Gra Tax Retuen Form

What is the Sweden VAT Return Form?

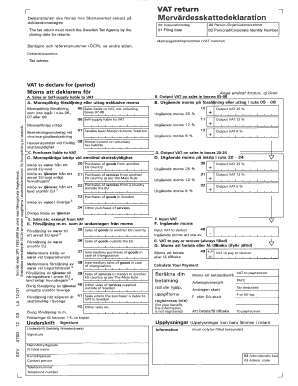

The Sweden VAT return form is a crucial document for businesses operating in Sweden, used to report value-added tax (VAT) collected and paid during a specific period. This form is essential for ensuring compliance with Swedish tax regulations. It allows businesses to calculate their VAT liability or reclaim VAT overpayments. Understanding the purpose and requirements of this form is vital for maintaining accurate financial records and fulfilling legal obligations.

Steps to Complete the Sweden VAT Return Form

Completing the Sweden VAT return form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales invoices and purchase receipts. Next, accurately calculate the total VAT collected from sales and the VAT paid on purchases. Fill out the form by entering these amounts in the designated sections. Finally, review the completed form for any errors before submitting it to the Swedish Tax Agency by the required deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Sweden VAT return form vary depending on the size of the business and the frequency of VAT reporting. Generally, businesses must file their VAT returns either monthly or quarterly. It is important to be aware of these deadlines to avoid penalties. For example, monthly filers typically need to submit their returns by the 12th of the following month, while quarterly filers may have different deadlines. Keeping a calendar of these dates can help ensure timely submissions.

Required Documents

To complete the Sweden VAT return form, several documents are necessary. These include sales invoices, purchase receipts, and any other records that detail VAT transactions. Maintaining organized records is essential for accurate reporting and for substantiating claims in case of audits. Businesses should also keep copies of submitted VAT returns for their records.

Form Submission Methods

The Sweden VAT return form can be submitted through various methods. Businesses can file online via the Swedish Tax Agency's website, which is often the most efficient and secure method. Alternatively, forms can be submitted by mail. It is important to choose a method that ensures timely delivery and receipt confirmation, particularly when filing close to deadlines.

Penalties for Non-Compliance

Failure to comply with Sweden's VAT regulations can result in significant penalties. These may include fines for late submissions, interest on unpaid VAT, and potential audits by the Swedish Tax Agency. Businesses should prioritize timely and accurate filing to avoid these consequences, which can impact financial health and reputation.

Quick guide on how to complete gra tax retuen form

Effortlessly Prepare Gra Tax Retuen Form on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as it allows you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Manage Gra Tax Retuen Form on any platform using the airSlate SignNow apps for Android or iOS, and simplify any document-related processes today.

How to Edit and Electronically Sign Gra Tax Retuen Form with Ease

- Locate Gra Tax Retuen Form and click Get Form to commence.

- Utilize the tools at your disposal to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools airSlate SignNow provides specifically for these tasks.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that require new document copies to be printed. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Gra Tax Retuen Form to ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gra tax retuen form

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The way to make an eSignature for a PDF document on Android OS

People also ask

-

What is the Sweden VAT return form?

The Sweden VAT return form is a document that businesses in Sweden use to report their Value Added Tax (VAT) obligations to the Swedish Tax Agency. It outlines the VAT collected and the VAT paid on purchases. Completing the form accurately is essential for compliance and to avoid penalties.

-

How can airSlate SignNow help with the Sweden VAT return form?

airSlate SignNow allows you to easily create, send, and eSign your Sweden VAT return form online. Our platform ensures that your documents are securely stored and shared, making the process of managing your VAT documentation efficient and straightforward. This helps you stay organized and compliant with Swedish tax regulations.

-

Is airSlate SignNow cost-effective for handling the Sweden VAT return form?

Yes, airSlate SignNow offers a cost-effective solution for managing your Sweden VAT return form. With various pricing plans, you can choose the one that fits your business needs, ensuring that you only pay for what you use. This flexibility helps businesses of all sizes streamline their VAT submission process without breaking the bank.

-

What features does airSlate SignNow offer for the Sweden VAT return form?

airSlate SignNow includes several features to optimize your Sweden VAT return form process, such as customizable templates, an intuitive user interface, and eSigning capabilities. These features simplify document management and enhance collaboration, enabling users to complete their VAT forms with ease and efficiency.

-

Can I integrate airSlate SignNow with my accounting software for the Sweden VAT return form?

Absolutely! airSlate SignNow seamlessly integrates with various accounting software, allowing you to sync your data when preparing the Sweden VAT return form. This integration ensures that all necessary financial information is accurate and up-to-date, reducing the risk of errors in your VAT submissions.

-

What are the benefits of using airSlate SignNow for the Sweden VAT return form?

Using airSlate SignNow for your Sweden VAT return form offers benefits like enhanced document security, time-saving electronic signatures, and streamlined workflows. These advantages help ensure that your VAT submissions are completed promptly and accurately, allowing your business to focus on growth without the hassle of paperwork.

-

Is it easy to eSign the Sweden VAT return form using airSlate SignNow?

Yes, eSigning the Sweden VAT return form with airSlate SignNow is straightforward. Our user-friendly platform allows multiple signers to electronically sign your document from anywhere. This process is not only time-efficient but also legally binding, ensuring your submissions are valid under Swedish law.

Get more for Gra Tax Retuen Form

- Cwv 1 wv secretary of state wvgov form

- Dbc certificate of formation2019 alabama secretary of state

- Az l010 fill online printable fillable blank states business forms

- Arizona commission form

- Lee county notice of commencement form

- Maryland operating agreement template form

- Ucc 1 form louisiana

- City of chicago general contractor license renewal form

Find out other Gra Tax Retuen Form

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template