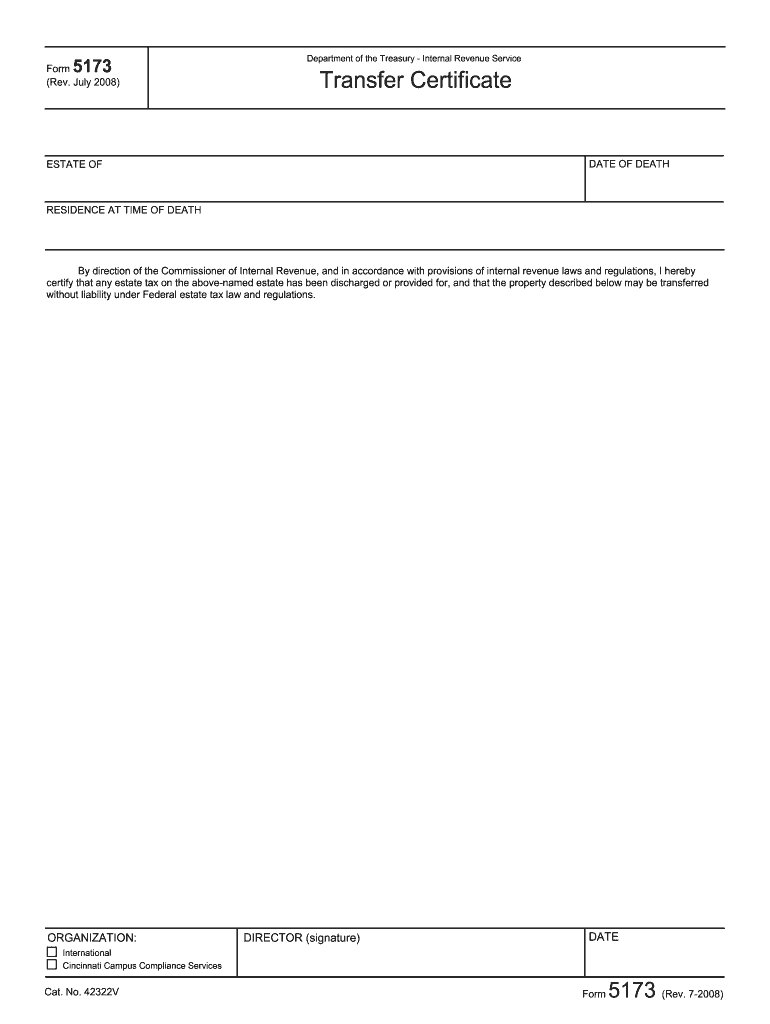

Irs Form 5173 2008-2026

What is the IRS Form 5173?

The IRS Form 5173, also known as the affidavit in lieu of transfer certificate, is a legal document used in specific circumstances to facilitate the transfer of assets without the need for a formal transfer certificate. This form is particularly relevant for individuals or entities that need to prove ownership of property or assets when the original transfer certificate is unavailable. The form serves as an affidavit, affirming the facts surrounding the transfer and the identity of the parties involved.

How to Use the IRS Form 5173

Using the IRS Form 5173 involves several key steps. First, ensure that you meet the eligibility criteria for filing the affidavit. Next, gather all necessary documentation that supports your claim, such as proof of ownership and any relevant identification. Complete the form accurately, providing all required information, including details about the property or assets in question. Once completed, the form must be signed and dated by the affiant, who is the individual making the statement under oath.

Steps to Complete the IRS Form 5173

Completing the IRS Form 5173 requires careful attention to detail. Follow these steps:

- Download the IRS Form 5173 from a reliable source.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including name, address, and contact details.

- Provide a clear description of the property or assets being transferred.

- Include any supporting documentation that validates your claim.

- Sign the form in the presence of a notary public, if required.

- Make copies of the completed form for your records.

Legal Use of the IRS Form 5173

The IRS Form 5173 is legally binding once it is signed and notarized, provided that all information is accurate and complete. It is essential to ensure that the affidavit complies with state laws and regulations regarding property transfers. Misrepresentation or inaccuracies in the form can lead to legal repercussions, including penalties or challenges to the validity of the transfer.

Key Elements of the IRS Form 5173

Several key elements must be included in the IRS Form 5173 to ensure its validity:

- Affiant Information: Full name and contact details of the individual making the affidavit.

- Property Description: A detailed description of the asset or property involved in the transfer.

- Affirmation Statement: A declaration affirming the truthfulness of the information provided.

- Signature and Notarization: The affiant's signature, along with the notary's seal, if applicable.

Filing Deadlines / Important Dates

While the IRS Form 5173 does not have a specific filing deadline, it is crucial to submit the form promptly when needed for asset transfers. Delays in filing may impact the transfer process and could lead to complications in ownership claims. It is advisable to check with local authorities for any relevant deadlines associated with property transfers in your state.

Quick guide on how to complete irs form 5173

Complete Irs Form 5173 effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Manage Irs Form 5173 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to alter and eSign Irs Form 5173 with ease

- Locate Irs Form 5173 and then click Get Form to start.

- Utilize the features we provide to finish your form.

- Emphasize signNow sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Irs Form 5173 and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 5173

The way to generate an eSignature for a PDF document online

The way to generate an eSignature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

How to generate an eSignature from your smart phone

The way to create an eSignature for a PDF document on iOS

How to generate an eSignature for a PDF file on Android OS

People also ask

-

What is an affidavit in lieu of transfer certificate?

An affidavit in lieu of transfer certificate serves as a declaration that substitutes the need for a transfer certificate, usually required for property transfers. This document verifies ownership and legal rights of the signer, ensuring a smooth transaction process. It is commonly used in real estate dealings to expedite property transfer without delays.

-

How can airSlate SignNow help with creating an affidavit in lieu of transfer certificate?

airSlate SignNow offers an easy-to-use platform to create and sign your affidavit in lieu of transfer certificate electronically. Our user-friendly interface allows you to customize templates, ensuring your document meets all legal requirements. Additionally, you can invite multiple signers, making the process efficient and hassle-free.

-

Is there a cost associated with using airSlate SignNow for affidavits?

Yes, airSlate SignNow provides several pricing plans tailored to suit different business needs. You can choose a plan that allows for an unlimited number of documents and eSignatures, making it a cost-effective solution for managing your affidavits in lieu of transfer certificates. Trial periods are also available for evaluation.

-

What features does airSlate SignNow offer for managing affidavits?

With airSlate SignNow, you get features such as document templates, secure eSignature capabilities, team collaboration tools, and compliance tracking for your affidavit in lieu of transfer certificate. These features help streamline the legal documentation process, ensuring full compliance with regulations while saving time.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems, cloud storage platforms, and more. This capability allows you to efficiently manage your affidavit in lieu of transfer certificate alongside other essential business documents. Integration enhances productivity and keeps your workflow smooth.

-

What benefits can I expect from using airSlate SignNow for affidavits?

Using airSlate SignNow for your affidavit in lieu of transfer certificate offers various benefits, such as increased efficiency, improved accuracy, and better document security. You can track the status of your documents in real time and receive notifications when documents are signed, ensuring that your transactions proceed without unnecessary delays.

-

Is airSlate SignNow legally compliant for affidavits?

Yes, airSlate SignNow complies with all relevant electronic signature laws, including the ESIGN and UETA Acts. This ensures that your affidavit in lieu of transfer certificate will hold up in a court of law. We prioritize data security and legal compliance, providing you confidence in your document management.

Get more for Irs Form 5173

- Chili cook off entry form template

- Ventura county area agency on aging elderhelp program ehp form

- Evidence of completion for workshop conference seminar etc form 77 21b d131

- Fill free fillable annual approved provider report pdf form

- Texas roadhouse nutrition pdf form

- Release student records and information

- University district review committee planning commission form

- Cl 100 form

Find out other Irs Form 5173

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed