means you can focus on your business without getting bogged down by complicated paperwork.

Get more for Appalachain State University W9

- Va form 26 1849

- Va form 21 0960g 1 vba va

- Minor child emergency information ampamp parentguardian

- Va form 6298

- Va form 10 10172 community care provider request for service

- Using the ebola risk triage tool template in cprs va form

- Agency information collection activity presidential memorial

- Instructions for filling out form va form 10 0423

Find out other Appalachain State University W9

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe