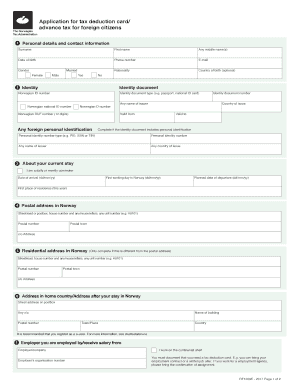

Application Tax Card 2017-2026

What is the Application Tax Card

The application tax card is a crucial document for individuals and businesses in the United States. It serves as a means to identify taxpayers and facilitate the process of reporting income and claiming deductions. This card is particularly important for those who need to navigate the complexities of the tax system. It helps ensure compliance with federal and state tax regulations, allowing for accurate tax reporting and payment.

Steps to Complete the Application Tax Card

Completing the application tax card involves several key steps to ensure accuracy and compliance. First, gather all necessary personal and financial information, including your Social Security number, income details, and any applicable deductions. Next, fill out the application tax card form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. Finally, choose your preferred method for submitting the form, whether online, by mail, or in person.

Required Documents

To successfully complete the application tax card, you will need to provide certain documents. These typically include:

- Proof of identity, such as a driver's license or passport

- Social Security number or Individual Taxpayer Identification Number (ITIN)

- Income statements, such as W-2s or 1099s

- Documentation of any deductions you plan to claim

Having these documents ready will streamline the application process and help avoid delays.

Legal Use of the Application Tax Card

The application tax card must be used in accordance with federal and state tax laws. It is essential to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or legal issues. The card is legally binding when filled out correctly and submitted through the appropriate channels. Understanding the legal implications of using this card is vital for maintaining compliance with tax regulations.

Form Submission Methods

There are several methods for submitting the application tax card, each offering different advantages. You can submit the form online through the official tax authority's website, which often provides immediate confirmation of receipt. Alternatively, you may choose to mail the completed form to the designated address, ensuring you use a reliable mailing service to track your submission. In-person submission is also an option at local tax offices, where assistance may be available if needed.

Eligibility Criteria

Eligibility for the application tax card varies based on individual circumstances. Generally, all residents and citizens of the United States are eligible to apply. Specific criteria may include age requirements, income thresholds, and residency status. It is important to review these criteria carefully to ensure that you qualify before beginning the application process.

Quick guide on how to complete application tax card

Complete Application Tax Card effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, alter, and electronically sign your documents promptly without delays. Manage Application Tax Card on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest method to modify and eSign Application Tax Card seamlessly

- Find Application Tax Card and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize signNow parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Application Tax Card and ensure effective communication at any point of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application tax card

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is an application tax deduction card?

An application tax deduction card is a financial tool that helps individuals track expenses related to their business or job. By using this card, you can ensure that eligible expenses are easily documented, making it simpler to claim tax deductions. This tool is particularly useful for freelance workers and entrepreneurs.

-

How can the application tax deduction card benefit my business?

The application tax deduction card benefits your business by simplifying expense tracking, which can lead to signNow tax savings. By effectively categorizing and managing your expenses, you are better positioned to maximize eligible deductions during tax season. This feature ultimately enhances your financial efficiency.

-

Is the application tax deduction card easy to use?

Yes, the application tax deduction card is designed for ease of use, allowing you to quickly log expenses as they occur. Its user-friendly interface ensures that users of all skill levels can navigate the features without a steep learning curve. This ease of use makes it a valuable tool for busy professionals.

-

What features are included with the application tax deduction card?

The application tax deduction card includes features such as expense tracking, reporting tools, and integration capabilities with accounting software. These features help streamline your financial management, making it easier to prepare for tax filings. Additionally, it helps ensure that all eligible expenses are accounted for.

-

Are there any costs associated with the application tax deduction card?

There may be fees associated with the application tax deduction card, depending on the service plan you choose. However, it is essential to consider the potential tax savings that can result from using this card. Overall, the investment often pays off through streamlined processes and maximized deductions.

-

Can the application tax deduction card integrate with other accounting software?

Absolutely! The application tax deduction card is designed to seamlessly integrate with various accounting software platforms. This integration simplifies the process of tracking and categorizing expenses, ensuring that all your financial data is cohesive and easily accessible.

-

Is there customer support available for issues with the application tax deduction card?

Yes, customer support is readily available for any issues related to the application tax deduction card. Our dedicated support team is equipped to assist with troubleshooting and can provide helpful resources to ensure you're making the most of the card's features. We're committed to your satisfaction and success.

Get more for Application Tax Card

Find out other Application Tax Card

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF