Maryland Form W4

What is the Maryland Form W-4

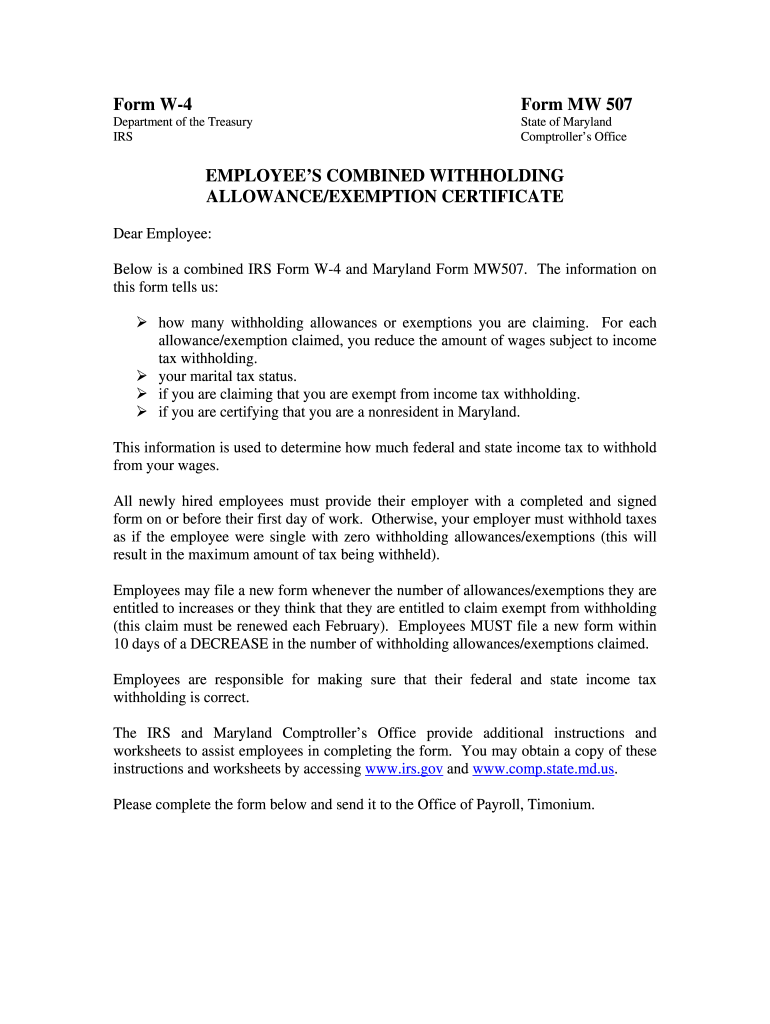

The Maryland Form W-4 is a state-specific tax withholding form used by employers to determine the amount of state income tax to withhold from employees' paychecks. It is essential for ensuring accurate tax withholding to avoid underpayment or overpayment of state taxes. The form captures personal information, including the employee's name, address, and Social Security number, as well as details about the number of allowances claimed and any additional withholding amounts. Understanding this form is crucial for both employers and employees in Maryland to comply with state tax regulations.

Steps to complete the Maryland Form W-4

Completing the Maryland Form W-4 involves several straightforward steps:

- Personal Information: Enter your full name, address, and Social Security number at the top of the form.

- Filing Status: Indicate your filing status, such as single, married, or head of household.

- Allowances: Calculate the number of allowances you are claiming based on your personal and financial situation. This may include factors like dependents and tax credits.

- Additional Withholding: If you want to withhold an extra amount from your paycheck, specify that amount in the designated section.

- Signature: Sign and date the form to certify that the information provided is accurate.

Once completed, the form should be submitted to your employer, who will use it to adjust your state tax withholding accordingly.

How to obtain the Maryland Form W-4

The Maryland Form W-4 can be easily obtained through various channels. It is available on the official Maryland state website, where you can download a PDF version for printing. Additionally, many employers provide the form directly to their employees during the onboarding process or upon request. It is important to ensure that you are using the most current version of the form to comply with state tax regulations.

Legal use of the Maryland Form W-4

The Maryland Form W-4 is legally binding and must be filled out accurately to ensure compliance with state tax laws. Employers are required to use this form to determine the correct amount of state income tax to withhold from employee wages. Misrepresentation or errors on the form can lead to penalties for both the employee and employer. Therefore, it is crucial to provide truthful information and update the form whenever there are changes in your personal circumstances, such as marital status or number of dependents.

Key elements of the Maryland Form W-4

Several key elements are essential to understand when filling out the Maryland Form W-4:

- Personal Information: Accurate identification details are necessary for proper processing.

- Allowances: The number of allowances directly affects the withholding amount; more allowances mean less tax withheld.

- Additional Withholding: This option allows employees to specify any extra amount they wish to have withheld from their paychecks.

- Signature: The employee's signature is required to validate the form and confirm the accuracy of the information provided.

Understanding these elements helps ensure that the form is completed correctly, minimizing the risk of tax-related issues.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Maryland Form W-4 can be done through various methods, depending on your employer's policies. Generally, the completed form should be submitted directly to your employer's payroll or human resources department. Some employers may allow electronic submission through their internal systems, while others may require a printed copy. If submitting by mail, ensure that you send it to the correct address provided by your employer. In-person submission is also an option, especially for new employees during the onboarding process.

Quick guide on how to complete maryland form w4

Your assistance manual on how to prepare your Maryland Form W4

If you’re wondering how to generate and present your Maryland Form W4, here are some brief guidelines on how to make tax processing less challenging.

To start, all you need to do is register your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is a highly user-friendly and robust document solution that enables you to edit, create, and complete your tax forms with ease. Utilizing its editor, you can toggle between text, check boxes, and eSignatures, and revisit to amend answers as necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the instructions below to finalize your Maryland Form W4 in minutes:

- Set up your account and start working on PDFs in moments.

- Utilize our directory to find any IRS tax form; browse through different versions and schedules.

- Click Get form to open your Maryland Form W4 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Examine your document and correct any errors.

- Save changes, print your copy, send it to your intended recipient, and download it to your device.

Leverage this manual to submit your taxes electronically with airSlate SignNow. Be aware that submitting on paper can increase return errors and delay refunds. It’s important to check the IRS website for filing regulations specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

FAQs

-

What is the best way to fill out a W4 form?

Before understanding the best way, we need to understand what is W4 form?To answer this:A W-4 form advises your employer how much tax to withhold from every paycheck. Your employer transmits the tax to the IRS for your sake. Toward the year's end, your employer will send you a W-2 showing (in addition to other things) how much it withheld for you that year.How to fill Form W4:You'll most likely round out a W-4 when you begin an occupation, however you can change your W-4 whenever. Simply download it from the IRS website, round it out and offer it to your HR or finance group.The simple part is providing your name, address, conjugal status and other fundamental individual information. The crucial step is choosing the quantity of allowances to guarantee.Try not to freeze on the off chance that you don't have the foggiest idea how to round out a W-4. The W-4 form accompanies an allowances worksheet that will enable you to make sense of what number to guarantee.The more allowances you guarantee, the less tax will be withheld from your paycheck.What’s the best way to fill out Form W-4?Here’s the general strategy:If you got a huge tax bill in April and don’t want another, you can use Form W-4 to increase your withholding. That’ll help you owe less (or nothing) next April.If you got a huge refund last year, you’re giving the government a free loan and could be needlessly living on less of your paycheck all year. Consider using Form W-4 to reduce your withholding.The more allowances you claim, the less tax will be taken out of your paycheck.To know more about W4 form, join this W4 webinar and learn how fill this form.

-

How can my employer charge me taxes when I didn't fill out any form (like W2, W4, or W9)?

**UPDATE** After my answer was viewed over 4,100 times without a single upvote, I revisited it to see where I might have gone wrong with it. Honestly, it seems like a reasonable answer: I explained what each of the forms asked about is for and even suggested getting further information from a licensed tax preparer. BUT, I’m thinking I missed the underlying concern of the querent with my answer. Now I’m reading that they don’t care so much about the forms as they do about the right or, more accurately, the obligation of their employer to withhold taxes at all.So let me revise my answer a bit…Your employer doesn’t charge you taxes - the government does. The government forces employers to withhold (or charge, as you put it) taxes from the earnings of their employees by threatening fines and even jail time for failing to do so (or for reclassifying them as independent contractors in order to avoid the withholding and matching requirements). Whether you fill out any forms or not, employers will withhold taxes because they don’t want to be fined or go to jail.Now the meta-question in the question is how can the government tax its citizen’s income? Well, that’s a big debate in America. Tax is the only way governments make money and they use that money to provide services for their constituency. Without funding, no federal or state or county program, or employee, would exist. But still, some people believe taxation is illegal, unjustified, and flat out wrong. They believe that free market forces should fund the military, the Coast Guard, Department of Defense, Veterans Affairs, Border Patrol, the FBI, CIA, DEA, FDA, USDA, USPS, the Federal Prison Complex, the National Park Service, the Interstate Highway System, air traffic control, and the Judiciary (just to name a few things). They even believe paying politicians for the work they do, like the President and Congress, is wrong.Others (luckily, most of us) appreciate paying taxes, even if they seem a bit steep at times. We’re happy to benefit from all the things our tax dollars buy us and we feel what we pay gives us back returns far greater than our investment. If you’re on the fence about this issue, consider how expensive health care is and how much you’re getting out of paying for it privately (out of your own paycheck). Same with your education or that of your children. Do you pay for private schools? Private colleges? Do you pay for private child care too? All expensive, right?Well what if we had to pay for private fire fighting? Or all mail had to be shipped via FedEx or UPS? Or if the cost of a plane ticket to anywhere doubled because we had to pay out-of-pocket for air traffic control? What about the military, border control and veterans? How much are you willing to pay out of every paycheck DIRECTLY to the department of defense AND veterans affairs? If we privatized the military, would we still be able to afford $30 billion dollar fighter jets? Who would pay to defend us?I bet people living paycheck to paycheck would be hard pressed to find extra money to pay for the military, when they’re already spending so much for teachers, schools, health care, local emergency response, food safety inspections, social workers, the criminal justice system, road repairs and construction, bridge inspection and maintenance, and natural disaster remediation (just to name a few things).Think about if all the national and local parks were privatized. Visiting one would cost as much or more than it does to go to Disneyland. Think about how much more food would cost if farmers weren’t subsidized and food wasn’t inspected for safety. Imagine how devastating a pandemic would be without the Center for Disease Control to monitor and mitigate illness outbreaks.We all take for granted the myriad of benefits we get from paying taxes. We may like to gripe and moan but taxes aren’t just for the public good, they’re for our own. (That rhymes!)**END OF UPDATE**W-9 forms are what you fill out to verify your identification, or citizenship status, for your employers. They have nothing to do with payroll taxes other than being the primary tool to from which to glean the correct spelling of your name and your Social Security number.W-2 forms are issued by employers to employees for whom they paid the required payroll taxes to the government on their behalf. The W-2 also details the amount of a person’s pay was sent to the government to fund their Social Security and Medicare accounts. W-2 forms are necessary for people when filing their personal income taxes so they can calculate if they under or overpaid.W-4 forms are filled out by employees to assure that the appropriate amount of pay is being withheld (and transferred on their behalf) by their employers to the government. If you don’t fill out a W-4 then your employer withholds the standard default amount for a single individual. You can update your W-4 at any time with your employer and you may want to when the size of your household changes.Even if you aren’t an employee (like you get paid without taxes being withheld for you) and are issued a 1099-MISC form instead of a W-2, you’re STILL responsible for paying your taxes as you earn that money - in no greater than quarterly installments. If you go over three months without paying taxes when you’re making money - whether your employer is withholding it and paying it on your behalf or you just made the money and no one took any taxes out for you - you’ll be fined and charged interest on your late tax payments.Talk with a licensed tax preparer and they can help you better understand what it all means. Good luck and happy tax season!

-

Do un-contracted workers have to fill out IRS W4 form?

I have no idea what an “un-contracted worker” is. I am not familiar with that term.Employees working in the U.S. complete a Form W-4.Independent contractors in the U.S. do not. Instead, they usually complete a Form W-9.If unclear on the difference between an employee or an independent contractor, see Independent Contractor Self Employed or Employee

-

Do employees need to fill out a w4 every year?

No. Once you initially complete your W-4 form and give it to H.R. , that's it. The only time you want to have it amended or changed is if too much or not enough of your paycheck is being withheld for Federal Income taxes. Thanks for the question.

-

How do I fill out a W4 form if am I a dependent of my father -who is a non US citizen living abroad, but pays for most of my living expenses?

You can be claimed as a dependent for tax purposes by a parent if:1. You are under age 19 at the end of the year, or under age 24 and a full-time student, or permanently and totally disabled; and2. You lived with that parent for at least half of the year (counting time spent temporarily absent from the home, i.e. at school); and3. You did not provide more than half of your own support.I bring that up just in case your mother - who you did not mention - meets all of those requirements. Note that the support requirement is only that you don't provide more than half of your own support - and not that the claiming parent does, so it's possible that you may still be your mother's dependent.Assuming that's not the case, then yor father, as a nonresident alien, would not generally be allowed to claim any exemption for dependents (assuming he has a US tax obligation). He might be able to do so if you qualify as his dependent otherwise and he is a resident of Canada or Mexico, but that's an unusual circumstance.On the W4 it doesn't really matter that much; claiming 1 instead of zero only means that the employer will withhold less in taxes, and many people report a different number than the allowance calculator (which the IRS doesn't see) computes. What does matter is that you know your dependency status for the year when it comes time to actually file your return. If you can be claimed as a dependent on someone else's return, you cannot claim your own exemption - even if that other person does not claim you.

Create this form in 5 minutes!

How to create an eSignature for the maryland form w4

How to create an electronic signature for your Maryland Form W4 in the online mode

How to make an eSignature for the Maryland Form W4 in Google Chrome

How to generate an electronic signature for signing the Maryland Form W4 in Gmail

How to create an eSignature for the Maryland Form W4 straight from your smartphone

How to generate an electronic signature for the Maryland Form W4 on iOS

How to create an eSignature for the Maryland Form W4 on Android

People also ask

-

What is the Maryland Form W4 and why is it important?

The Maryland Form W4 is a state income tax withholding certificate that employees use to indicate their tax situation to employers. It is crucial for ensuring the correct amount of state tax is withheld from your paycheck. Using the Maryland Form W4 correctly helps you avoid underpayment or overpayment of taxes.

-

How can I fill out the Maryland Form W4 using airSlate SignNow?

airSlate SignNow offers an intuitive platform that allows you to fill out the Maryland Form W4 electronically. Simply upload the form, fill in your details, and eSign it directly within the application. This ensures a quick and hassle-free experience.

-

Is there a cost associated with using airSlate SignNow for the Maryland Form W4?

Yes, airSlate SignNow provides various pricing plans to cater to different business needs. Our cost-effective solutions allow you to manage the Maryland Form W4 and other documents seamlessly, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for managing the Maryland Form W4?

airSlate SignNow offers features such as eSignature, document templates, and automated workflows specifically for managing the Maryland Form W4. These features enhance efficiency and save time, allowing you to focus on your core business operations.

-

Can I integrate airSlate SignNow with other applications for handling the Maryland Form W4?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enabling you to manage the Maryland Form W4 alongside your existing software tools. This integration helps streamline your document management processes.

-

What are the benefits of using airSlate SignNow for the Maryland Form W4?

Using airSlate SignNow for the Maryland Form W4 provides numerous benefits, including faster processing times, reduced paperwork, and enhanced security. Our platform ensures that your data is safe while making it easy to manage tax forms electronically.

-

How does airSlate SignNow ensure the security of my Maryland Form W4?

airSlate SignNow prioritizes the security of your documents, including the Maryland Form W4, by employing advanced encryption and secure data storage. This means your sensitive information is protected throughout the signing process.

Get more for Maryland Form W4

- Petition for approval of adoption agreement adult form

- In the matter of the guardianshipconservatorship of an form

- Adoption agreement between adult and adopting parent form

- This revocable living trust agreement hereinafter quottrustquot is being made this form

- The haunt in atascadero sign up form release of

- General durable power of attorney form

- Affidavit of paternity by father of child form

- We have been retained by name to investigate various claims form

Find out other Maryland Form W4

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template